Empowering Financial Literacy: Introducing the New Era Budgeting App

Empowering Financial Literacy: Introducing the New Era Budgeting App

Empowering Financial Literacy: Introducing the New Era Budgeting App

Consulting Company

Consulting Company

(

(

2023

2023

)

)

The financial planning, learning, expense tracking, and personal asset management app for iOS and Android

The financial planning, learning, expense tracking, and personal asset management app for iOS and Android

The financial planning, learning, expense tracking, and personal asset management app for iOS and Android

Client

Client

Consulting Company

Consulting Company

Timeline

Timeline

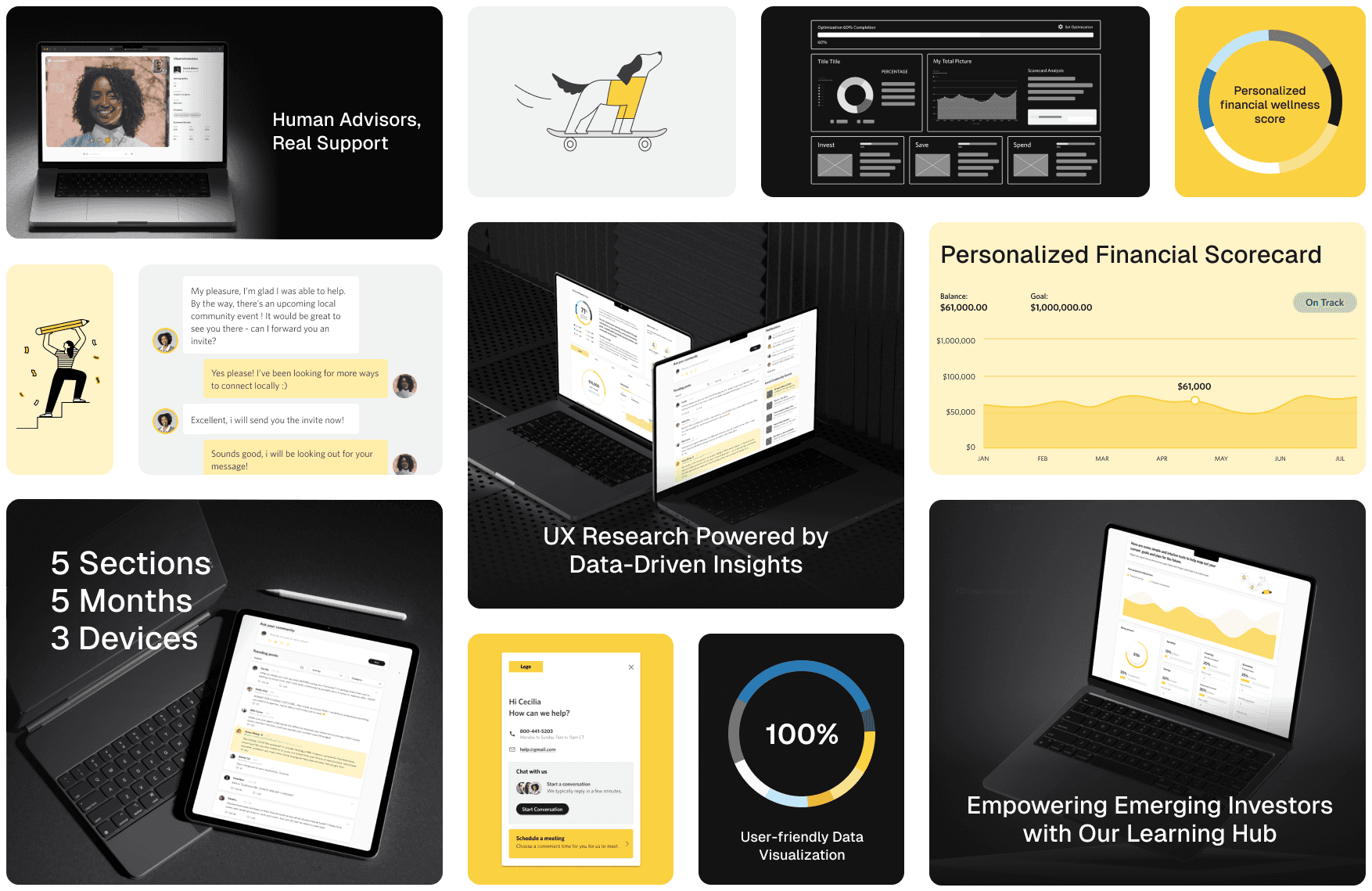

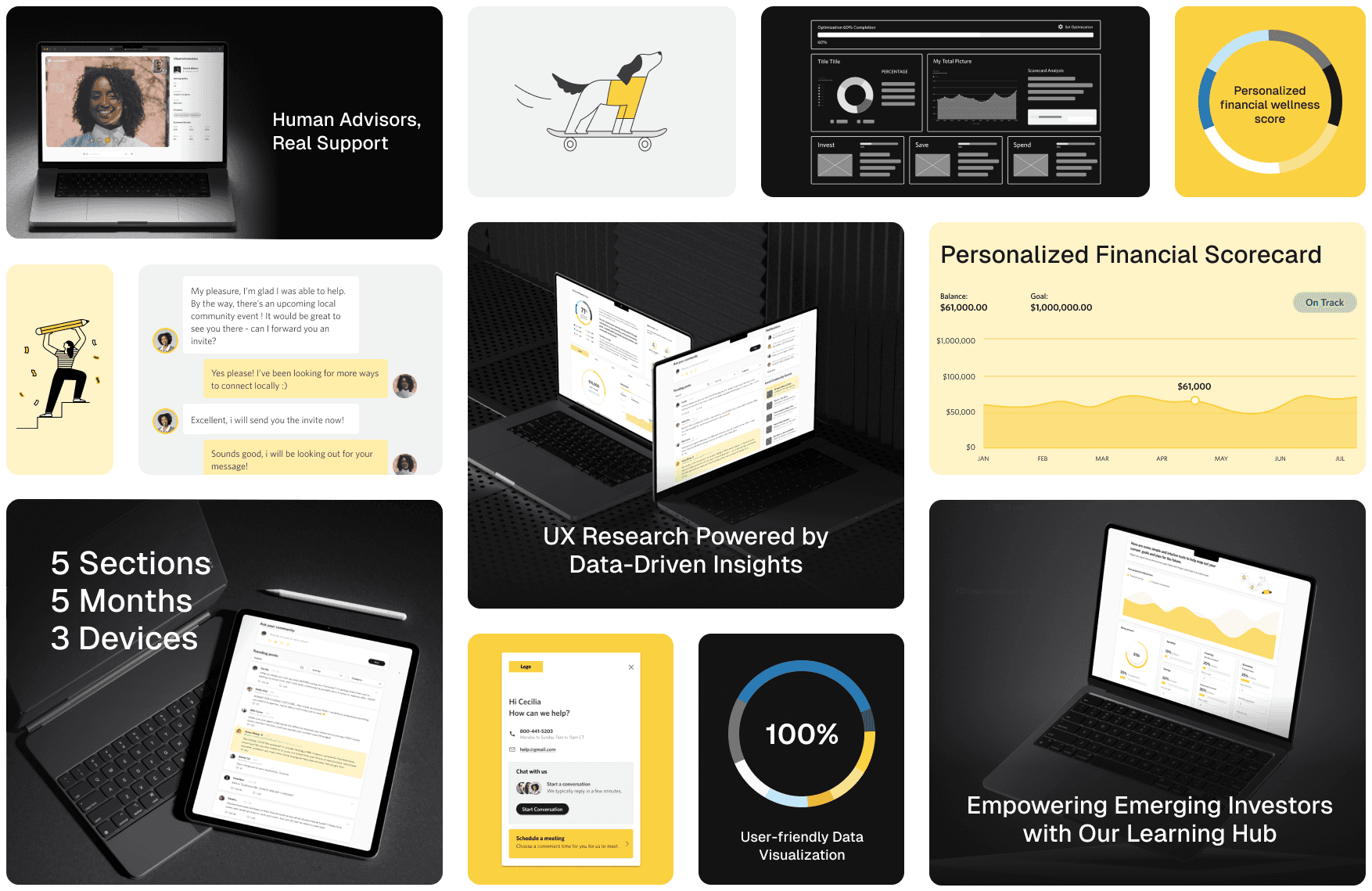

5 months

5 months

Devices

Devices

Desktop, Tablet, Mobile

Desktop, Tablet, Mobile

Team

Team

4 Designers, 4 Business Analysts, PM

4 Designers, 4 Business Analysts, PM

Services

Services

UI/UX Design

UI/UX Design

,

,

UX Research

UX Research

,

,

User Testing

User Testing

The problem

The problem

The need to attract and serve emerging investors while reducing the costs of serving these clients and increasing branch capacity.

The Client aims to attract and serve emerging investors, a segment projected to grow significantly. However, the current model they have is unprofitable for serving these clients who need immediate advice on investing, earning, borrowing, and saving. There is also a need to reduce the costs of serving existing clients in this segment while increasing branch capacity and improving overall economics.

The need to attract and serve emerging investors while reducing the costs of serving these clients and increasing branch capacity.

The Client aims to attract and serve emerging investors, a segment projected to grow significantly. However, the current model they have is unprofitable for serving these clients who need immediate advice on investing, earning, borrowing, and saving. There is also a need to reduce the costs of serving existing clients in this segment while increasing branch capacity and improving overall economics.

The solution

The solution

We developed a comprehensive go-to-market strategy focused on delivering a digital-first experience supported by human advisors.

This includes creating engaging data visualizations, an intuitive chatbot for support and scheduling, and a user-friendly interface based on deep research and user feedback. This approach aims to attract new clients, lower service costs, and enhance user satisfaction, ultimately positioning the Client to better compete in the market.

We developed a comprehensive go-to-market strategy focused on delivering a digital-first experience supported by human advisors.

This includes creating engaging data visualizations, an intuitive chatbot for support and scheduling, and a user-friendly interface based on deep research and user feedback. This approach aims to attract new clients, lower service costs, and enhance user satisfaction, ultimately positioning the Client to better compete in the market.

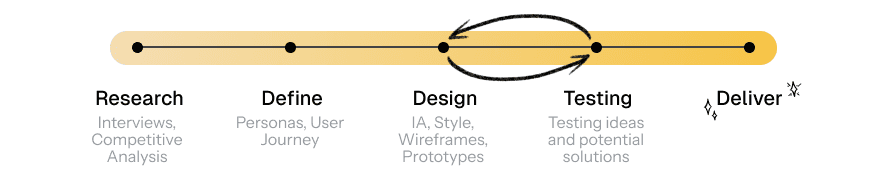

Research

Research

Interviews

Interviews

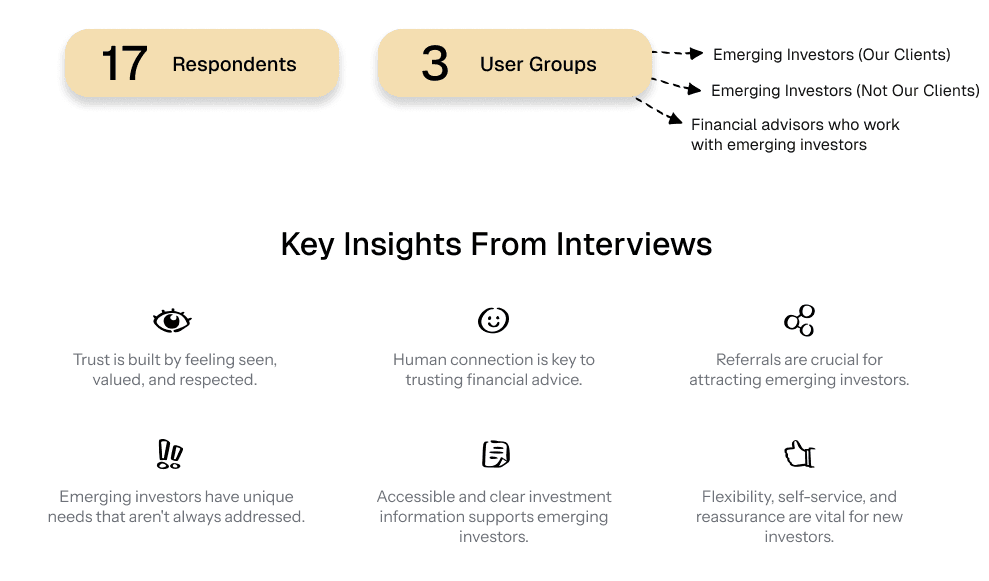

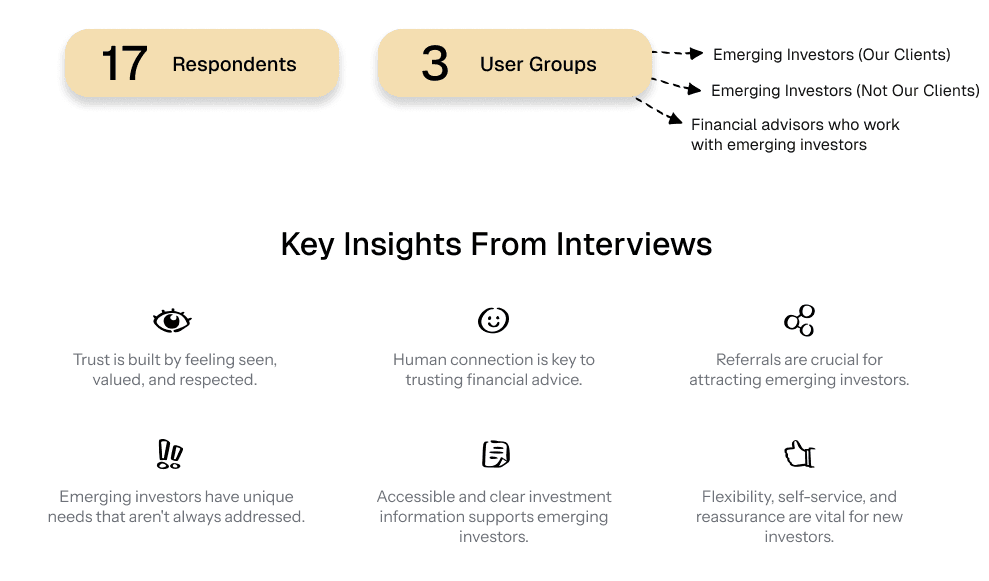

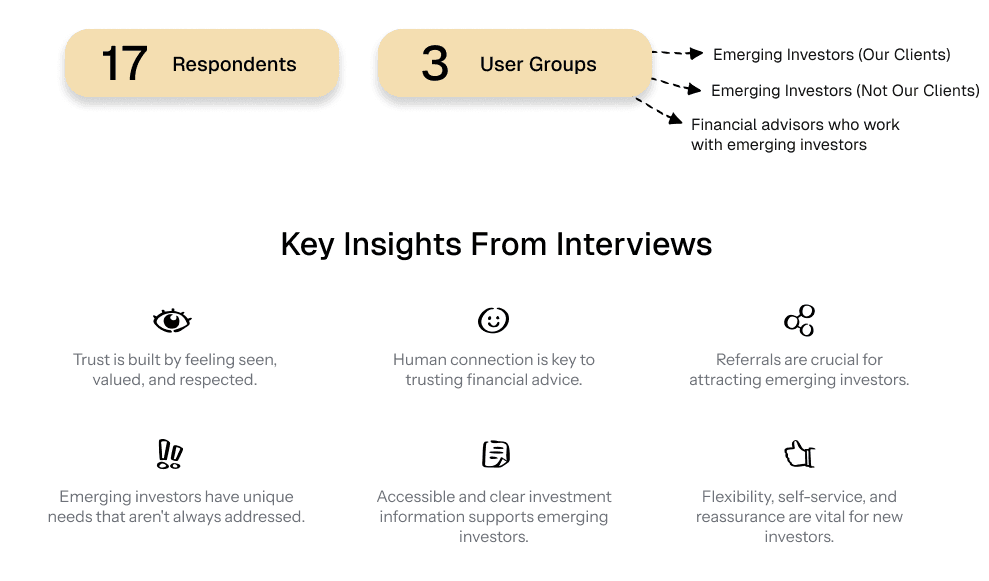

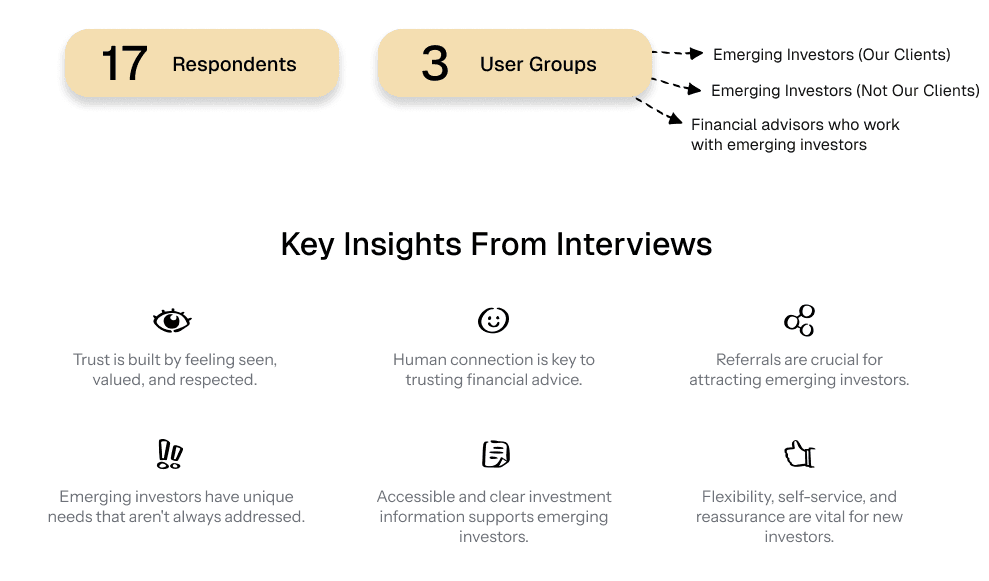

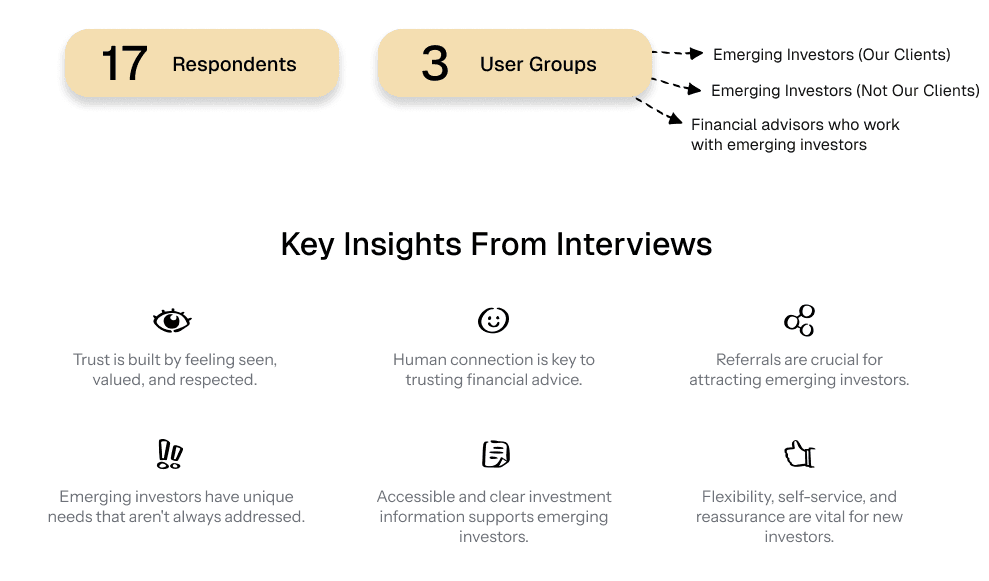

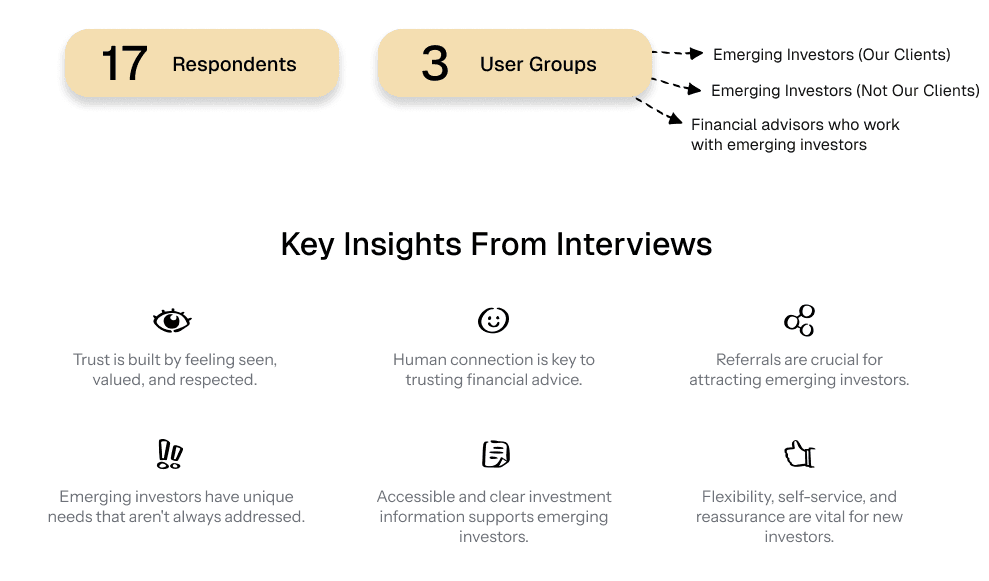

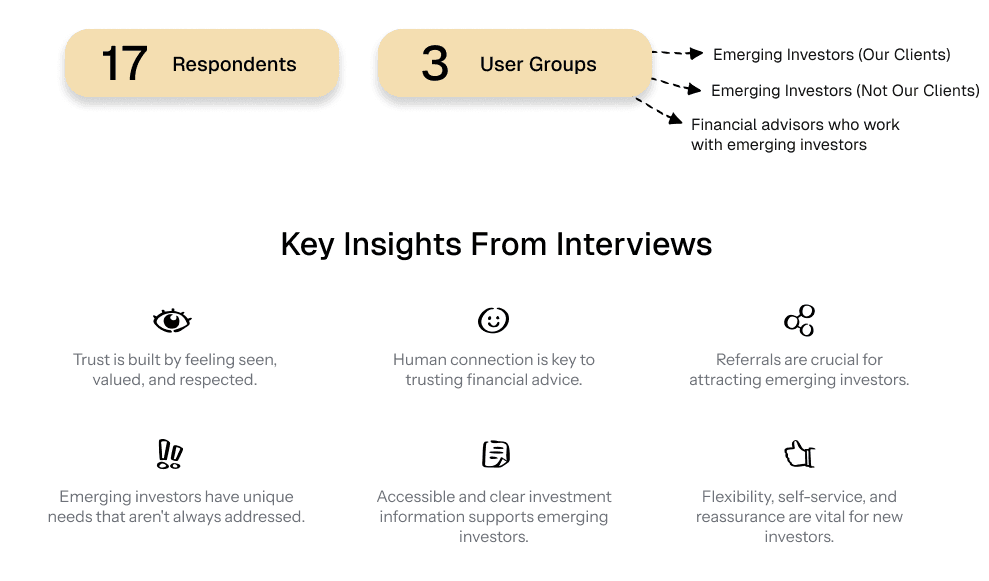

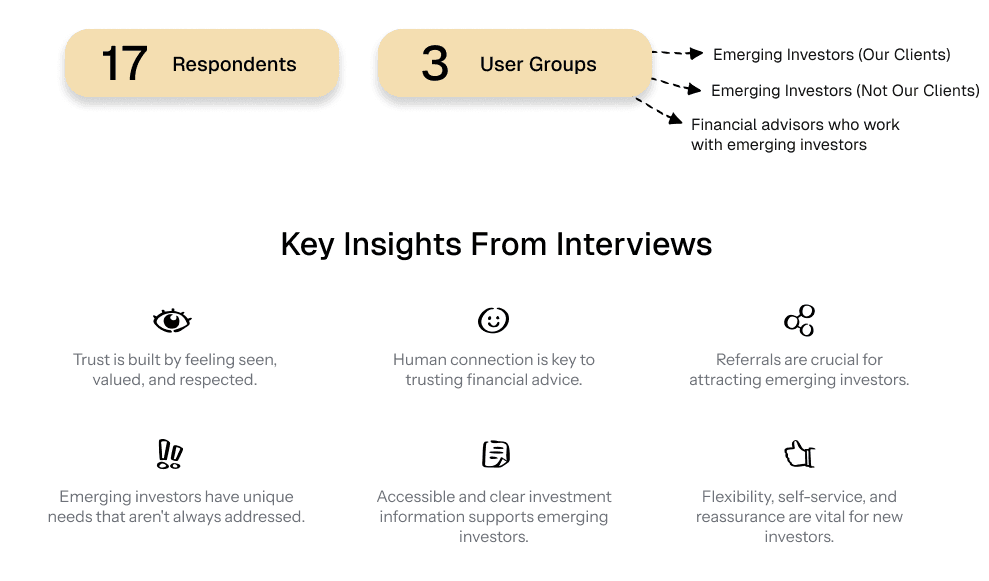

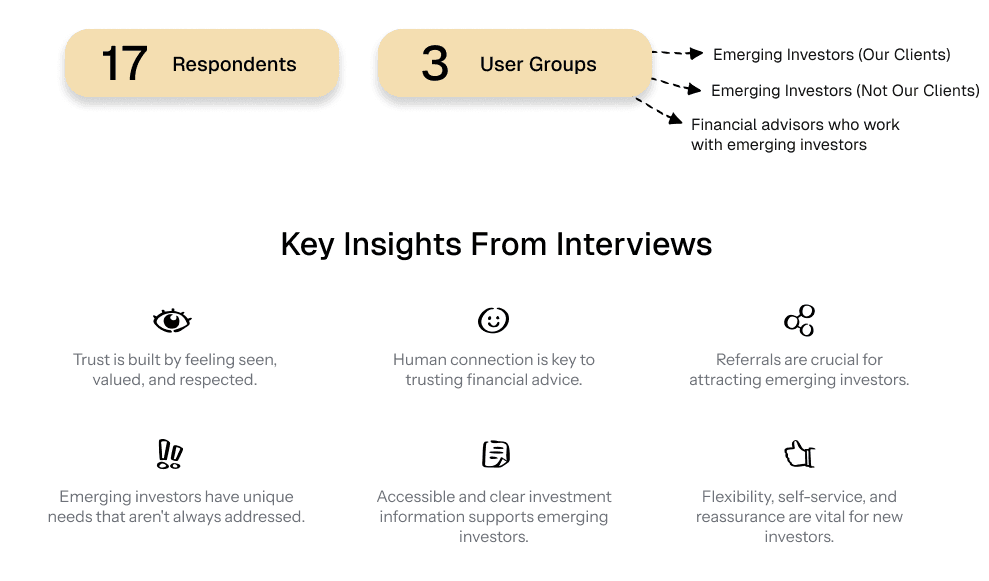

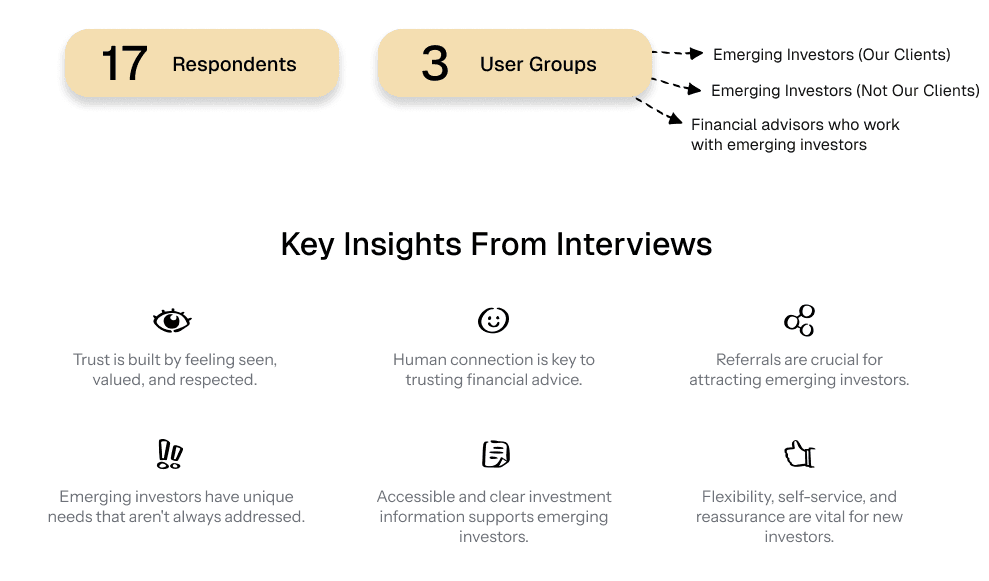

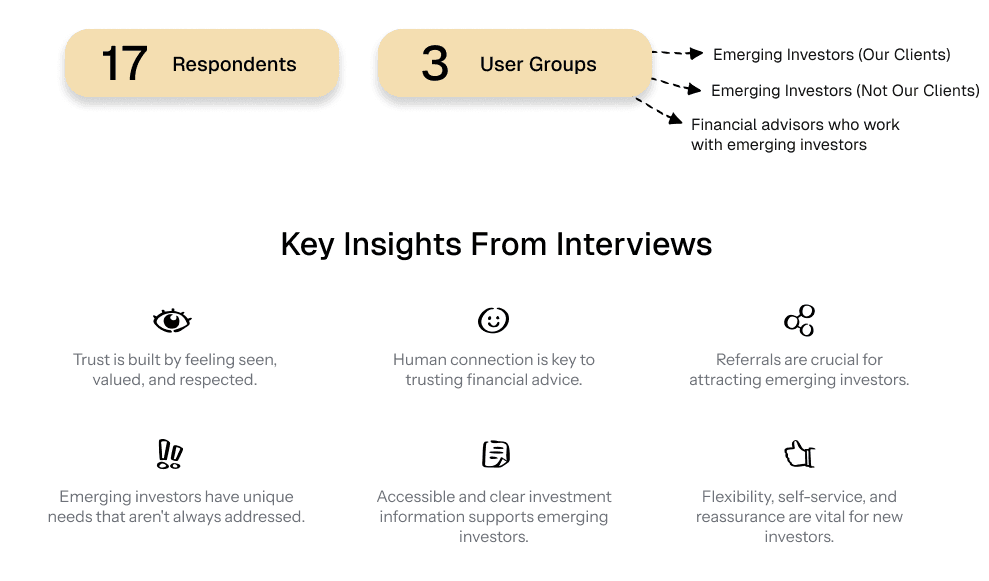

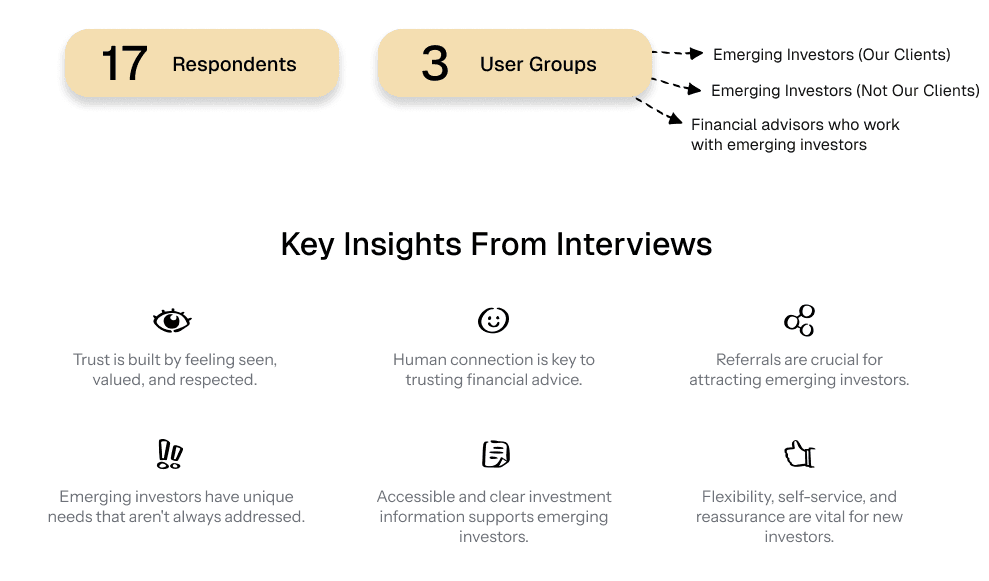

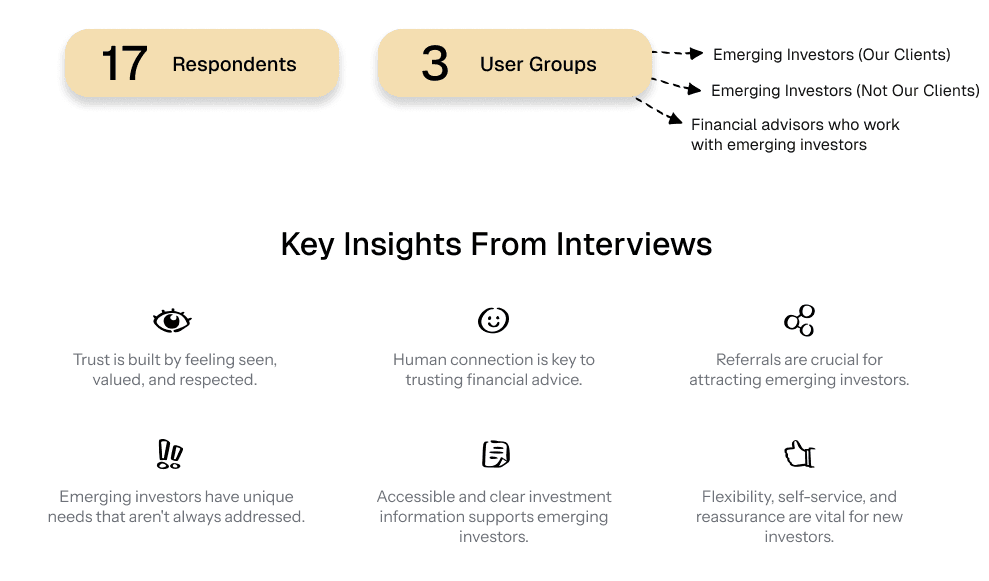

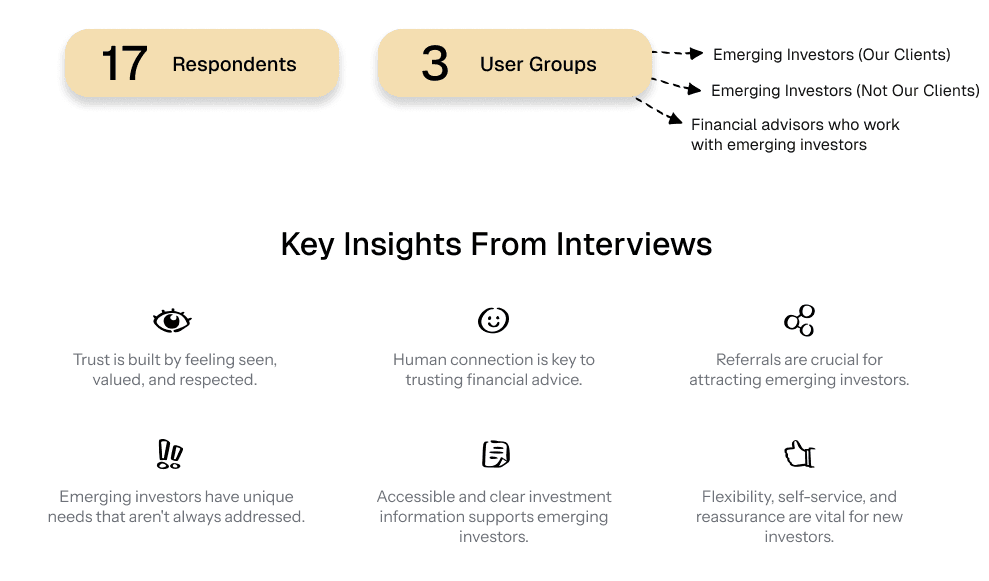

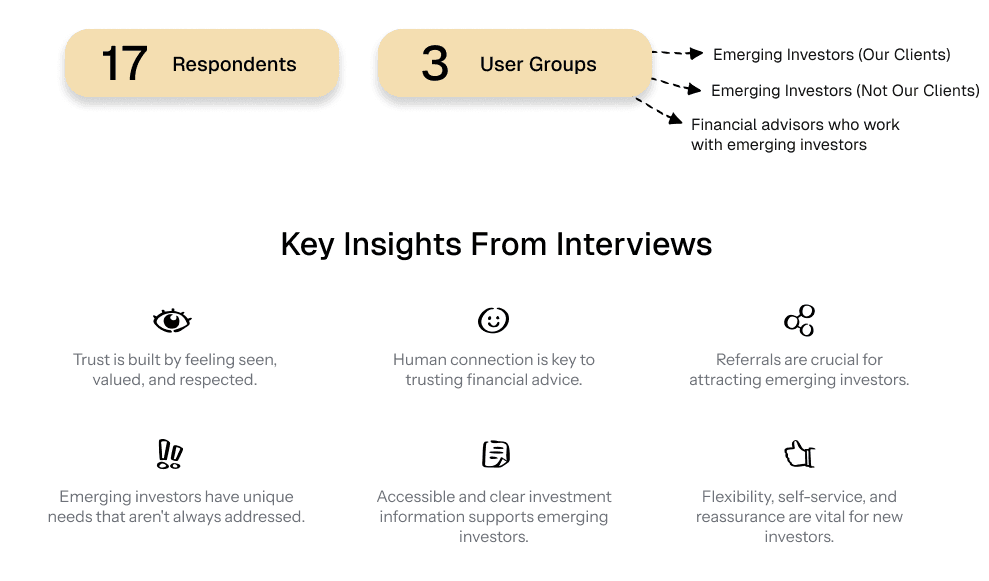

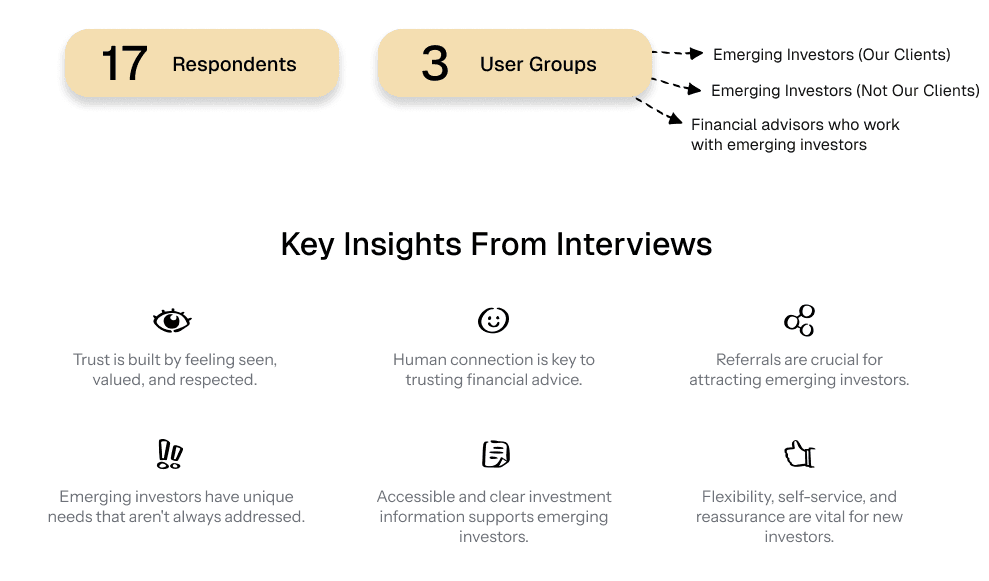

We conducted one-on-one interviews with three user groups to understand their priorities, goals for financial advice, and how we might better serve Emerging Investors.

The summary of our key findings highlights the importance of personalized and human-centric financial advice, the role of referrals in initiating positive relationships, and the necessity for easily accessible investment information and flexible, self-service offerings that build trust and knowledge.

We conducted one-on-one interviews with three user groups to understand their priorities, goals for financial advice, and how we might better serve Emerging Investors.

The summary of our key findings highlights the importance of personalized and human-centric financial advice, the role of referrals in initiating positive relationships, and the necessity for easily accessible investment information and flexible, self-service offerings that build trust and knowledge.

Themes from Interviews

Themes from Interviews

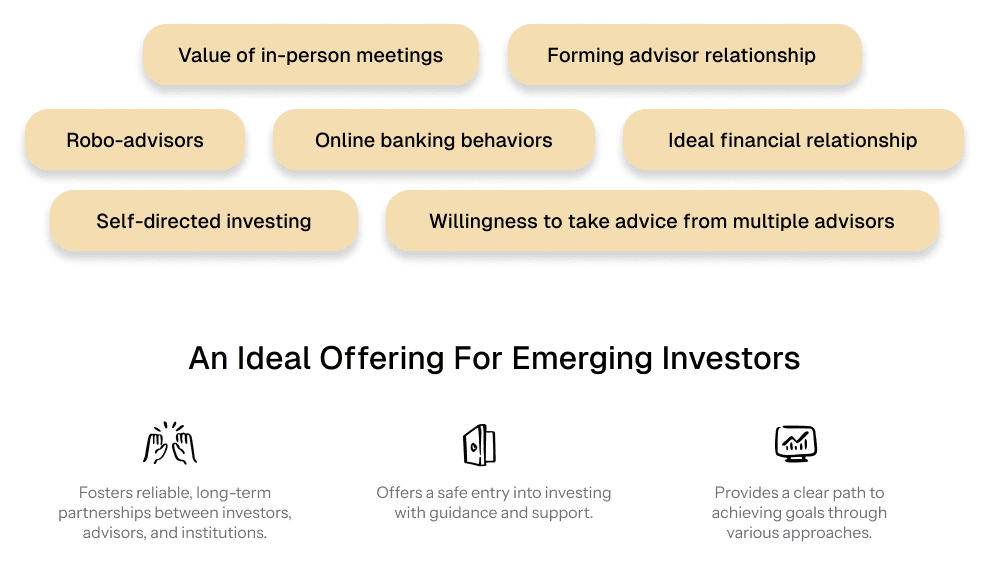

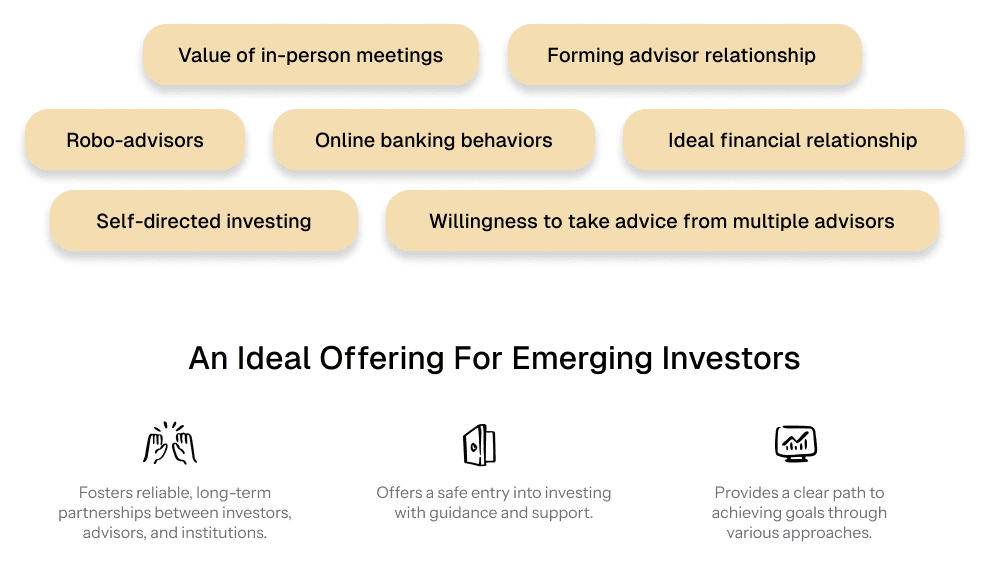

Through our user interviews, we identified several key patterns that reveal the preferences and behaviors of emerging investors, which we later leveraged during the design phase.

These themes summarize the common attitudes, behaviors, and preferences of the investors regarding specific aspects of their experience.

Through our user interviews, we identified several key patterns that reveal the preferences and behaviors of emerging investors, which we later leveraged during the design phase.

These themes summarize the common attitudes, behaviors, and preferences of the investors regarding specific aspects of their experience.

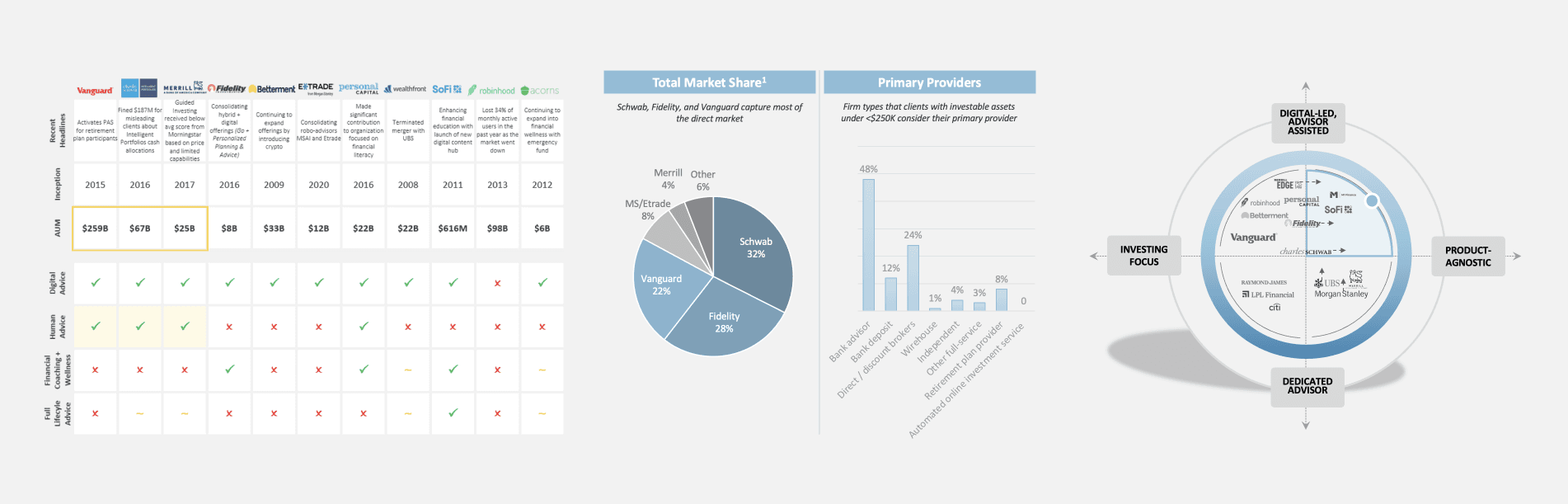

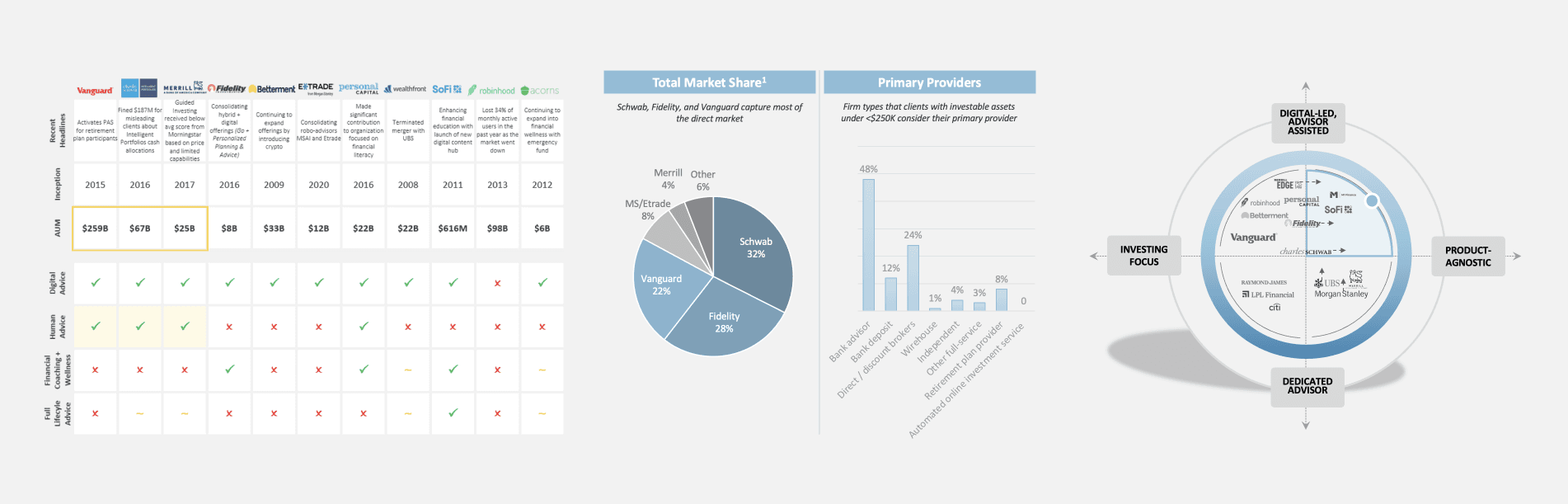

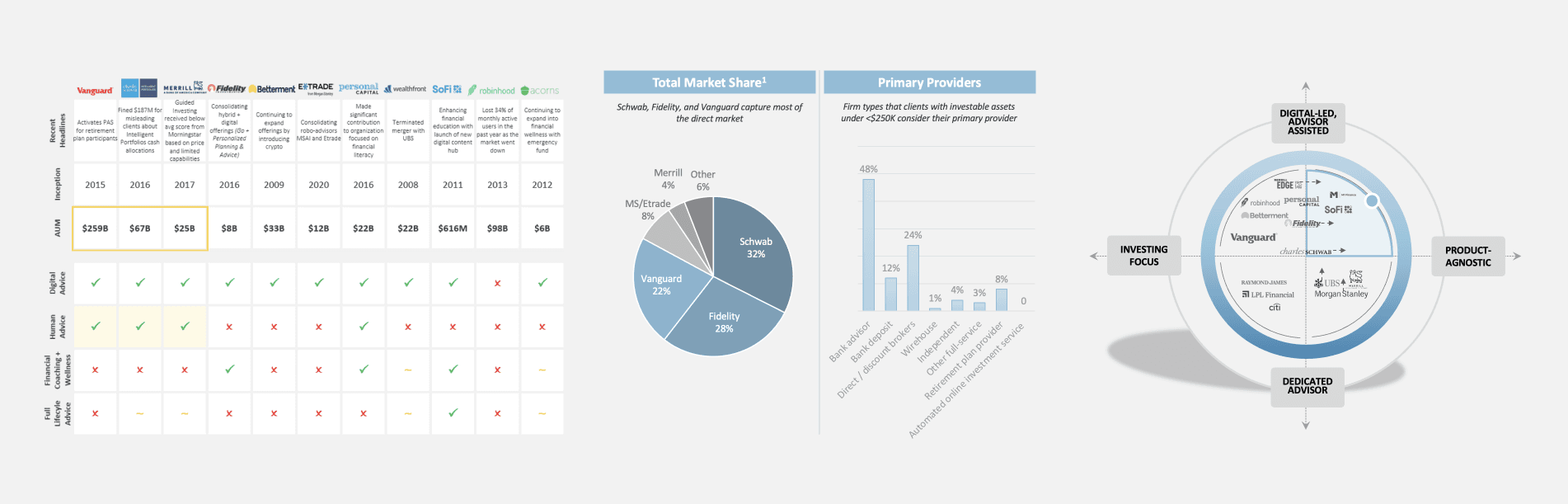

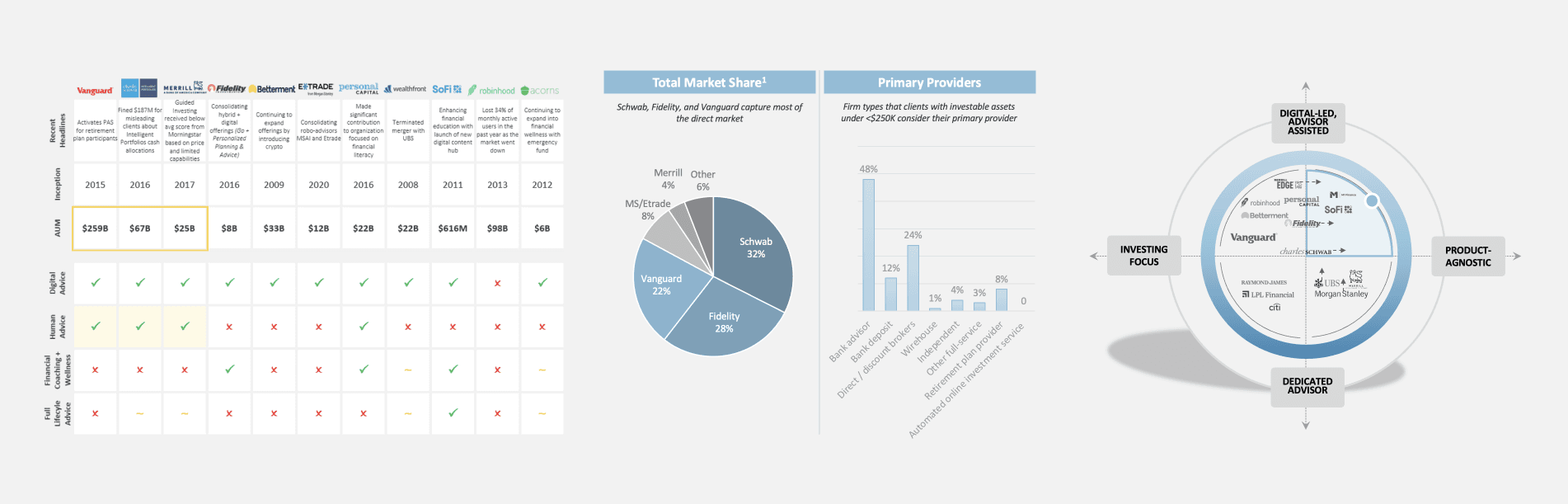

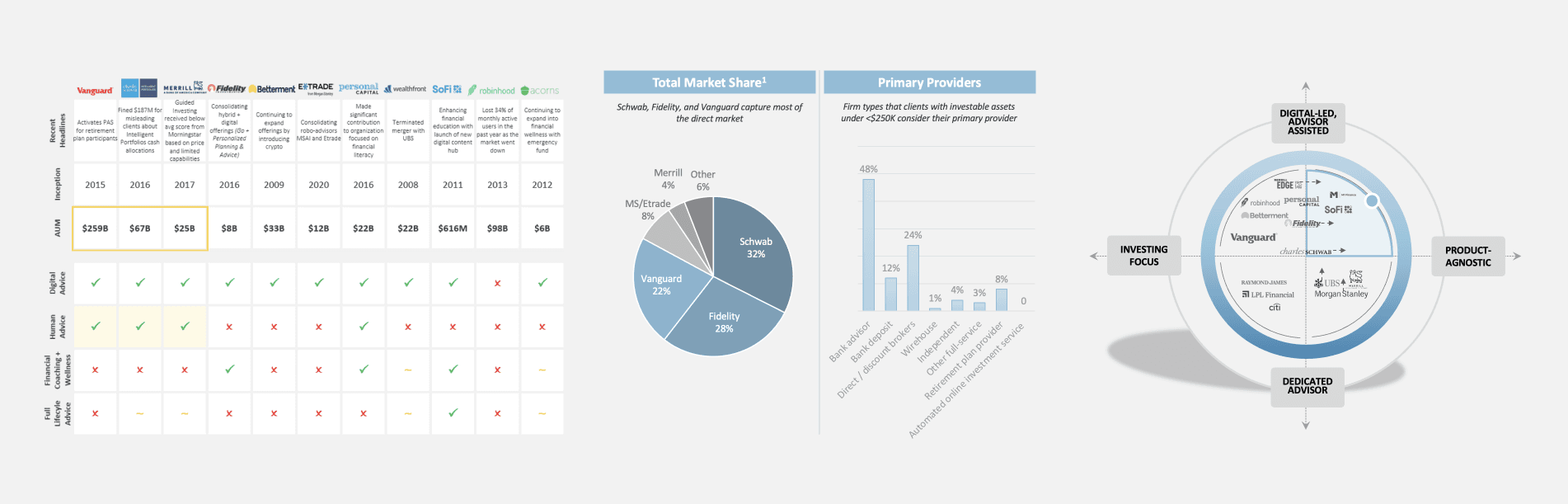

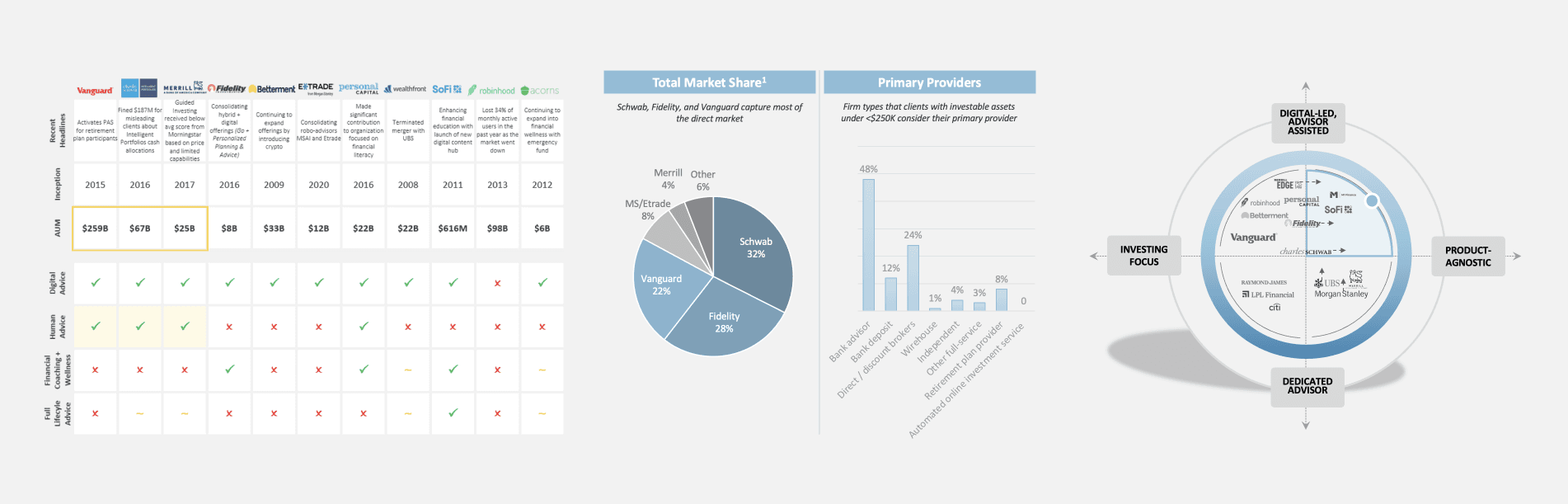

Competitive Analysis

Competitive Analysis

According to analysis, rather than going purely digital, hybrid solutions that mix the latest in investment technology with real human interaction and full balance sheet offerings have become the most attractive to the emerging investor segment.

Individuals prefer advisory firms over transactional ones like Schwab, Fidelity, and Vanguard.

Human advice increases assets for hybrid firms.

Expanding asset types beyond retirement accounts maximizes wallet share.

We can fill the market gap with a digital solution offering unbiased human advice.

According to analysis, rather than going purely digital, hybrid solutions that mix the latest in investment technology with real human interaction and full balance sheet offerings have become the most attractive to the emerging investor segment.

Individuals prefer advisory firms over transactional ones like Schwab, Fidelity, and Vanguard.

Human advice increases assets for hybrid firms.

Expanding asset types beyond retirement accounts maximizes wallet share.

We can fill the market gap with a digital solution offering unbiased human advice.

Mission Statement

Mission Statement

Based on our research, we have established three key mission statements to guide our efforts:

Enhance community financial health today for a better future.

Provide unbiased, product-agnostic financial guidance.

Offer a digital-first experience with support from human advisors at key moments.

Based on our research, we have established three key mission statements to guide our efforts:

Enhance community financial health today for a better future.

Provide unbiased, product-agnostic financial guidance.

Offer a digital-first experience with support from human advisors at key moments.

Define

Define

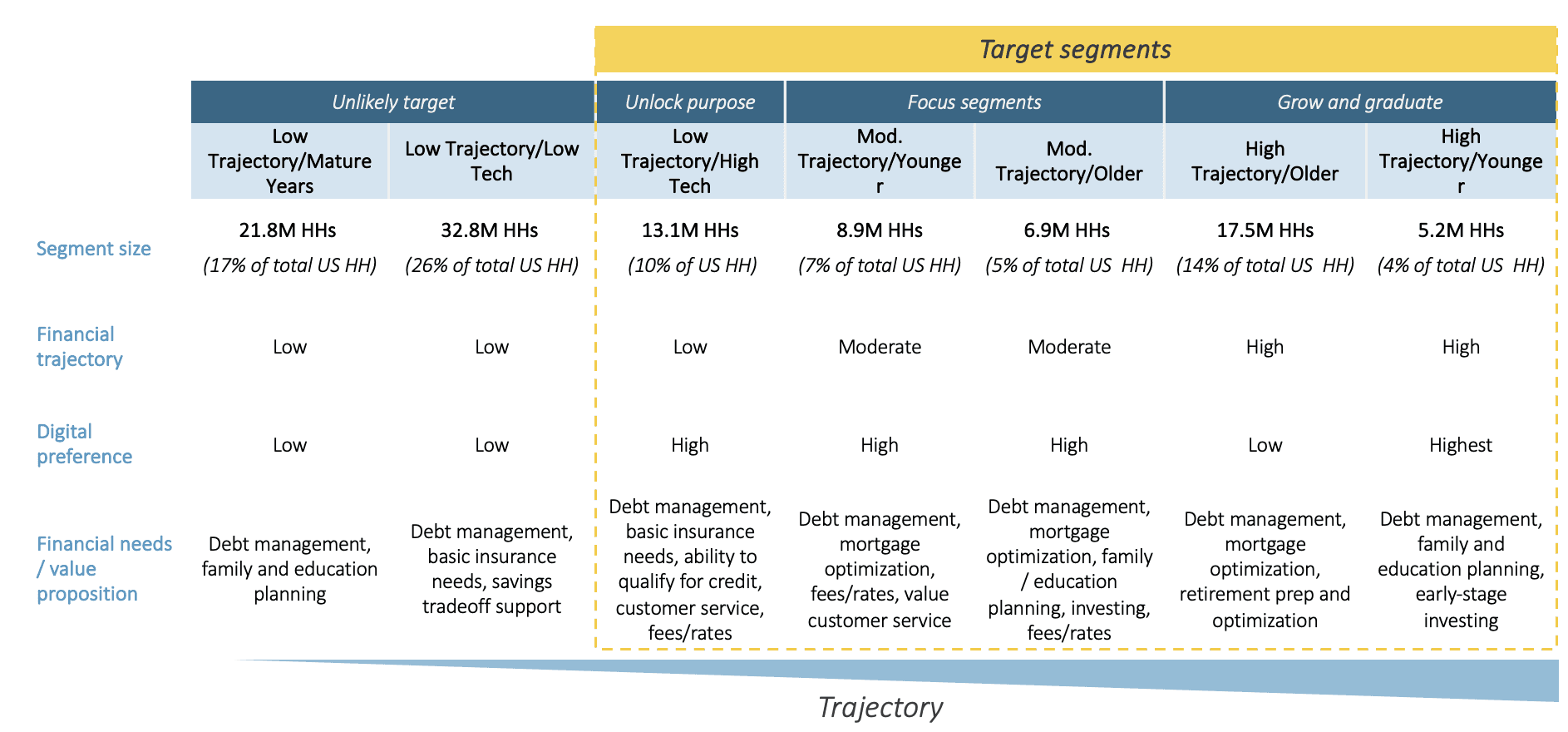

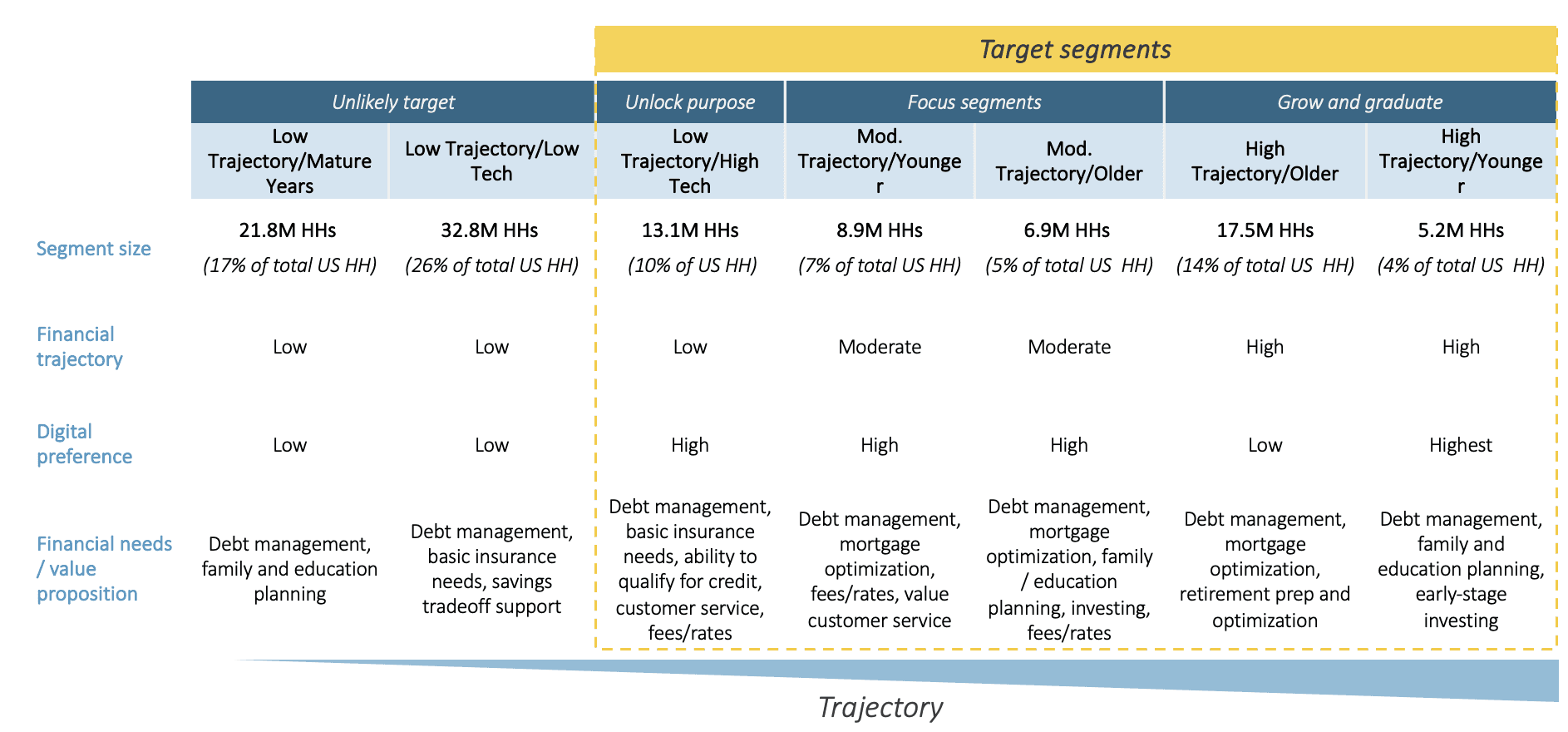

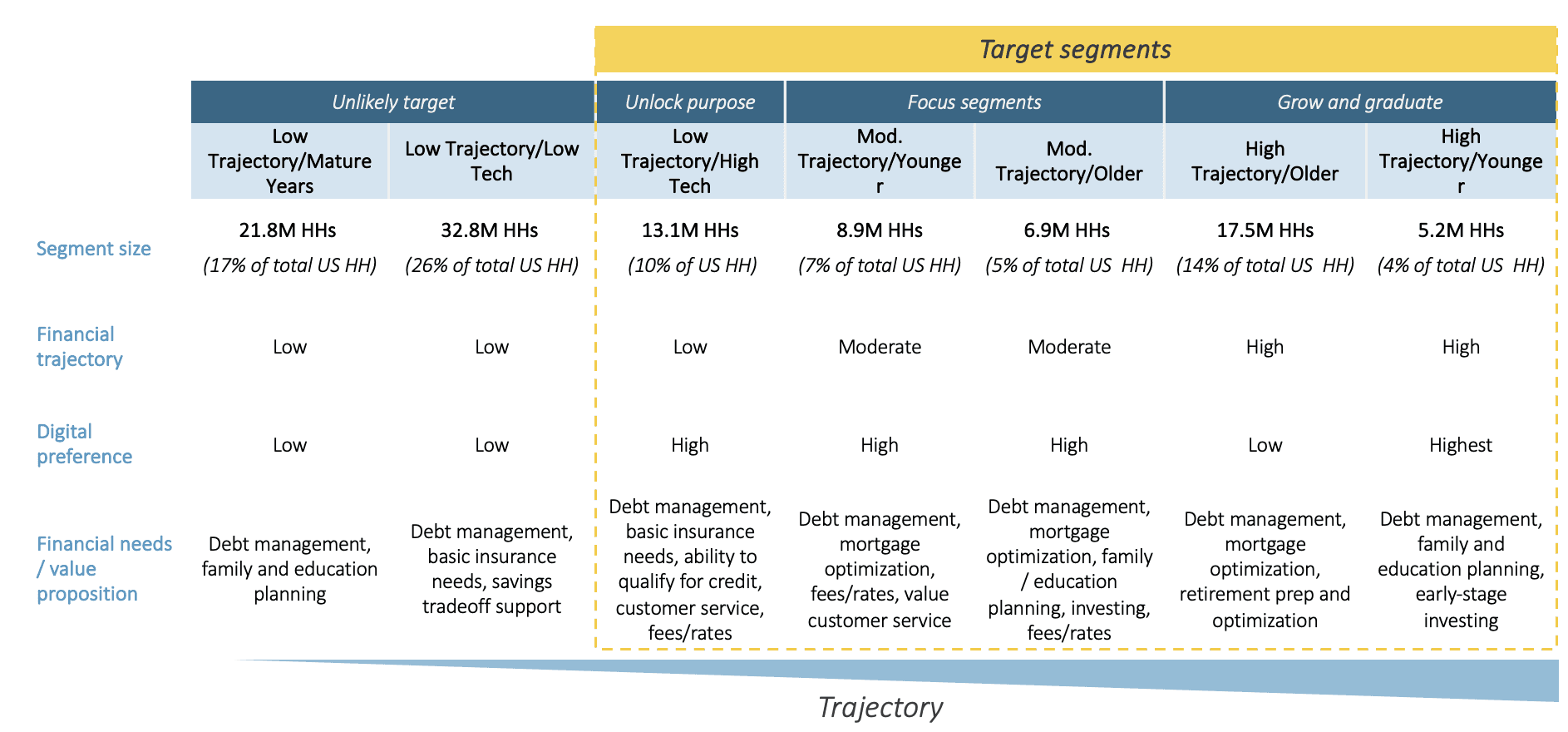

Target Segments

Target Segments

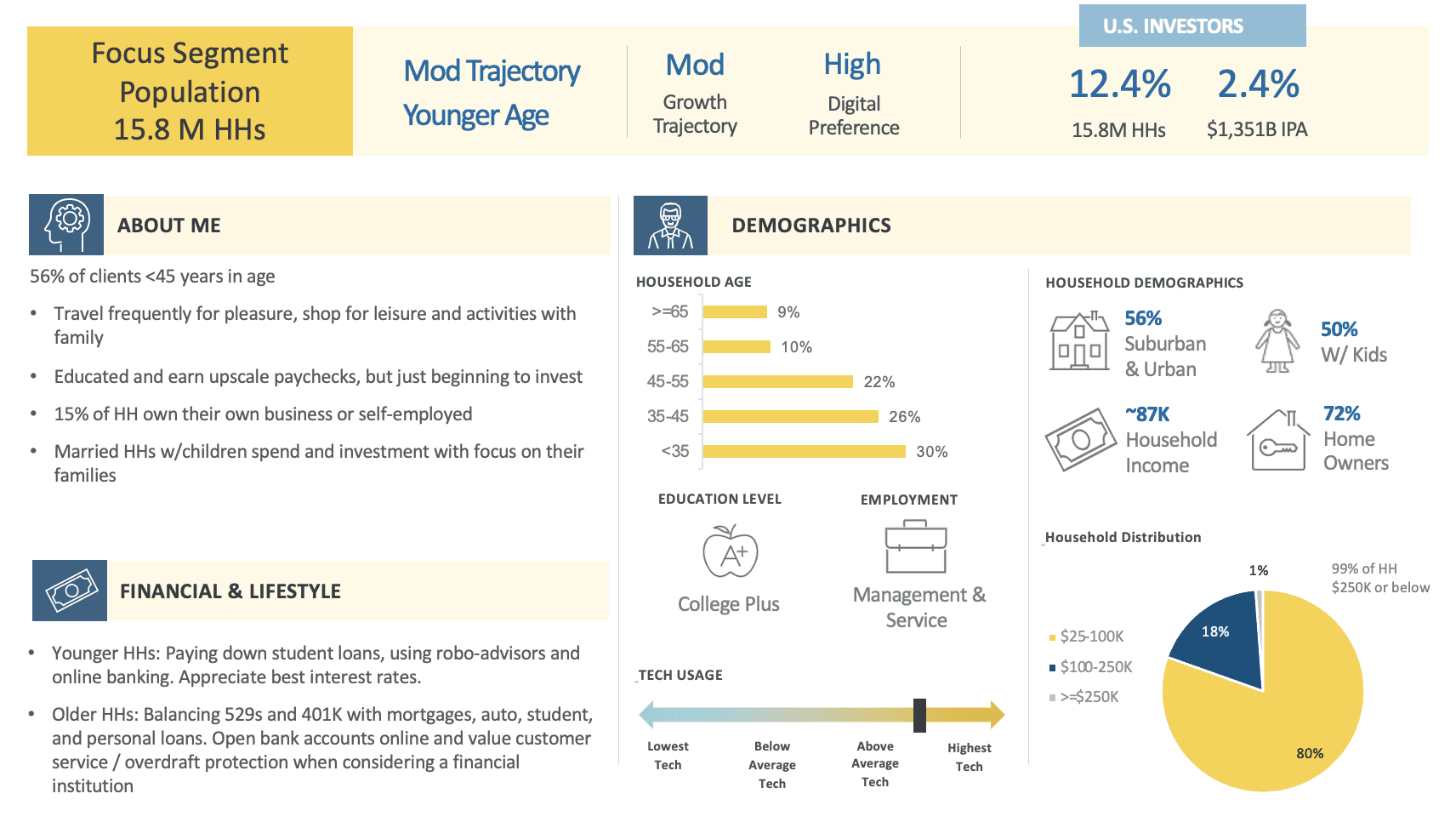

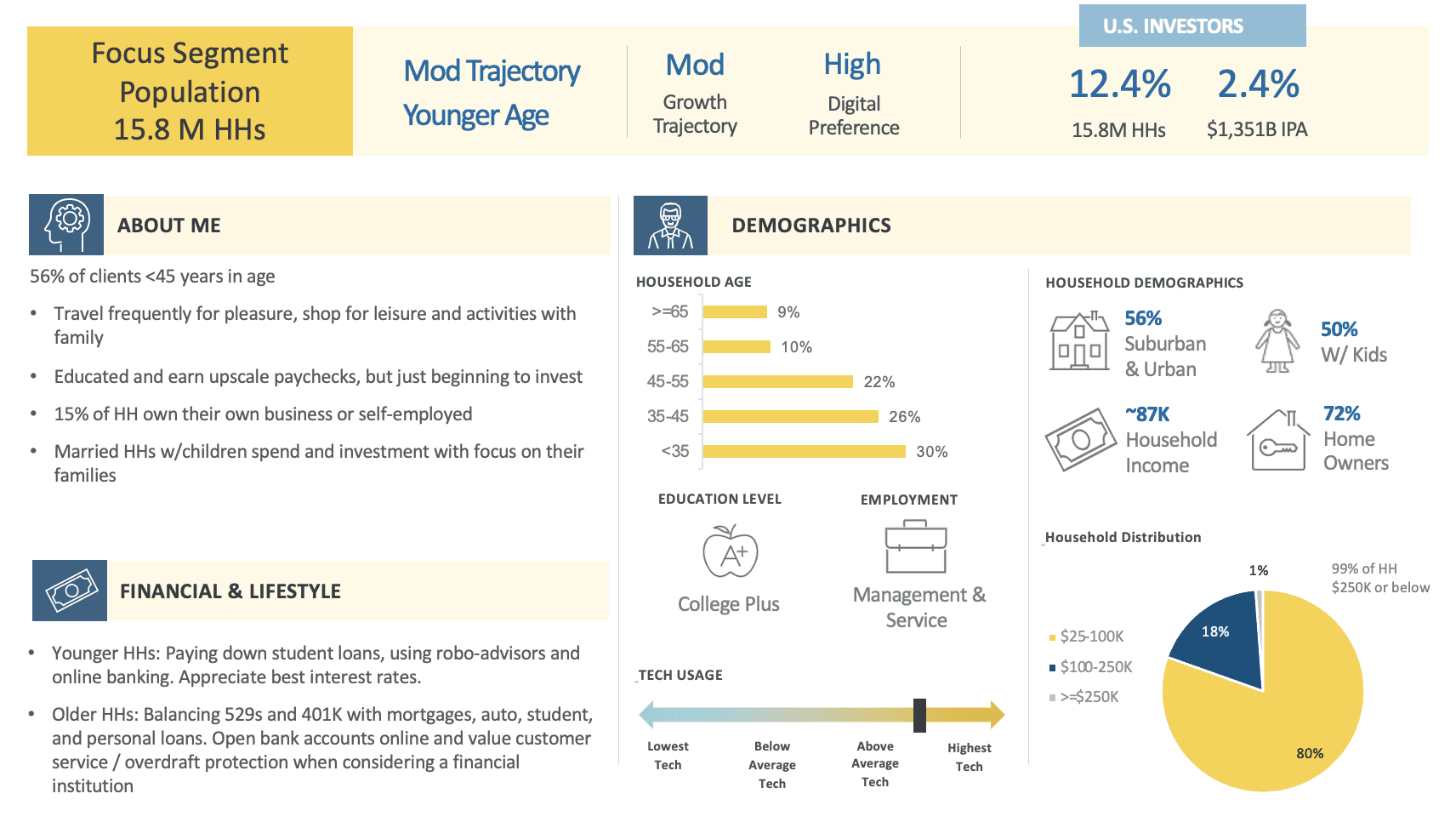

We identified 51.6 million U.S. households as our potential customers.

Among 106.2M US Households we consider Emerging Investors, target segments encompass 51.6M US HH’s primarily based on financial trajectory and digital preference.

We identified 51.6 million U.S. households as our potential customers.

Among 106.2M US Households we consider Emerging Investors, target segments encompass 51.6M US HH’s primarily based on financial trajectory and digital preference.

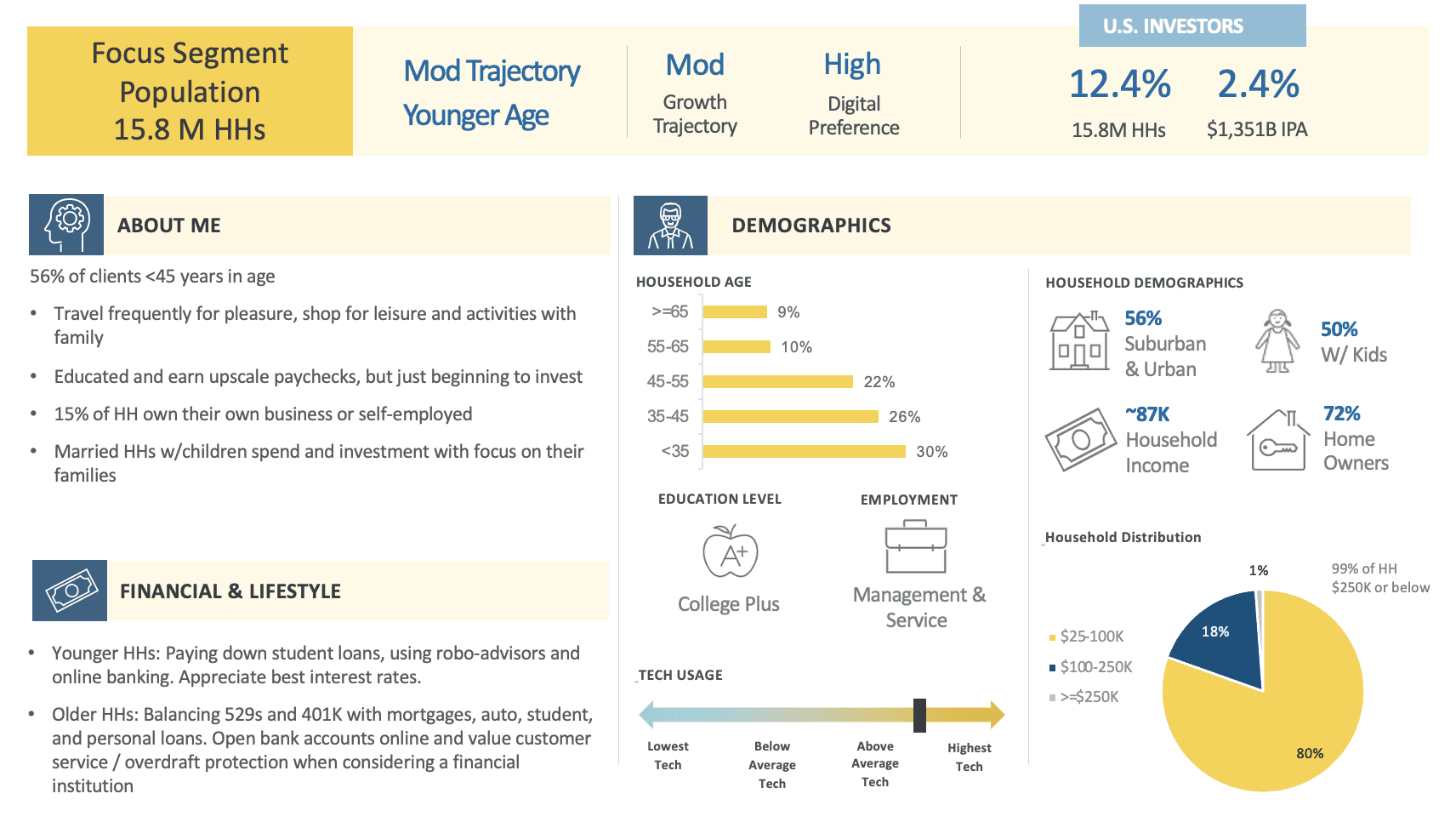

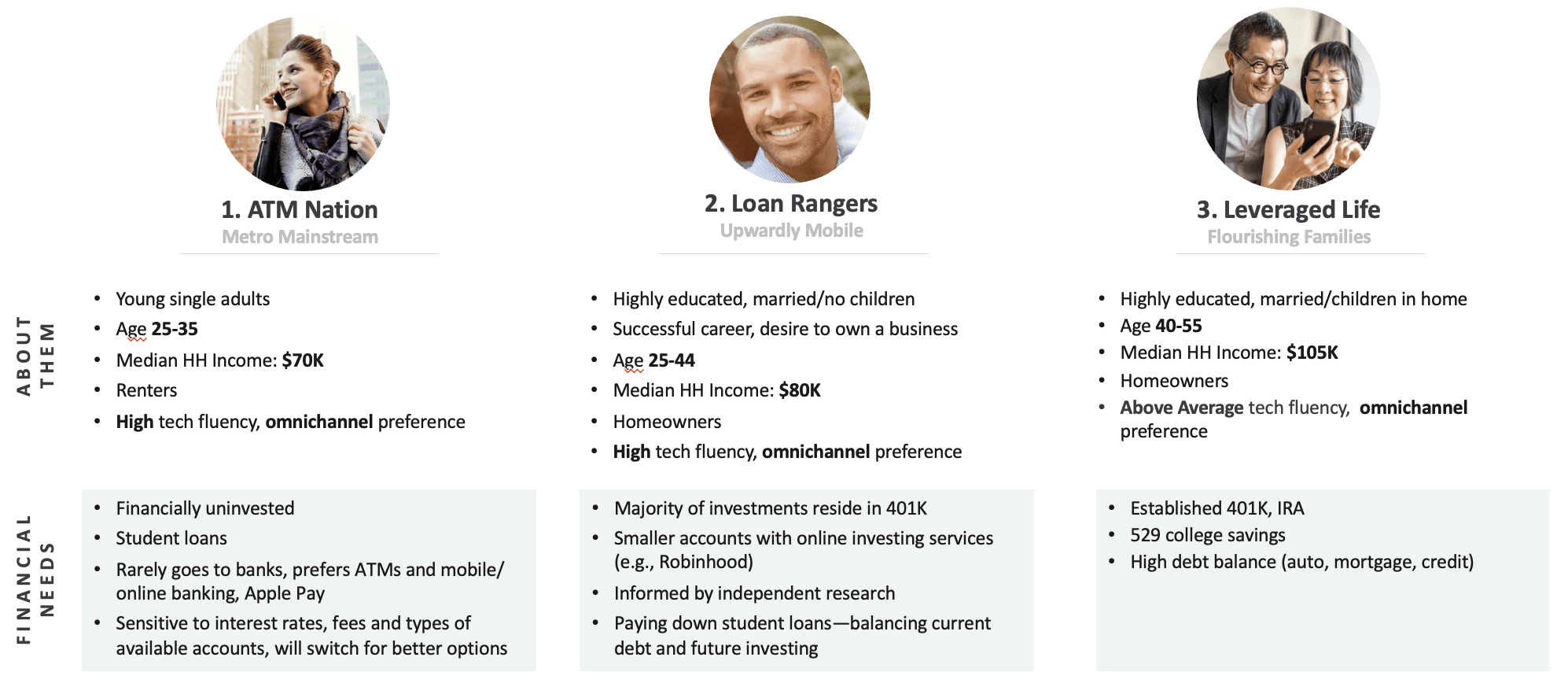

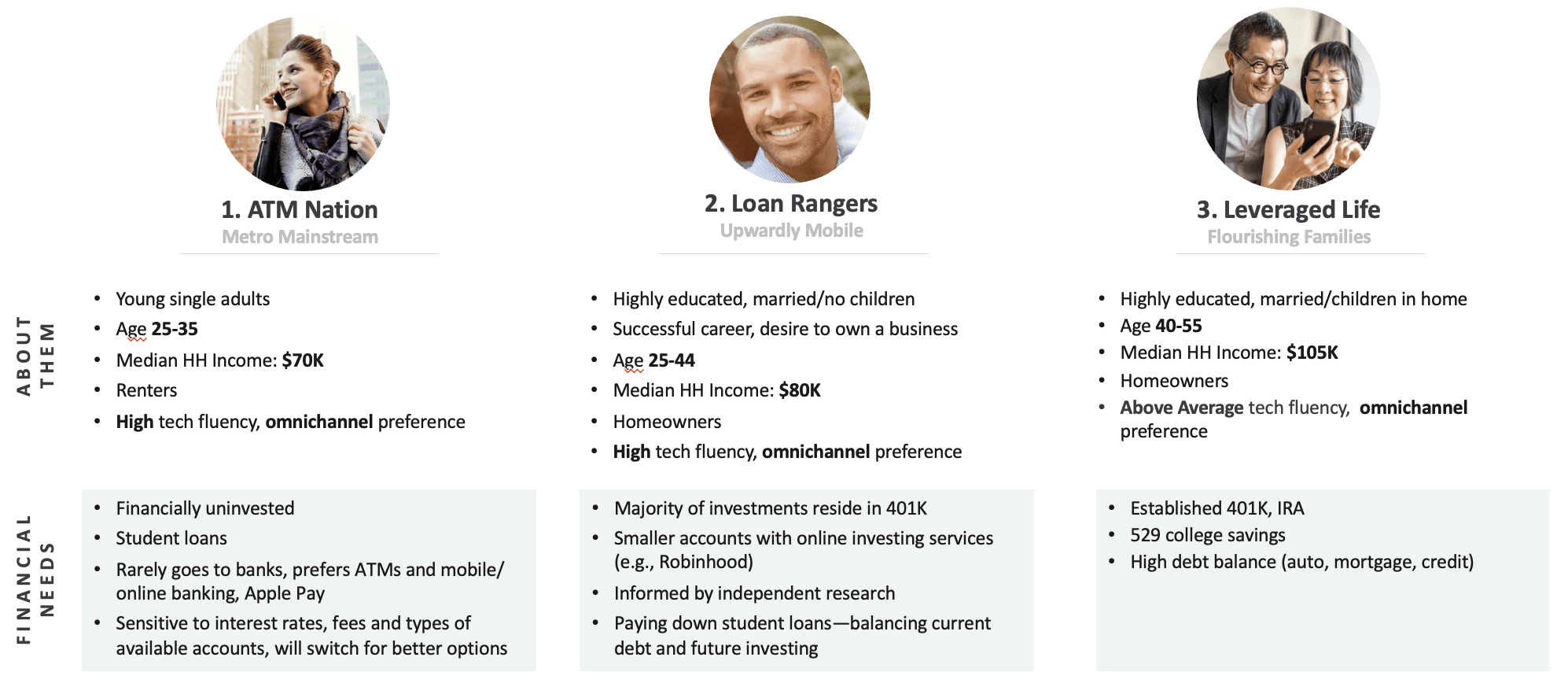

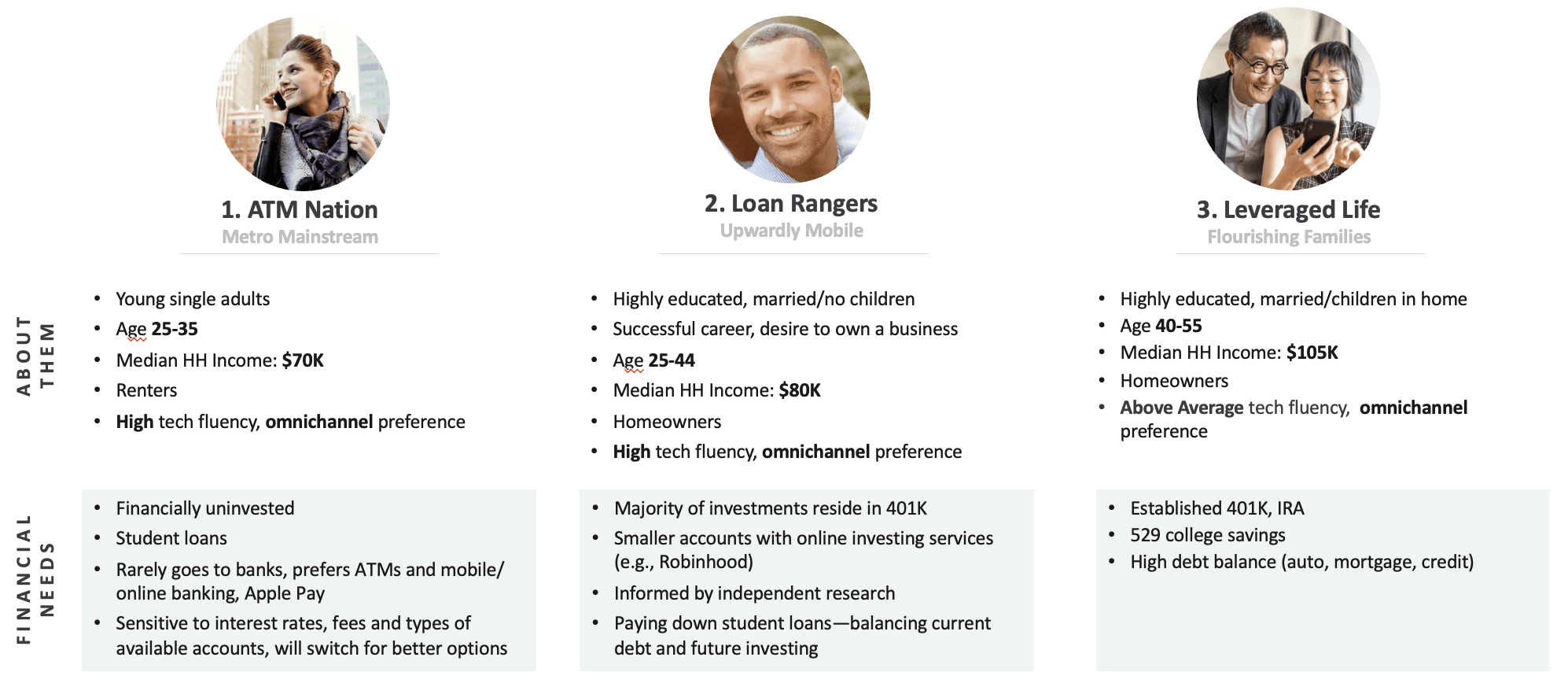

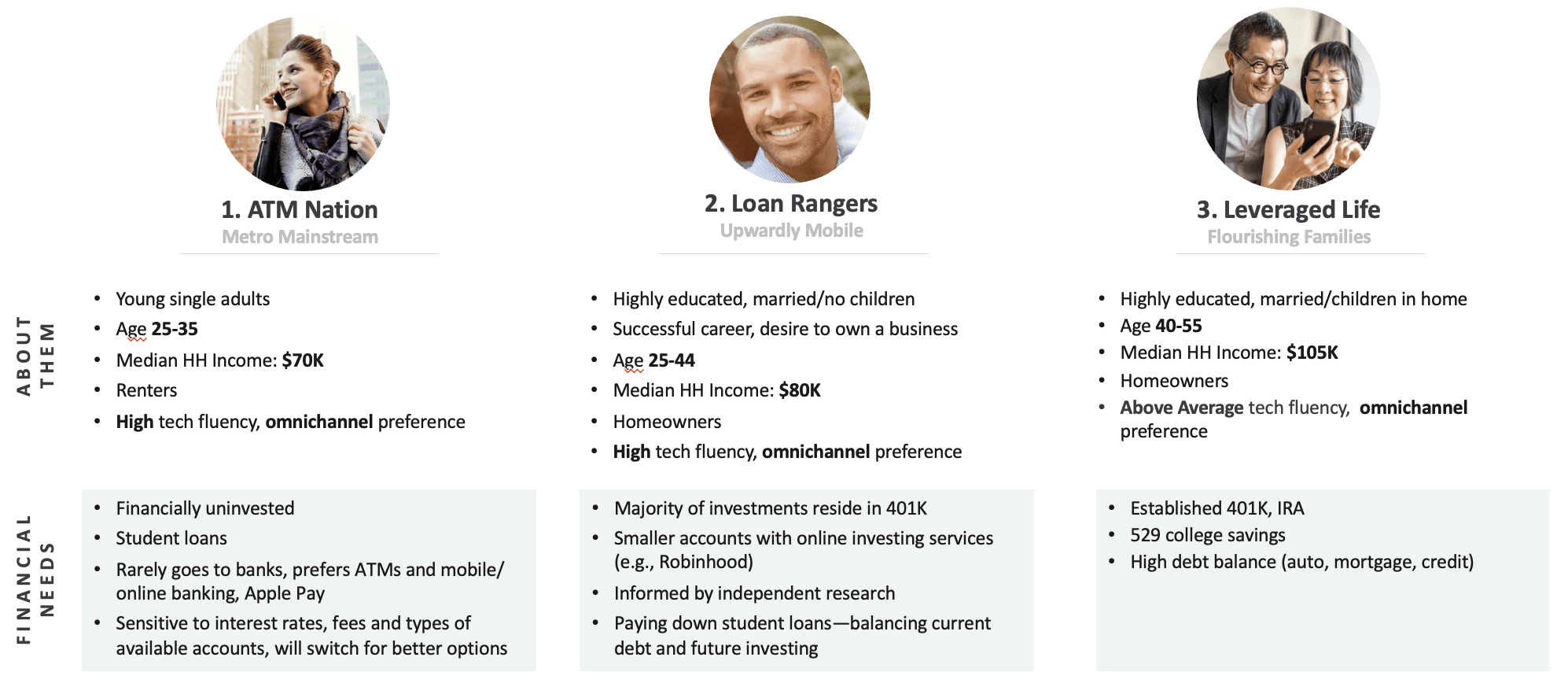

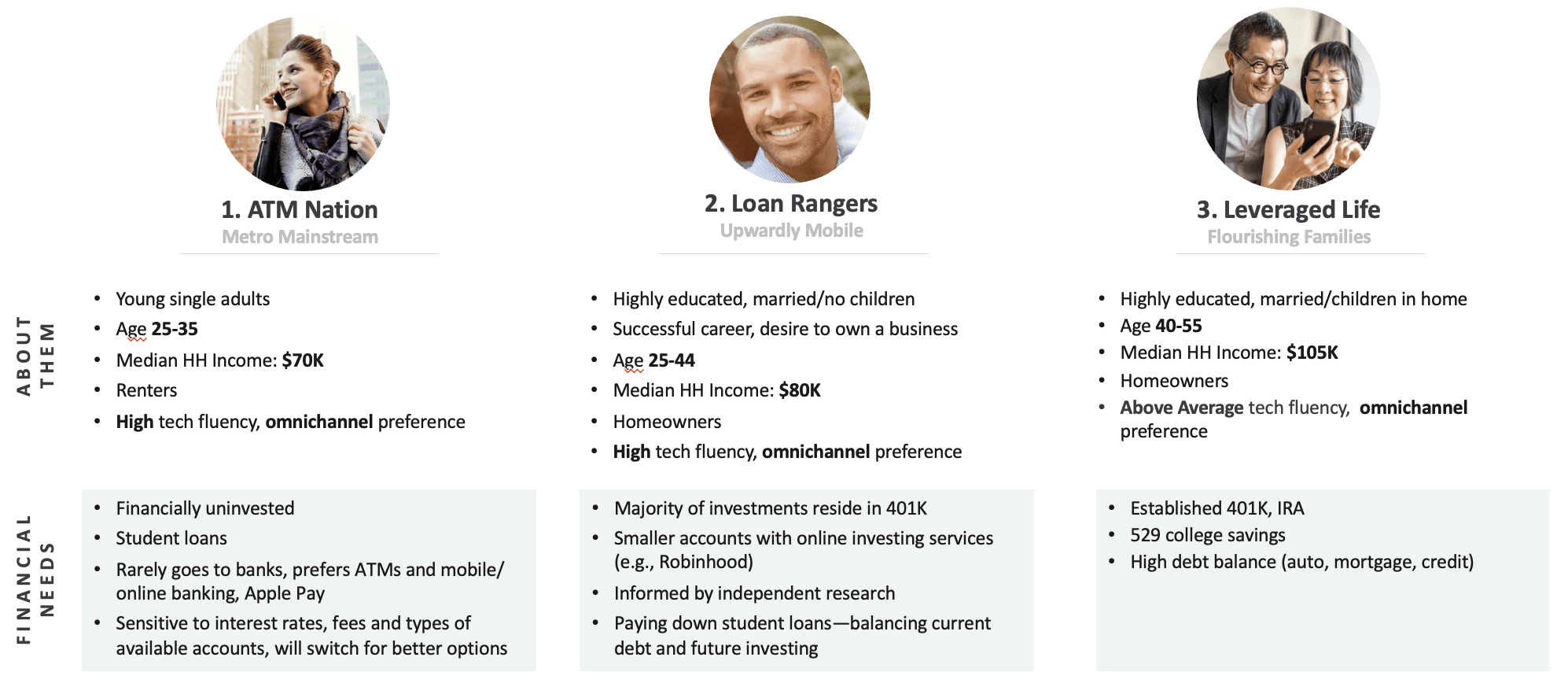

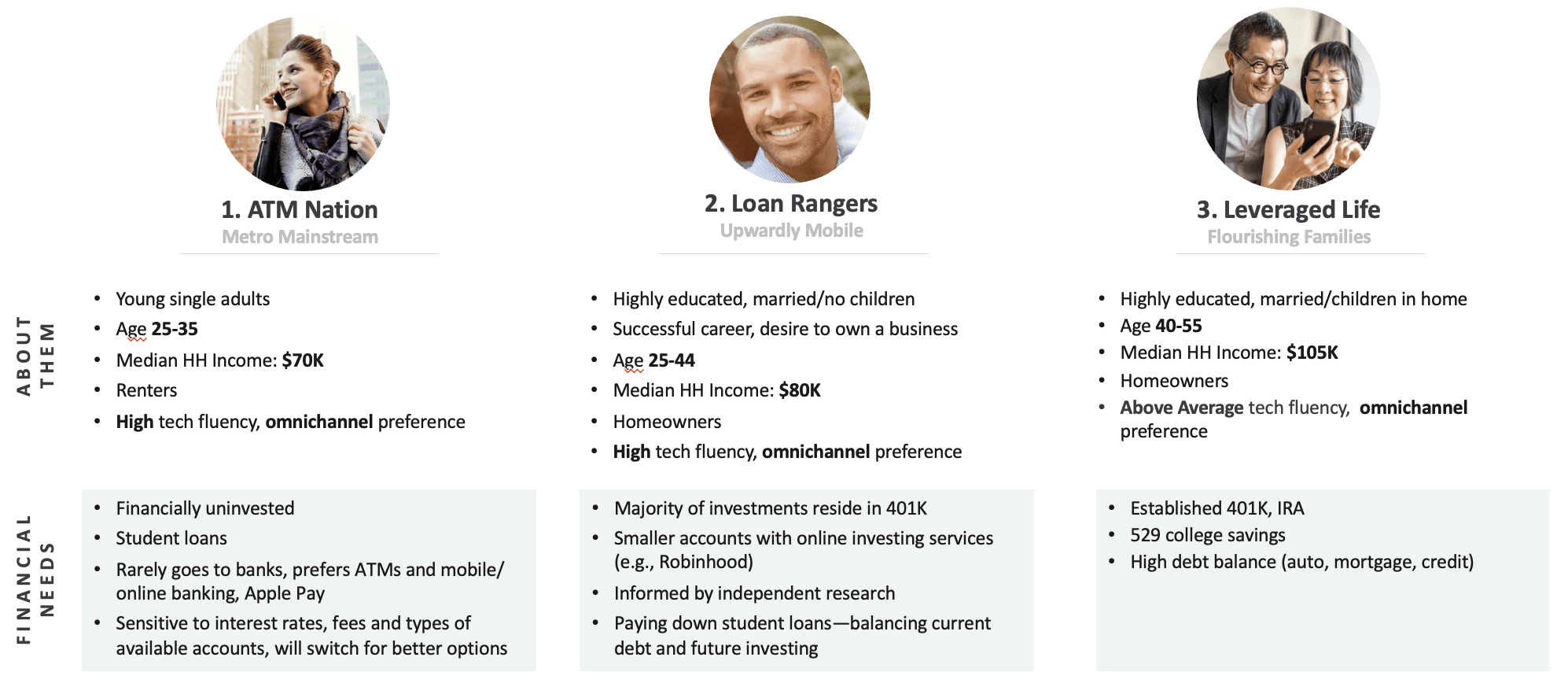

Personas

Personas

Given the extensive nature of our audience, we determined that emerging investors with <$250K in IPA can be best represented through 3 personas

The common traits observed across the personas affirm Stakeholder’s opportunity to serve their needs. While there are common traits across personas, each represent a different and unique set of needs, beliefs, and values that we need to address.

Given the extensive nature of our audience, we determined that emerging investors with <$250K in IPA can be best represented through 3 personas

The common traits observed across the personas affirm Stakeholder’s opportunity to serve their needs. While there are common traits across personas, each represent a different and unique set of needs, beliefs, and values that we need to address.

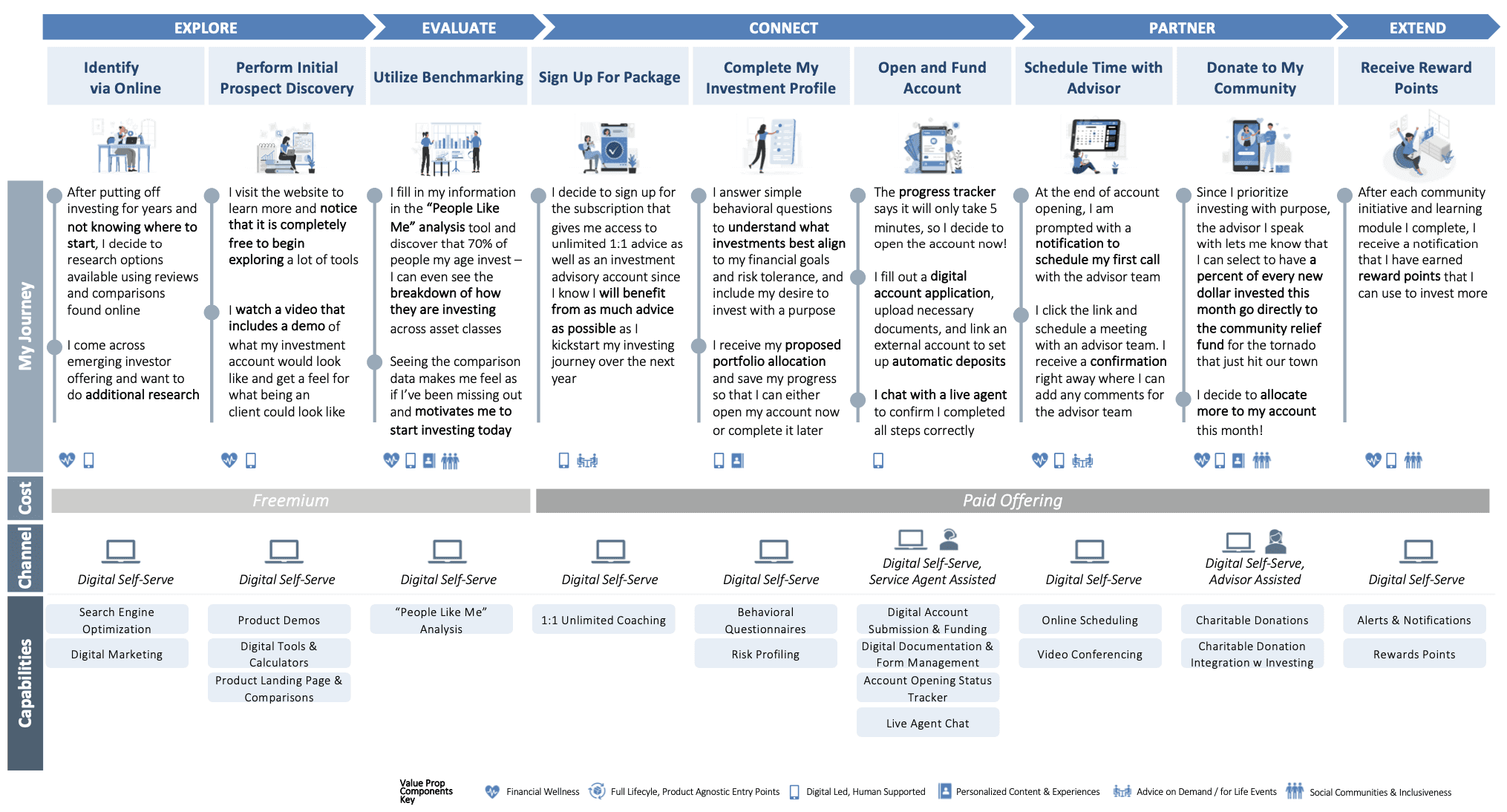

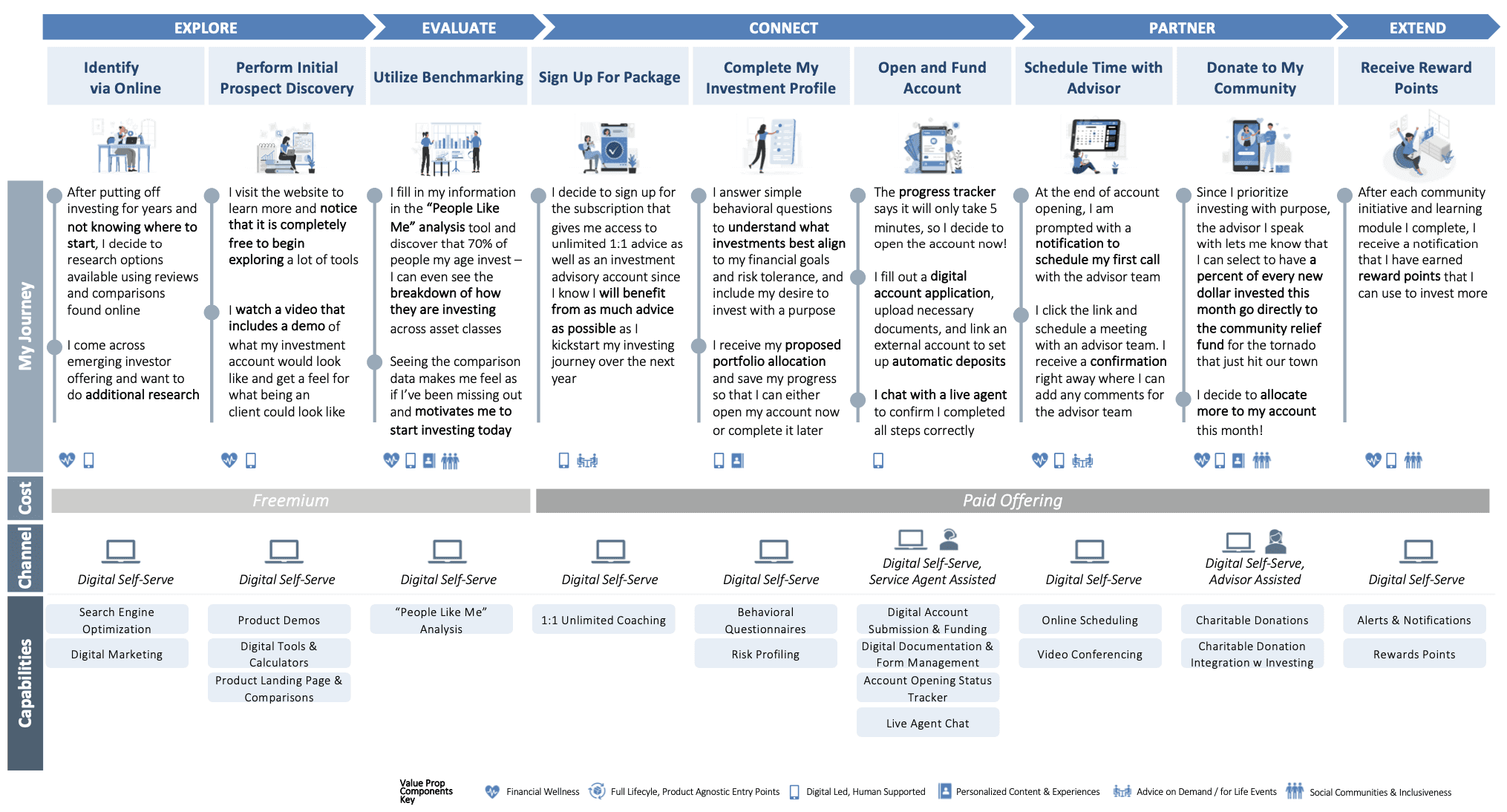

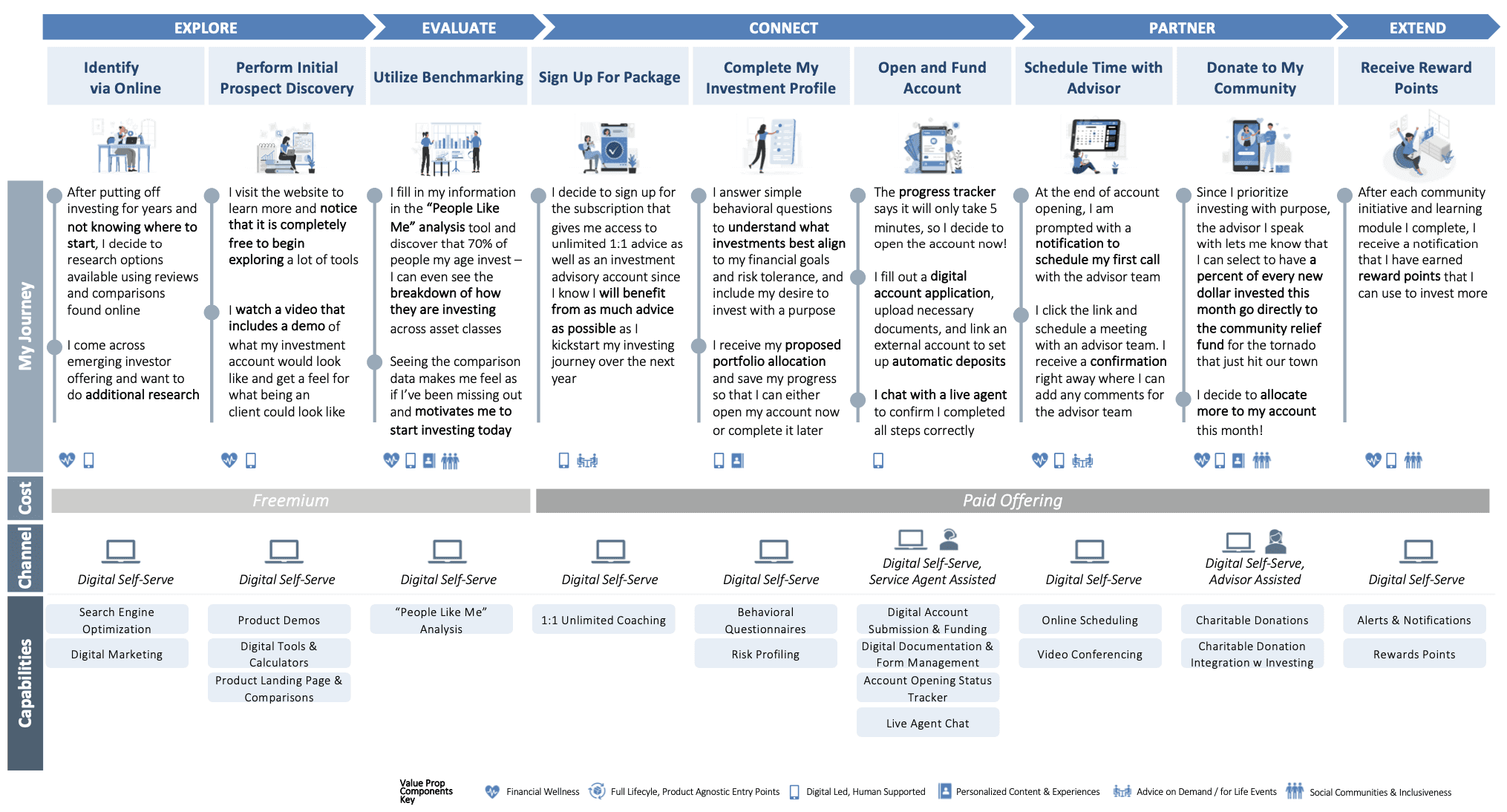

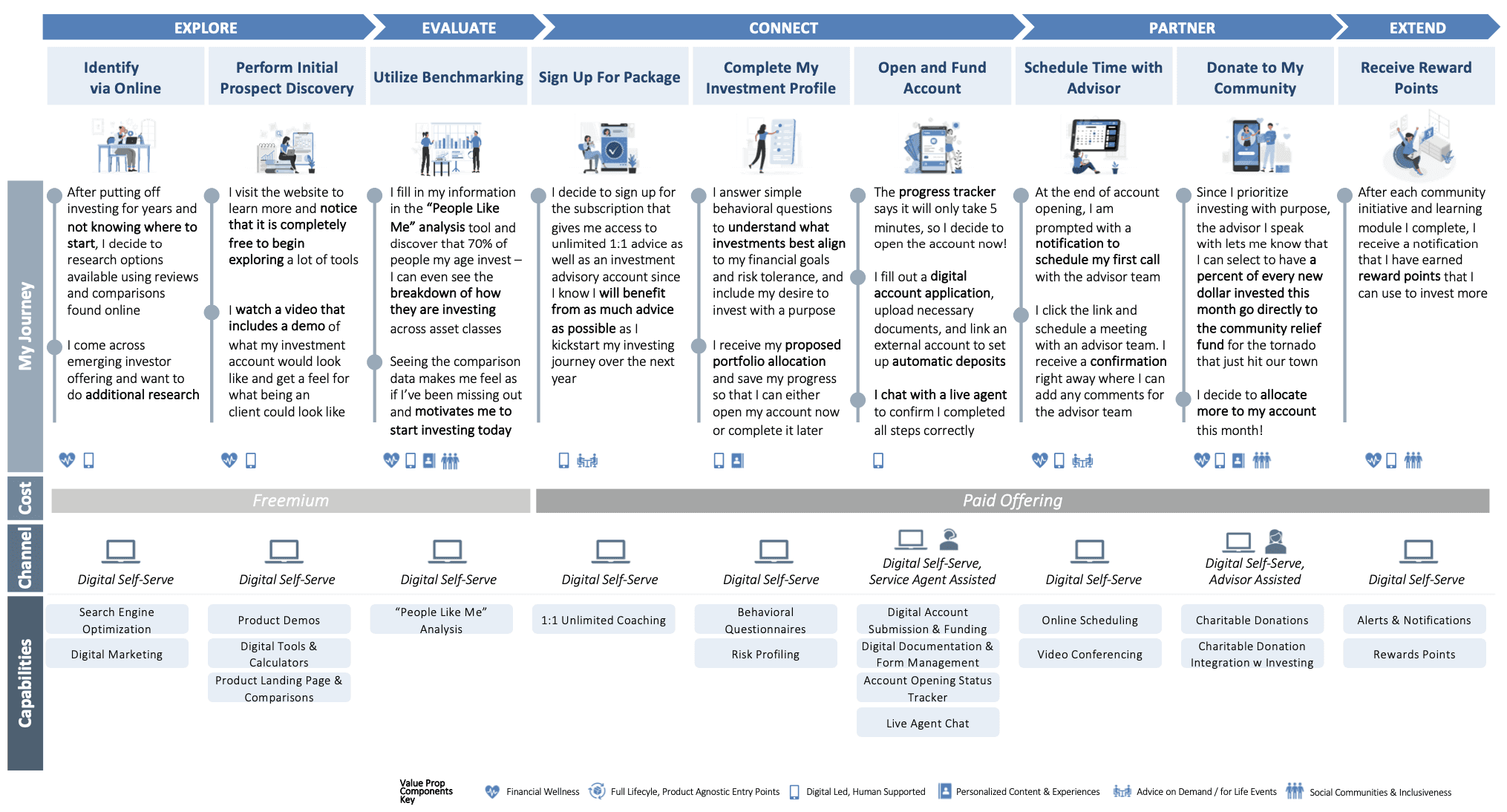

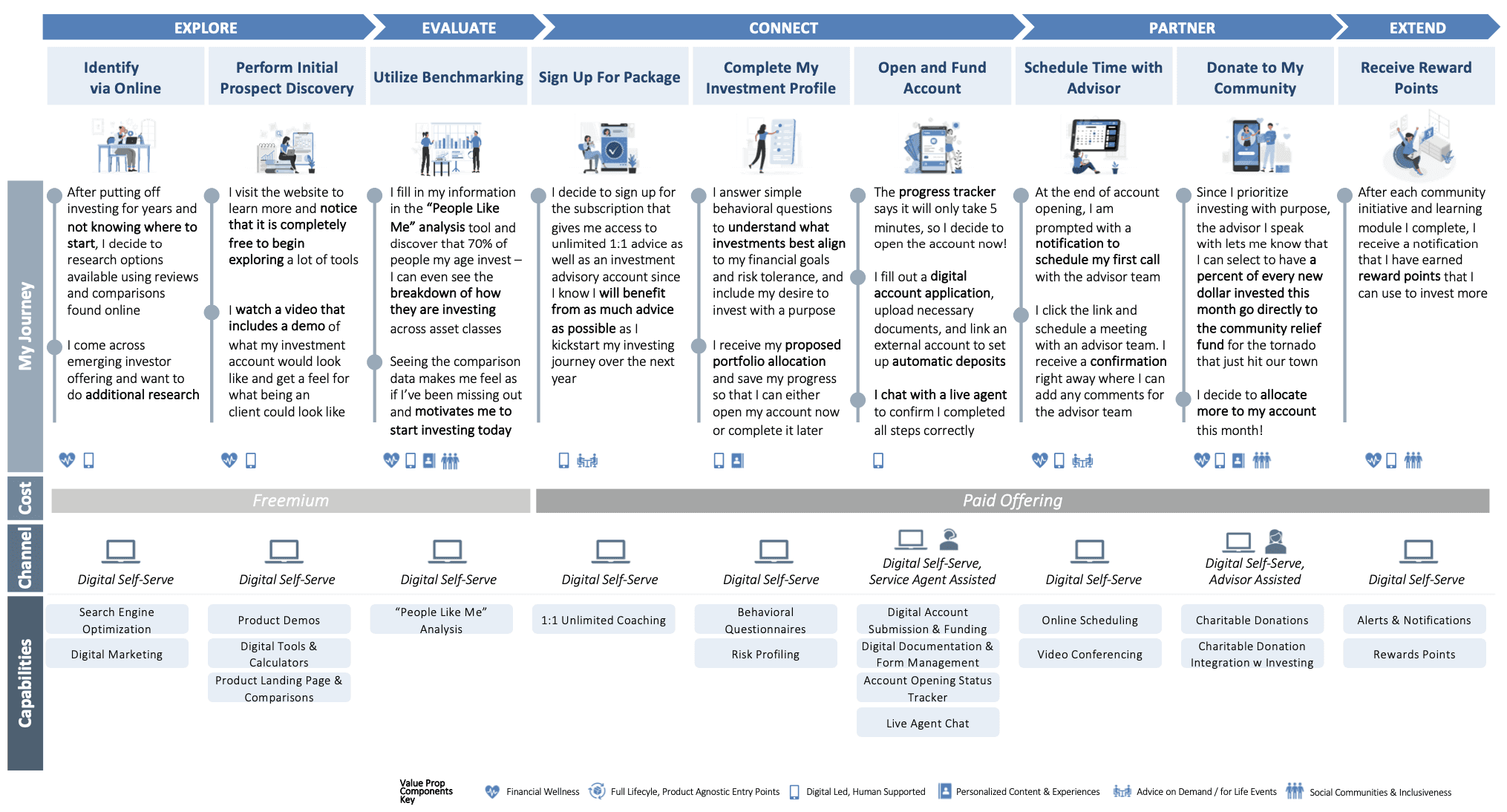

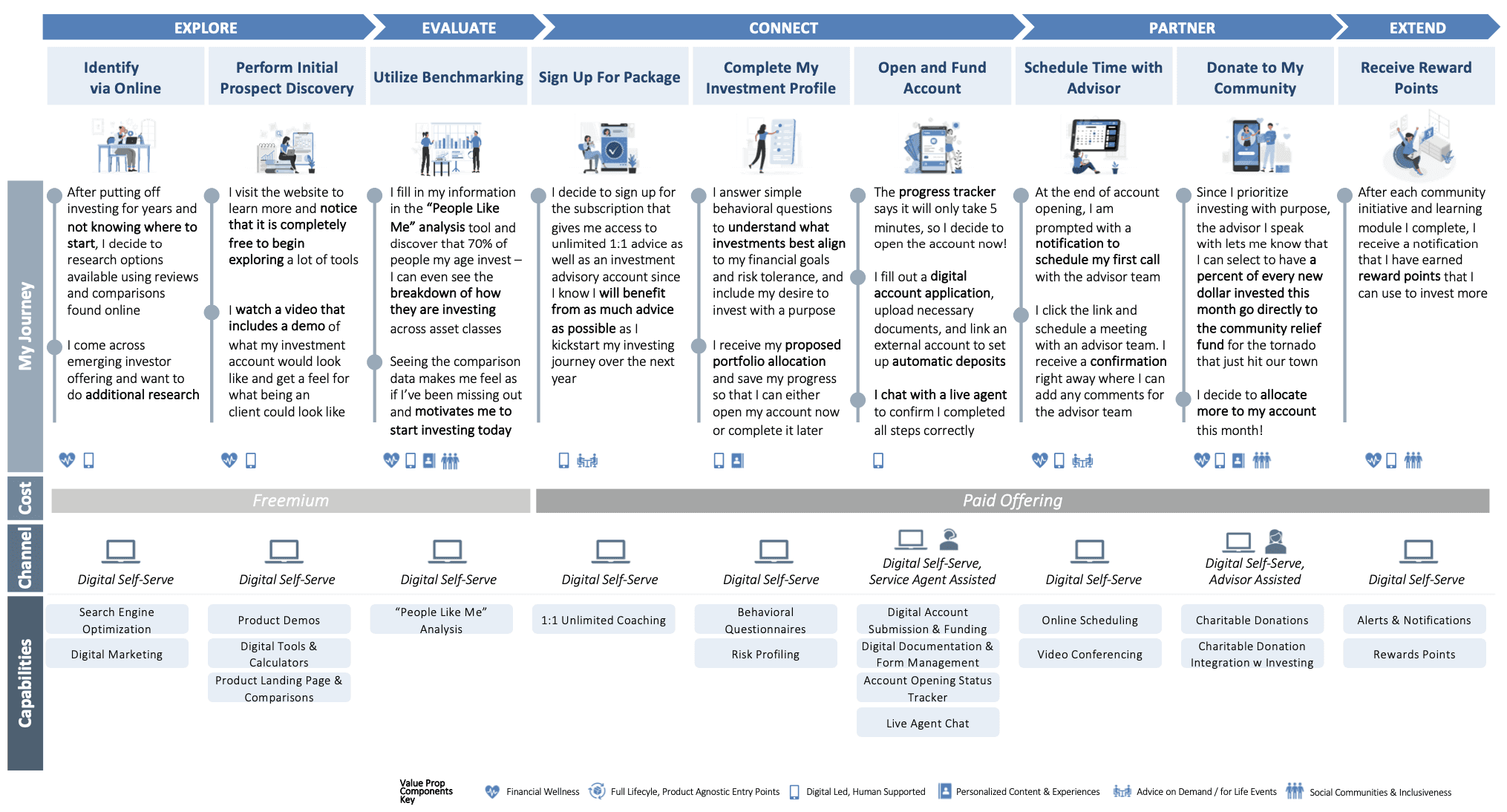

User Journey

User Journey

We illustrated the step-by-step process for emerging investors as they explore, evaluate, connect, partner, and extend their investment experiences.

This user journey map highlights key touchpoints and user actions, supported by digital and human-assisted capabilities. It emphasizes enhancing financial wellness, providing personalized guidance, and fostering community engagement through a seamless blend of digital self-service and human interaction.

We illustrated the step-by-step process for emerging investors as they explore, evaluate, connect, partner, and extend their investment experiences.

This user journey map highlights key touchpoints and user actions, supported by digital and human-assisted capabilities. It emphasizes enhancing financial wellness, providing personalized guidance, and fostering community engagement through a seamless blend of digital self-service and human interaction.

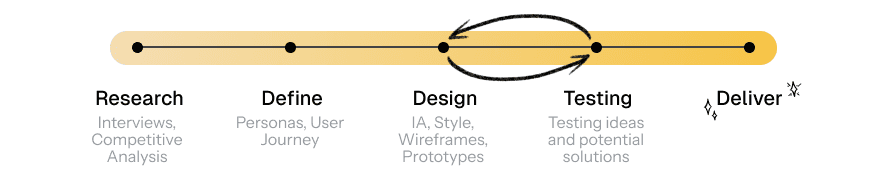

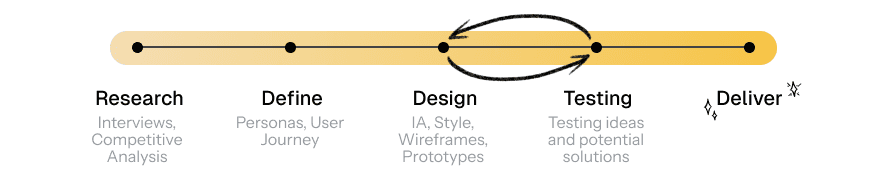

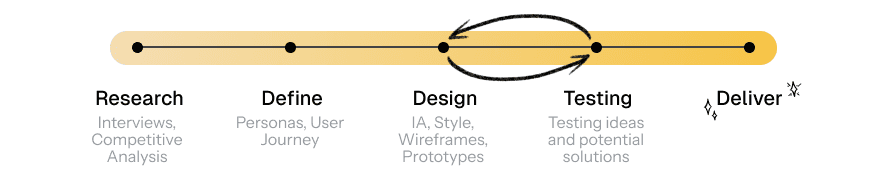

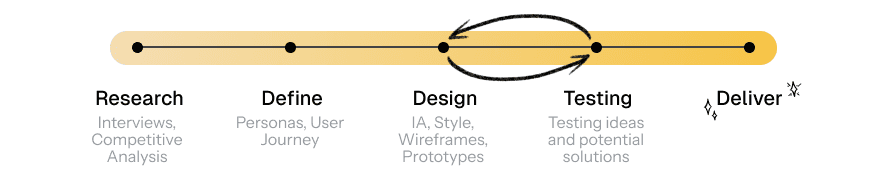

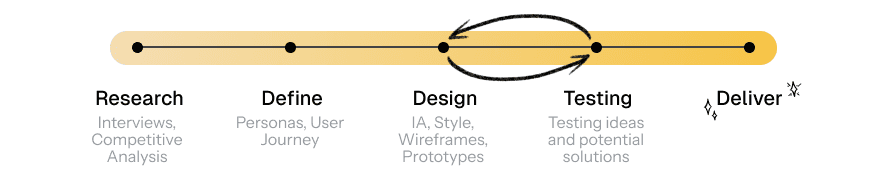

Design

Design

Information Architecture

Information Architecture

Based on our previous research and user journey analysis, we developed the IA to streamline user interaction.

This design ensures that key functionalities discovered in the Research stage, such as financial tracking, personalized coaching, community engagement, and educational resources, are easily accessible and intuitively organized to meet the diverse needs of emerging investors.

Based on our previous research and user journey analysis, we developed the IA to streamline user interaction.

This design ensures that key functionalities discovered in the Research stage, such as financial tracking, personalized coaching, community engagement, and educational resources, are easily accessible and intuitively organized to meet the diverse needs of emerging investors.

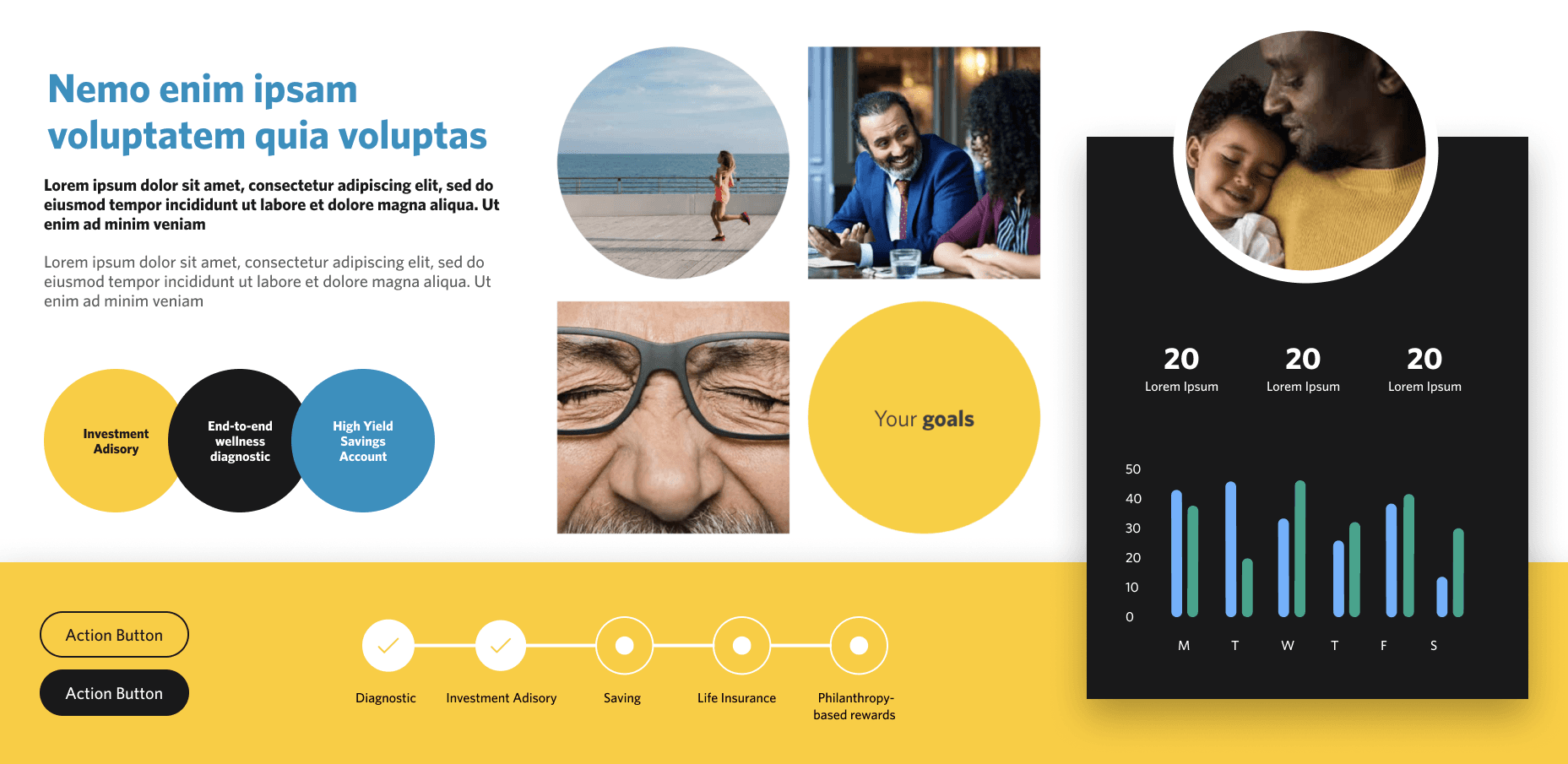

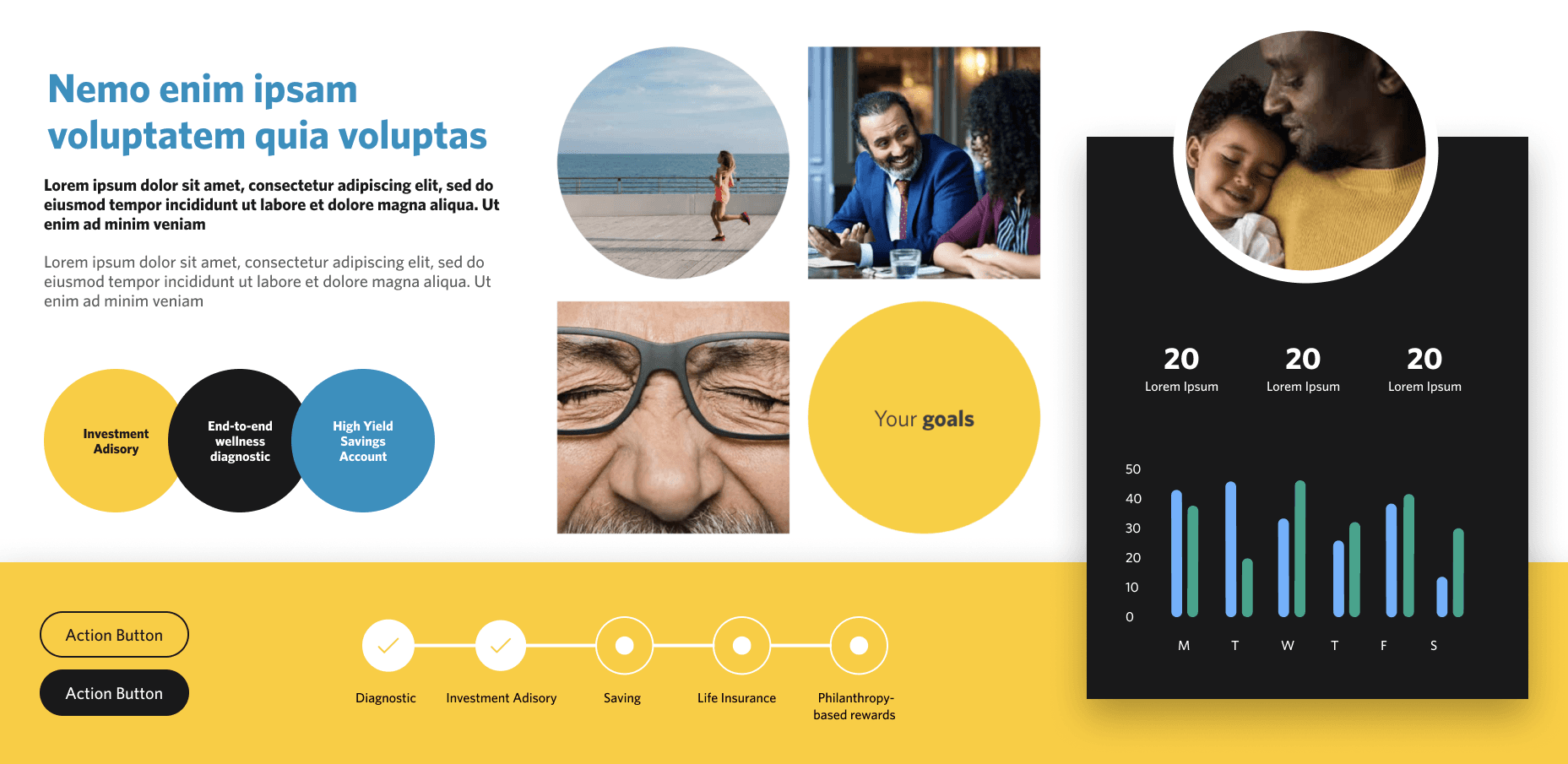

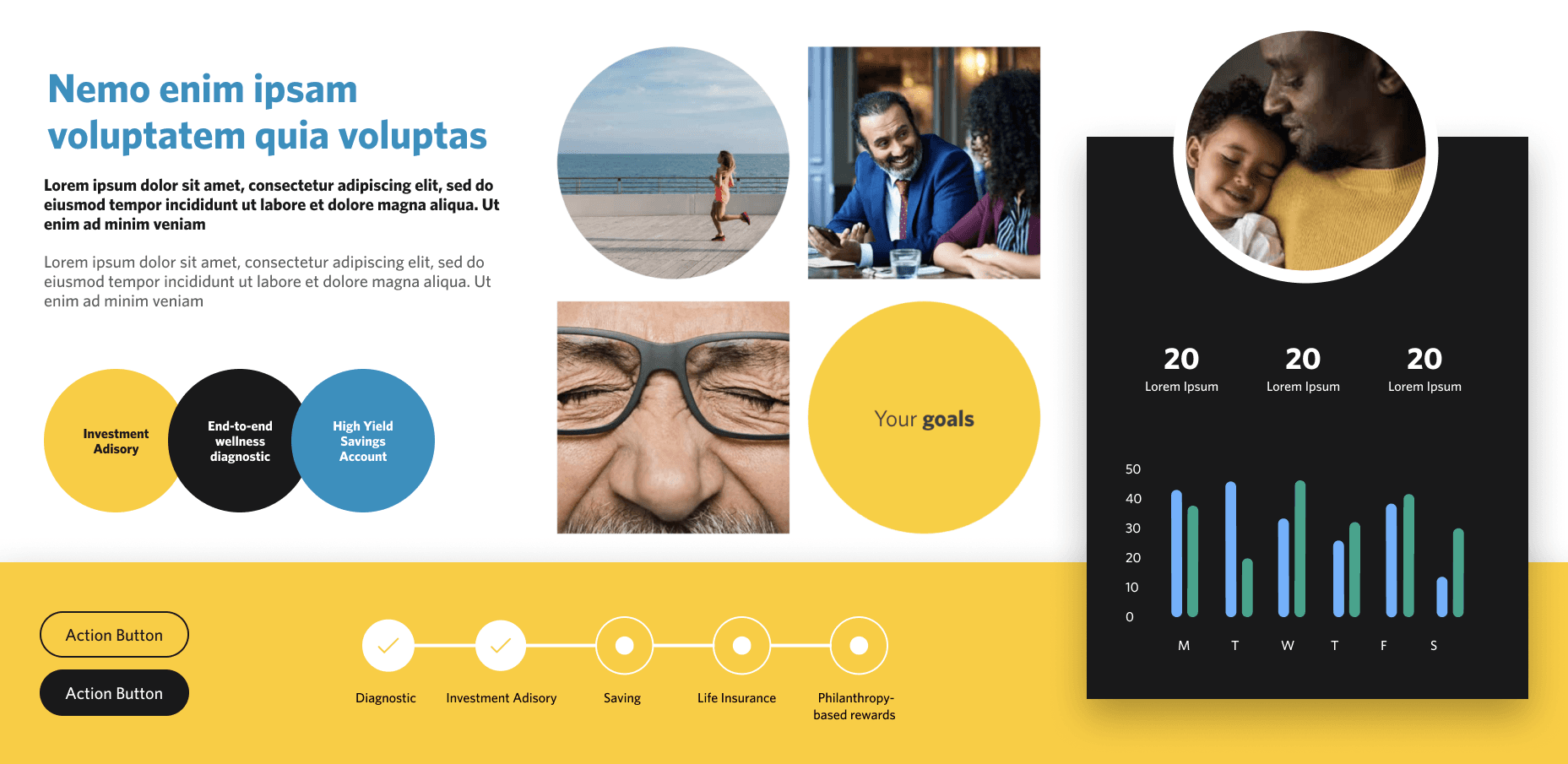

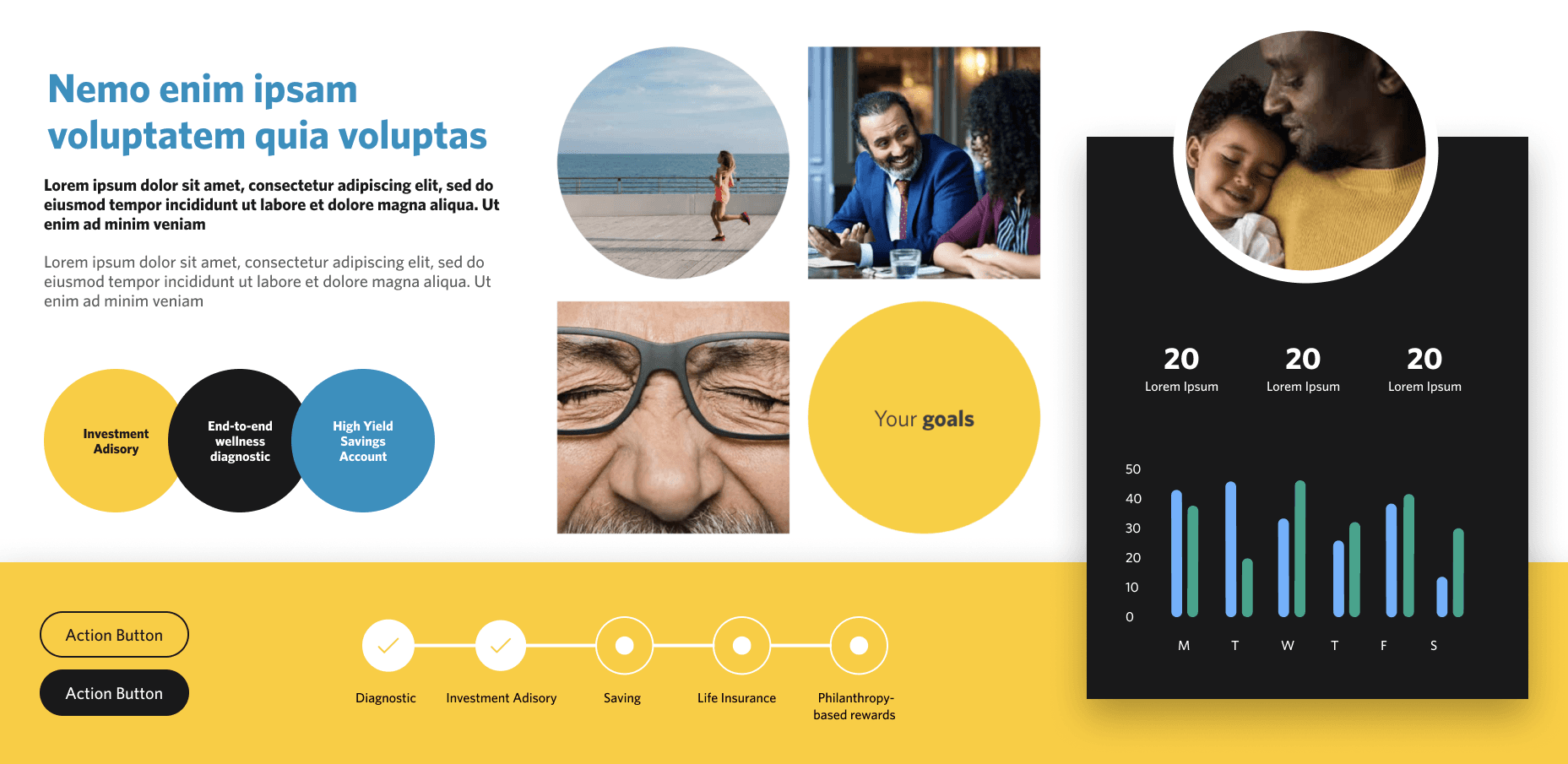

Style Guide

Style Guide

The next stage involved creating a moodboard based on the company's existing brand book to ensure consistency and alignment with established visual identity guidelines.

This moodboard helped define the color schemes, typography, and overall design aesthetics, ensuring a cohesive and recognizable style that resonates with our target audience while maintaining brand integrity.

The next stage involved creating a moodboard based on the company's existing brand book to ensure consistency and alignment with established visual identity guidelines.

This moodboard helped define the color schemes, typography, and overall design aesthetics, ensuring a cohesive and recognizable style that resonates with our target audience while maintaining brand integrity.

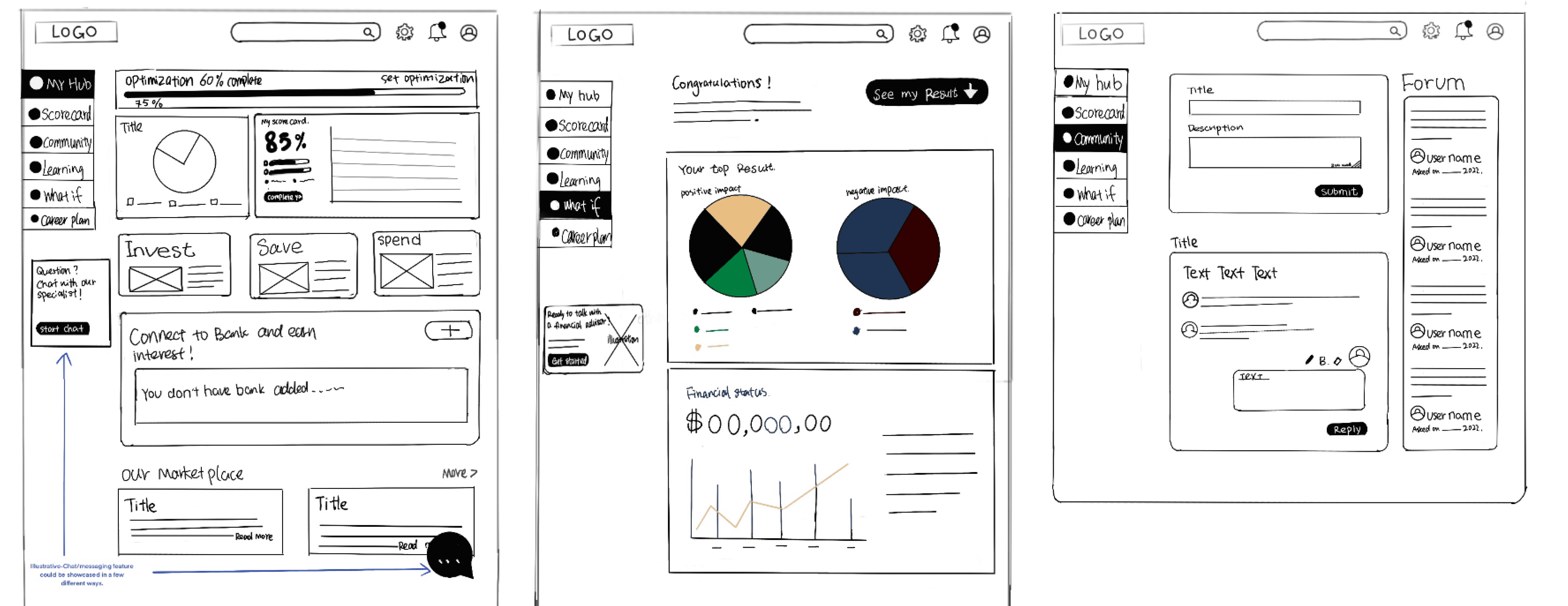

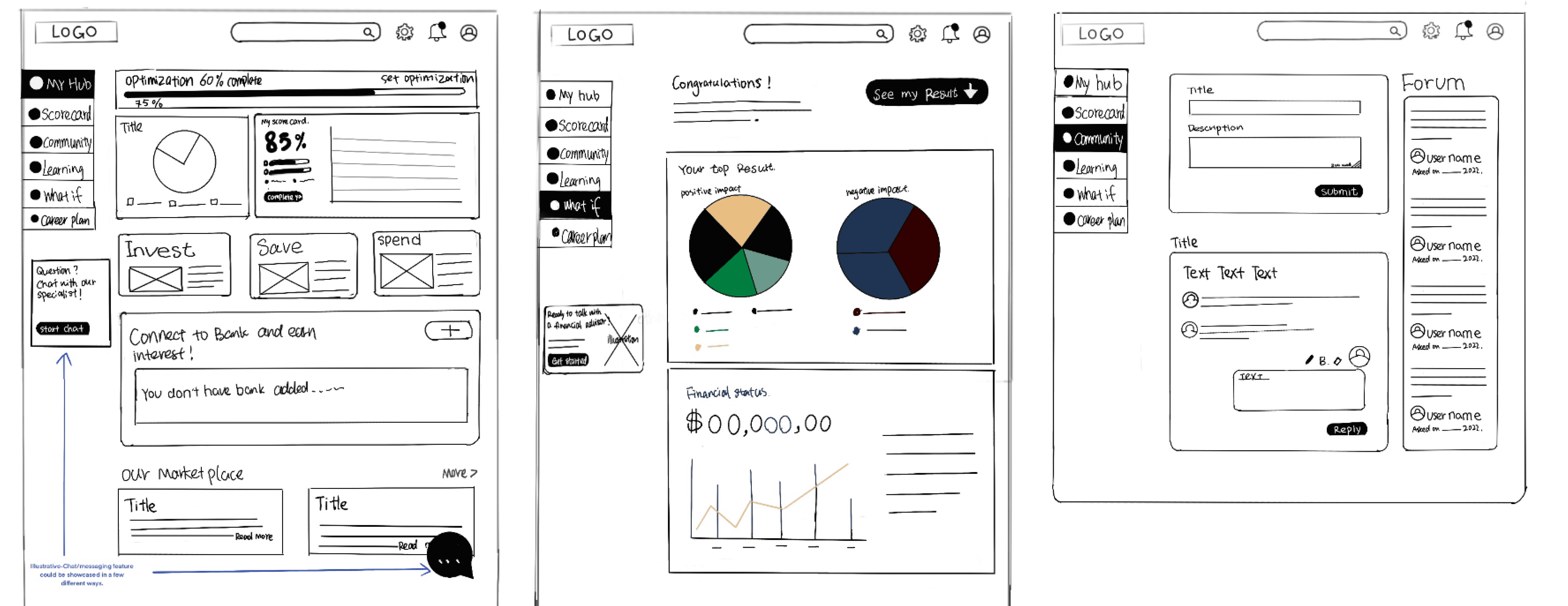

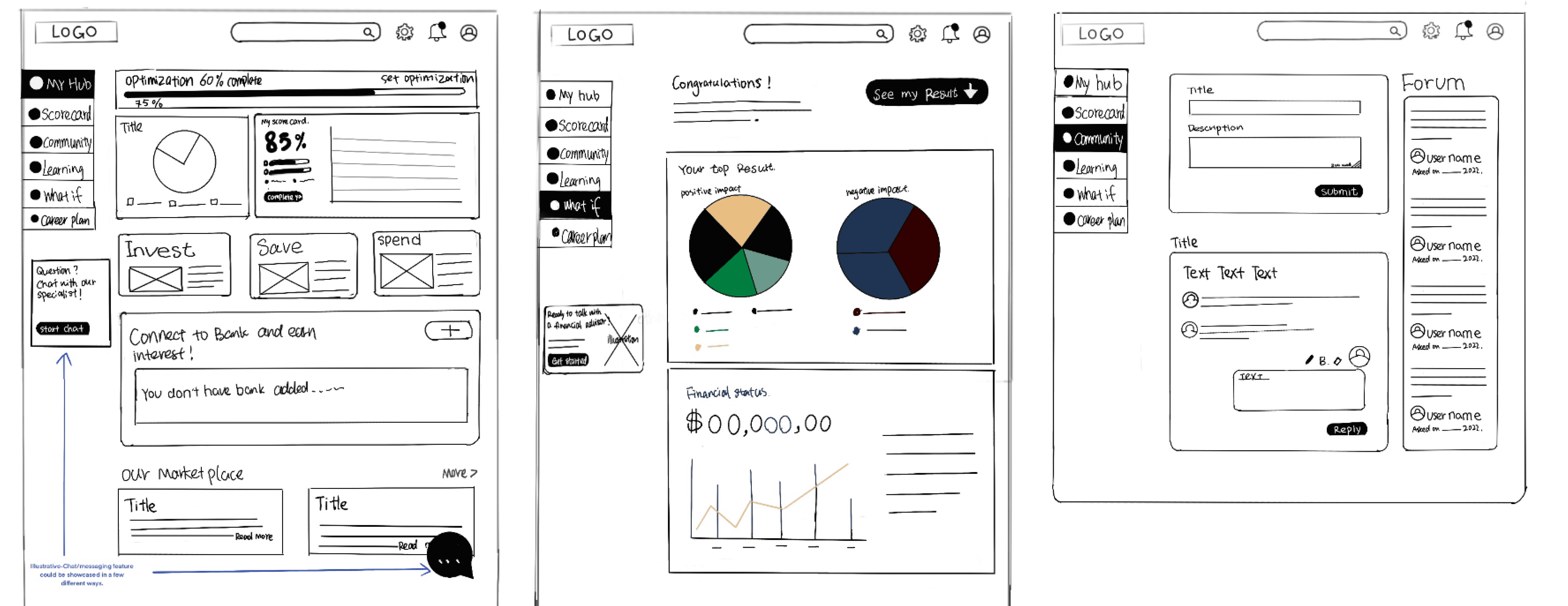

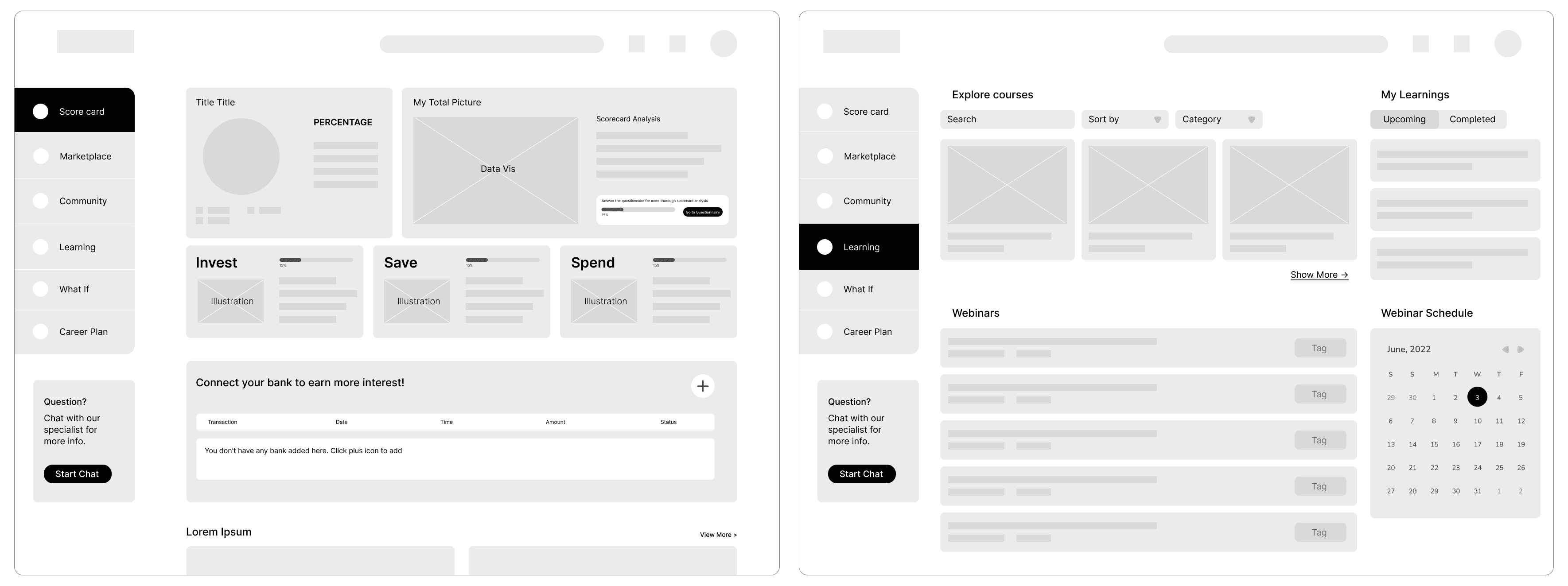

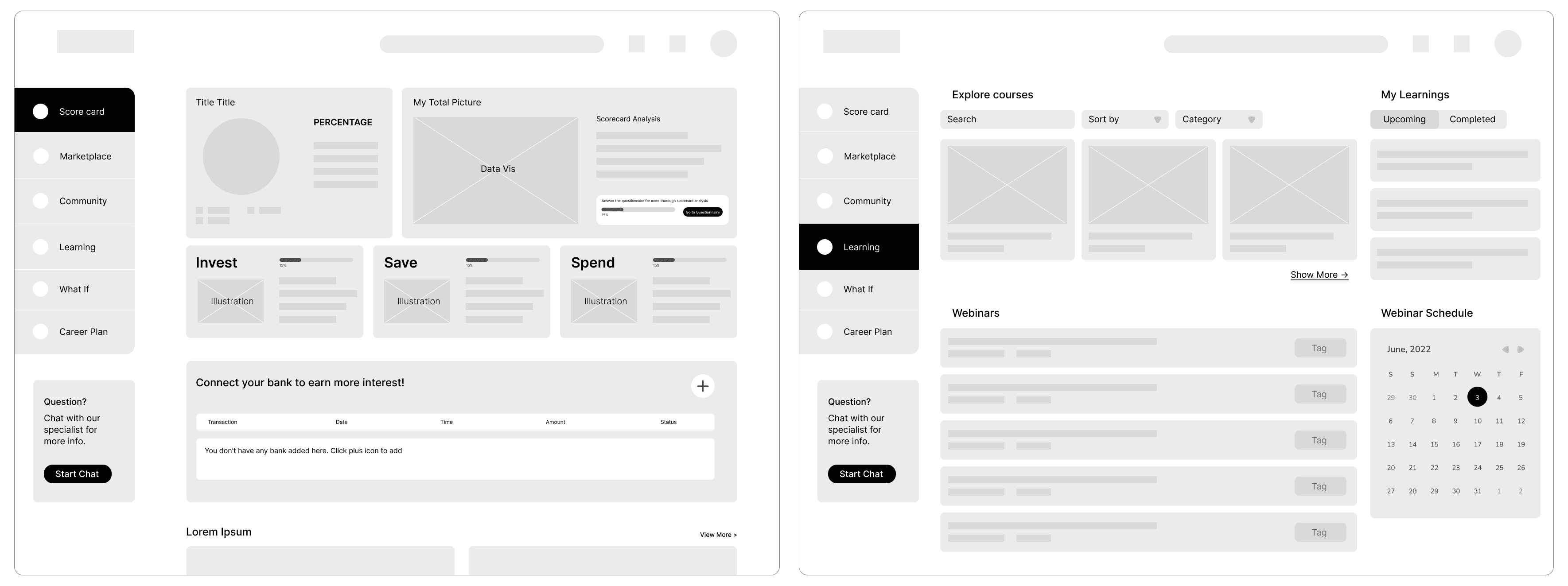

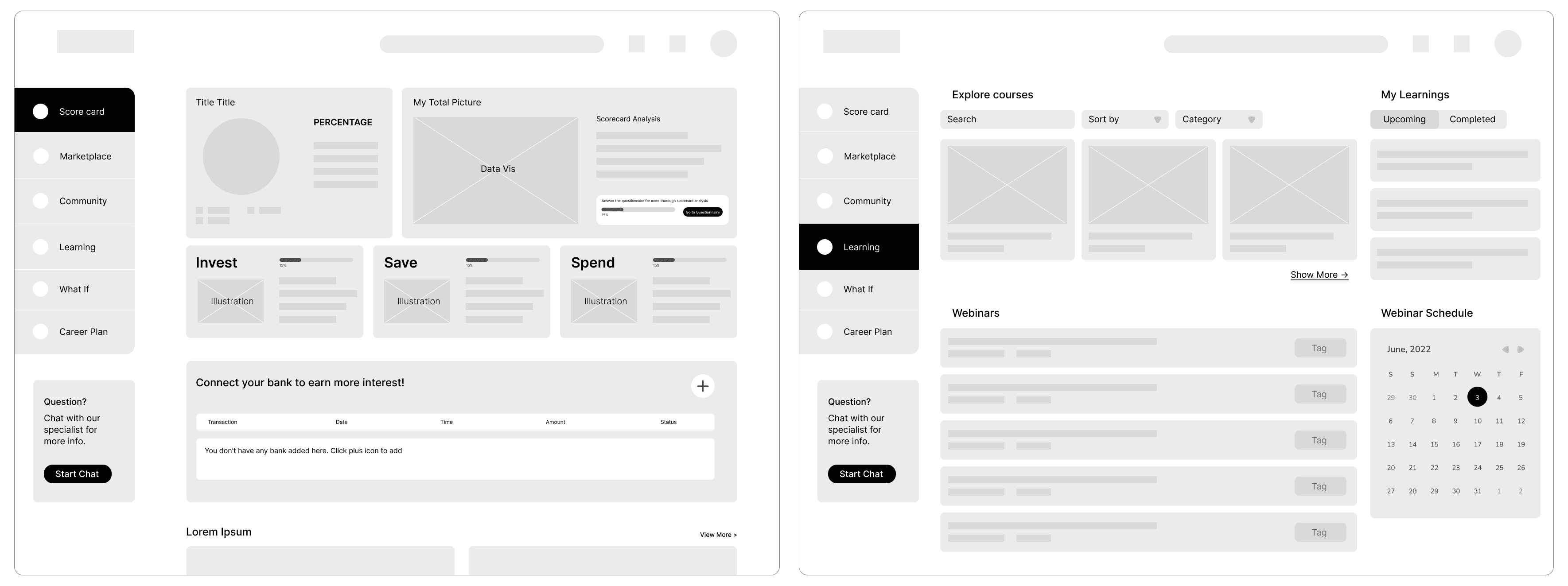

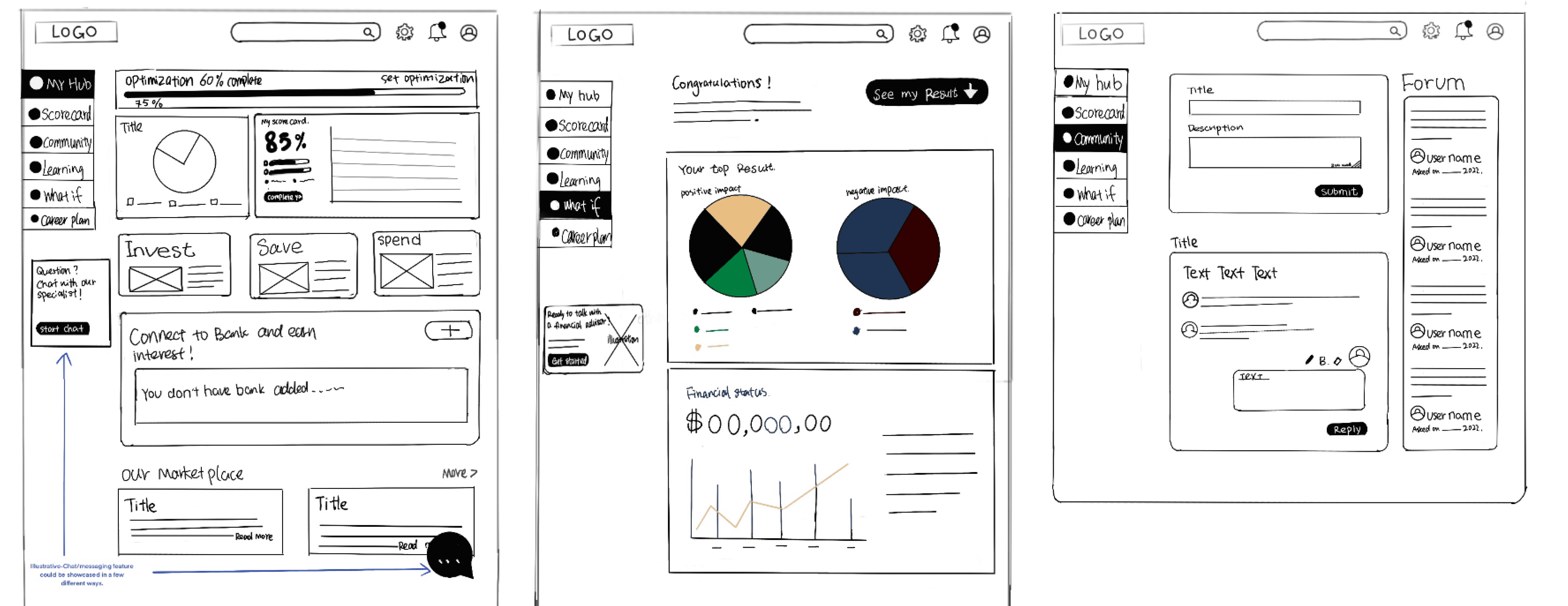

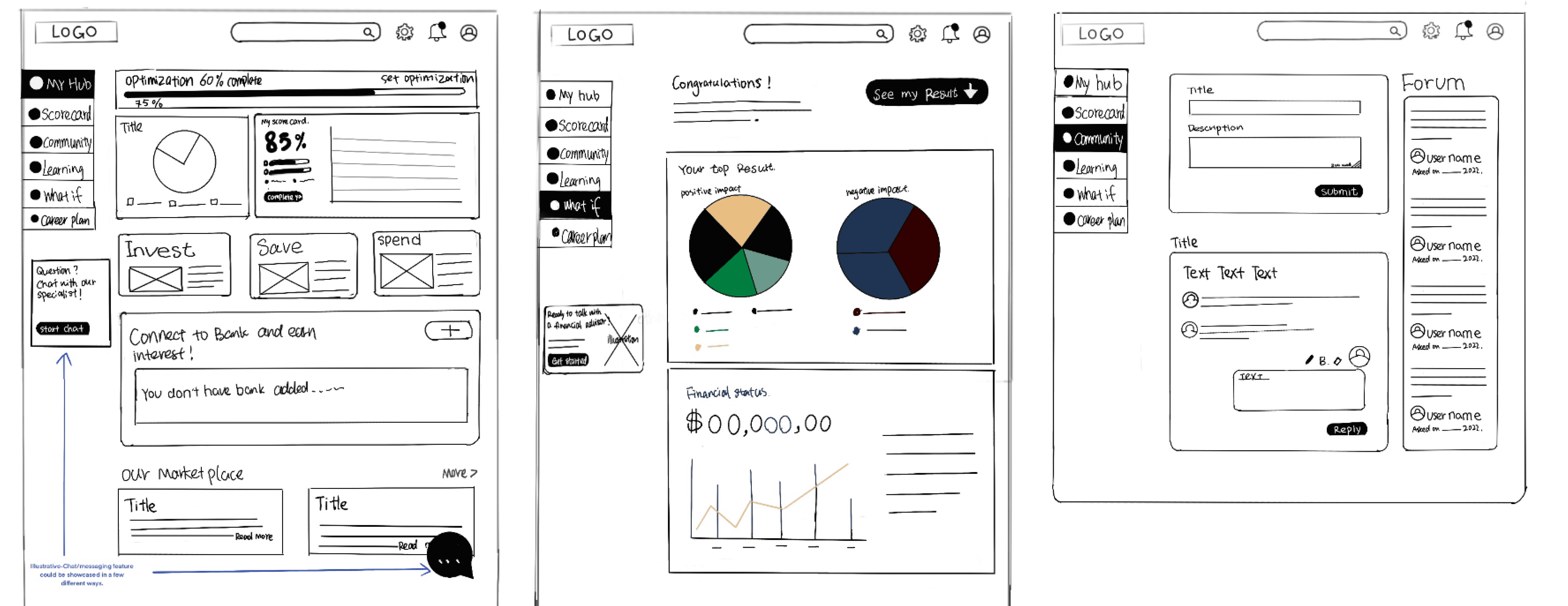

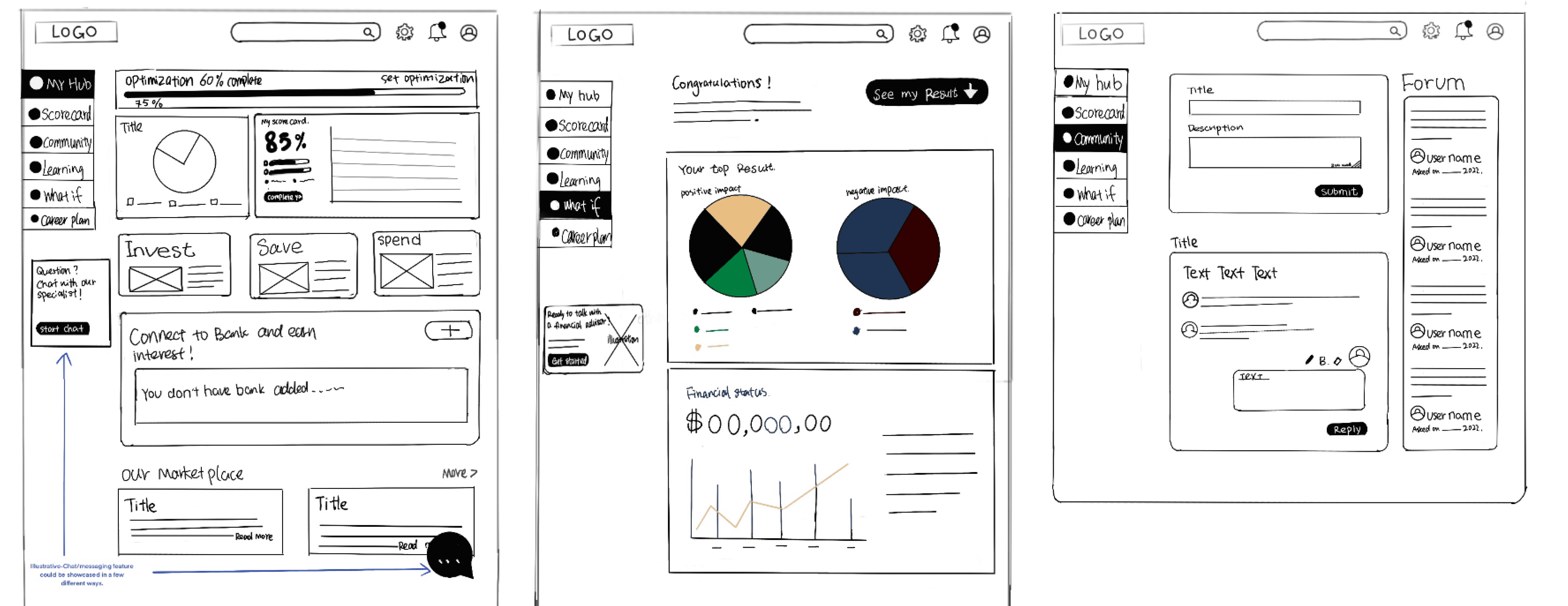

Wireframes

Wireframes

These wireframes outlined the layout and structure of each screen, ensuring a user-friendly interface that aligns with our design principles and effectively supports the user journey.

This step allowed us to visualize the user flow, identify potential issues early, and ensure that all necessary elements were logically and intuitively placed for optimal user experience.

These wireframes outlined the layout and structure of each screen, ensuring a user-friendly interface that aligns with our design principles and effectively supports the user journey.

This step allowed us to visualize the user flow, identify potential issues early, and ensure that all necessary elements were logically and intuitively placed for optimal user experience.

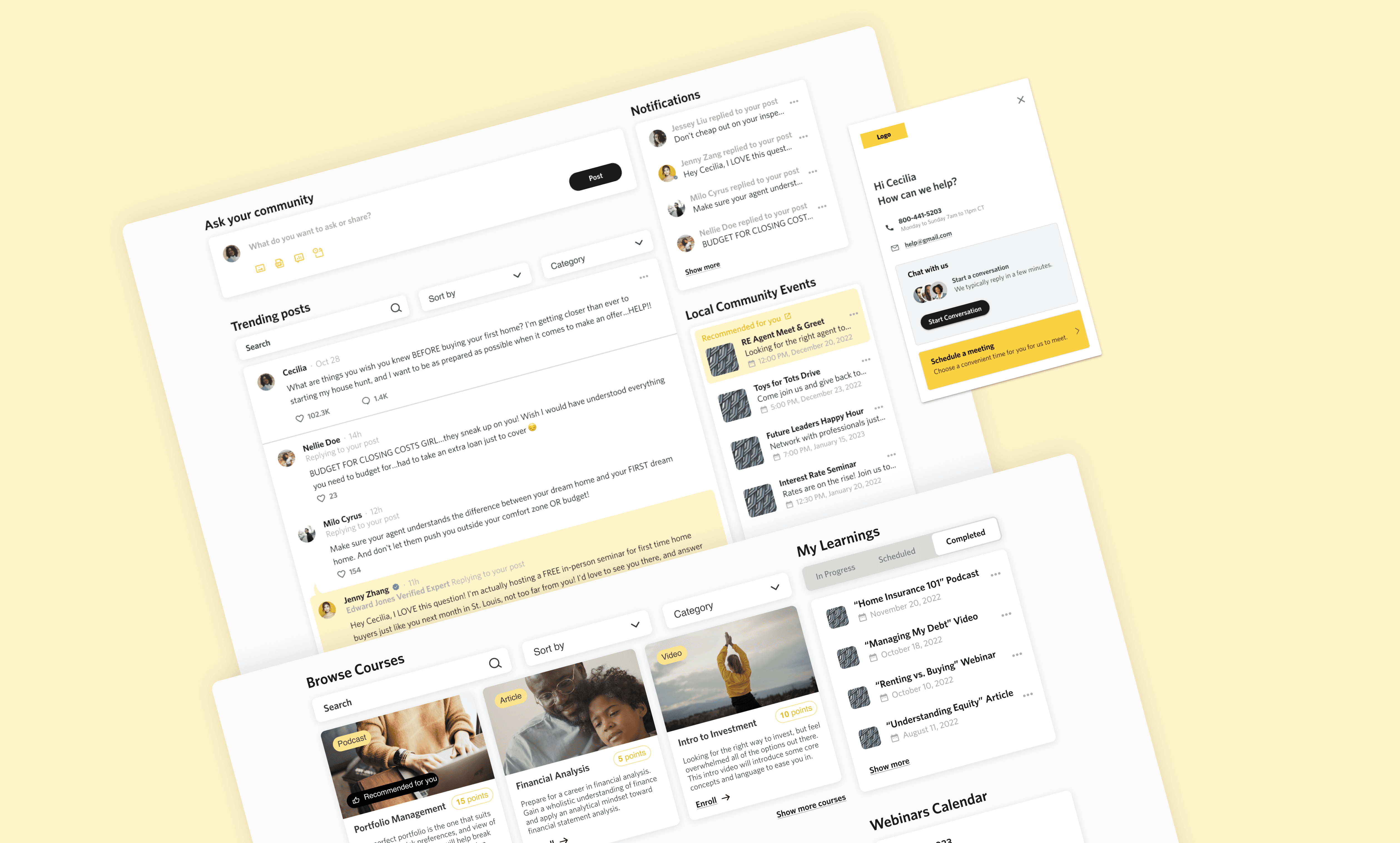

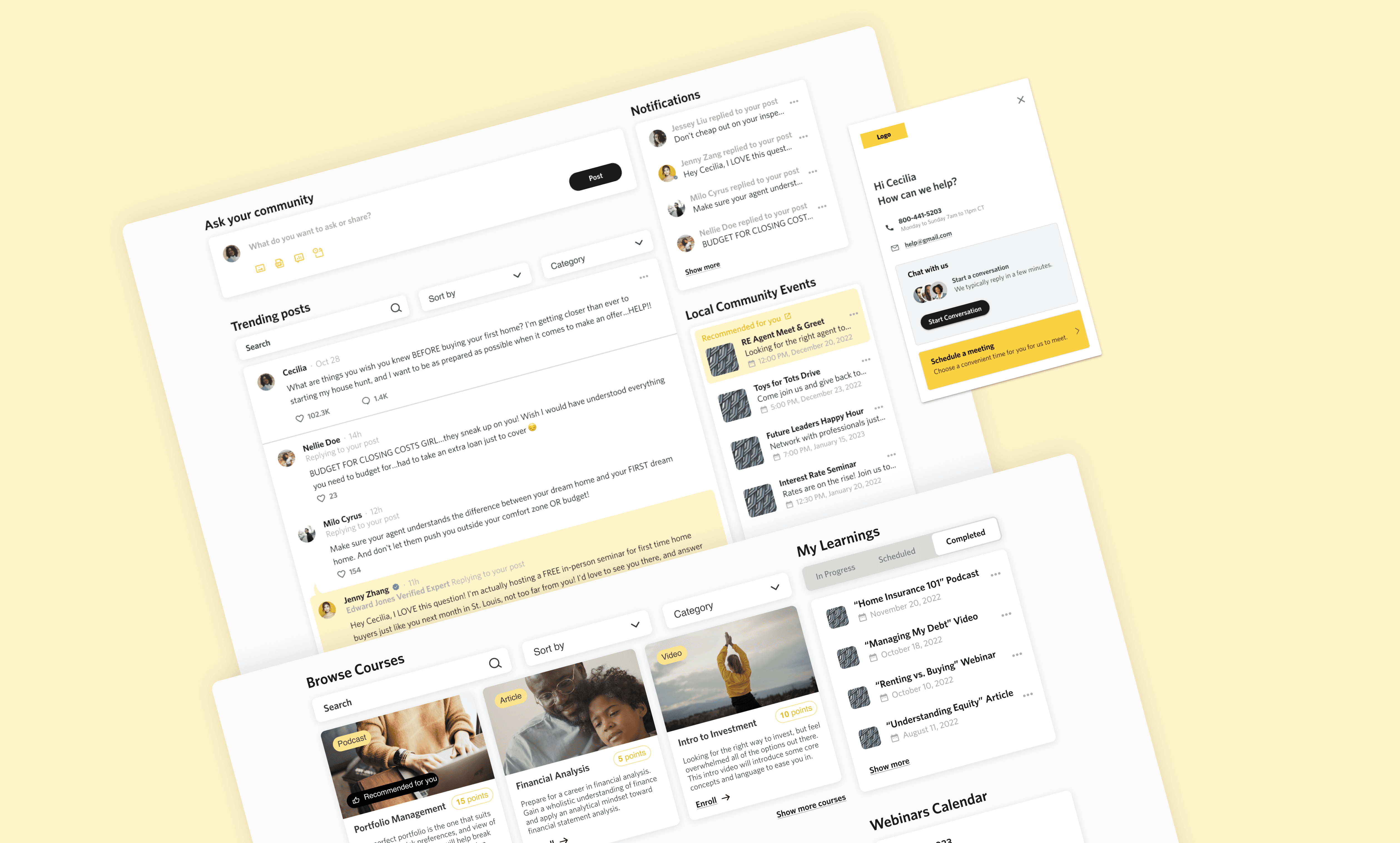

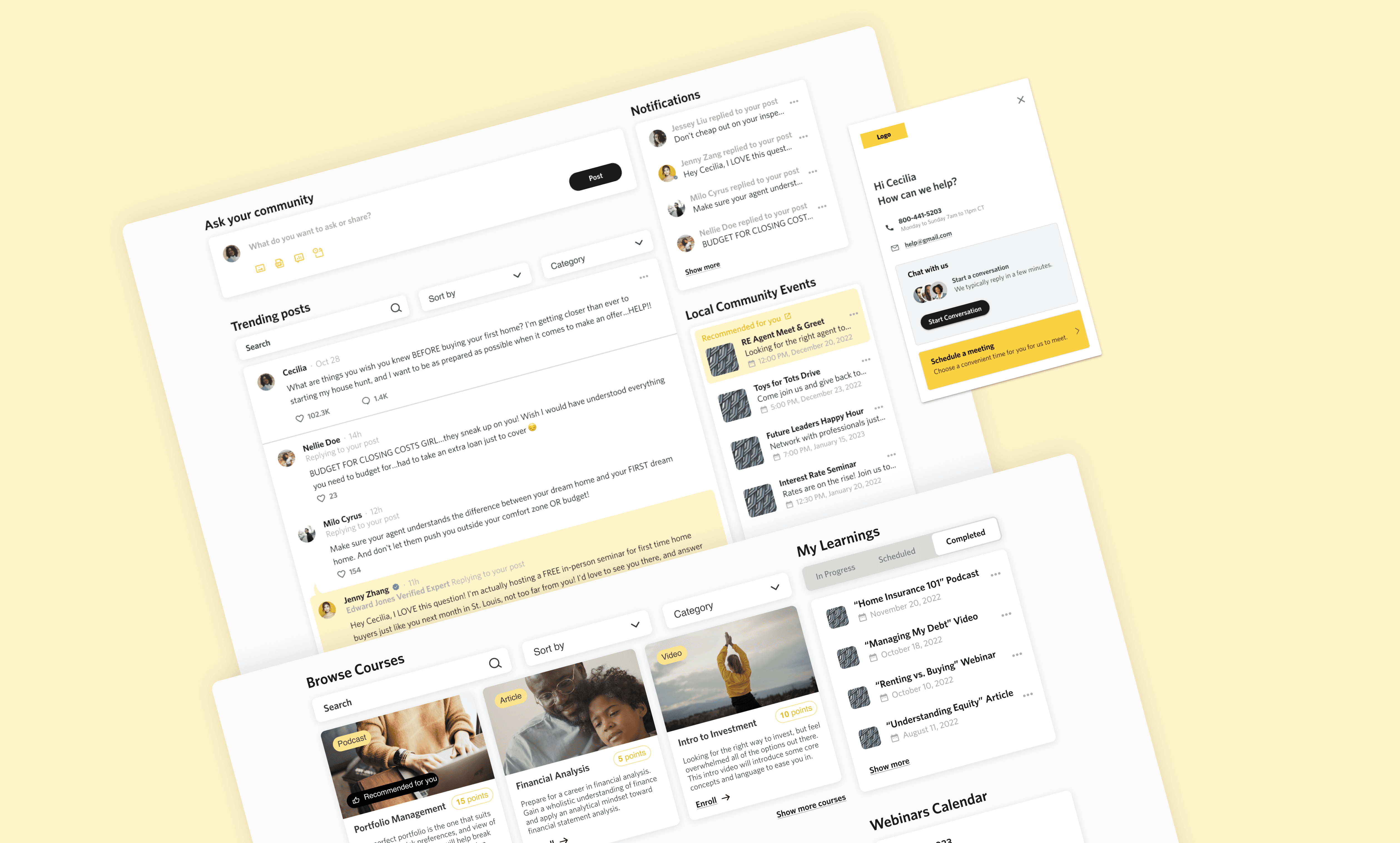

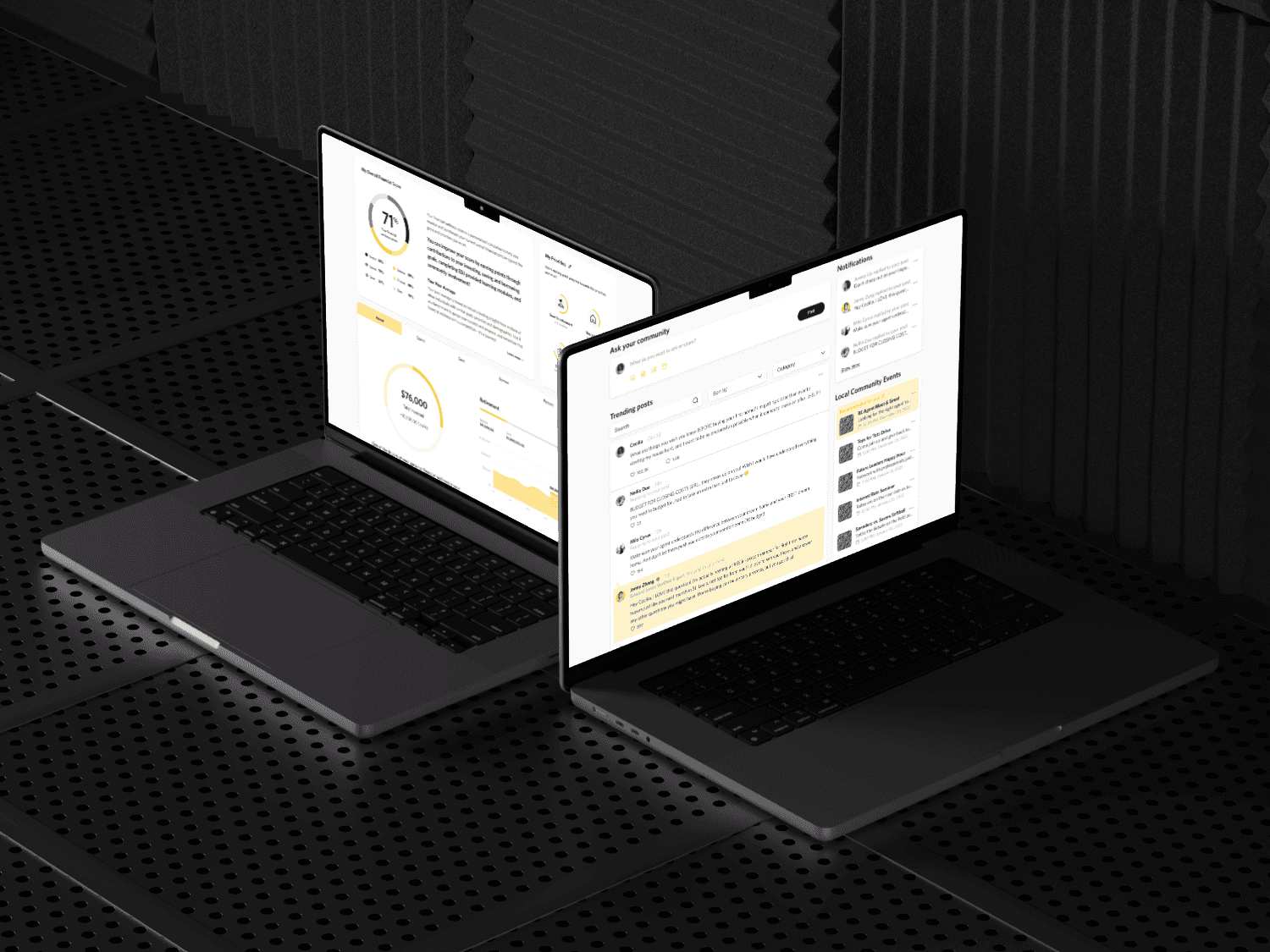

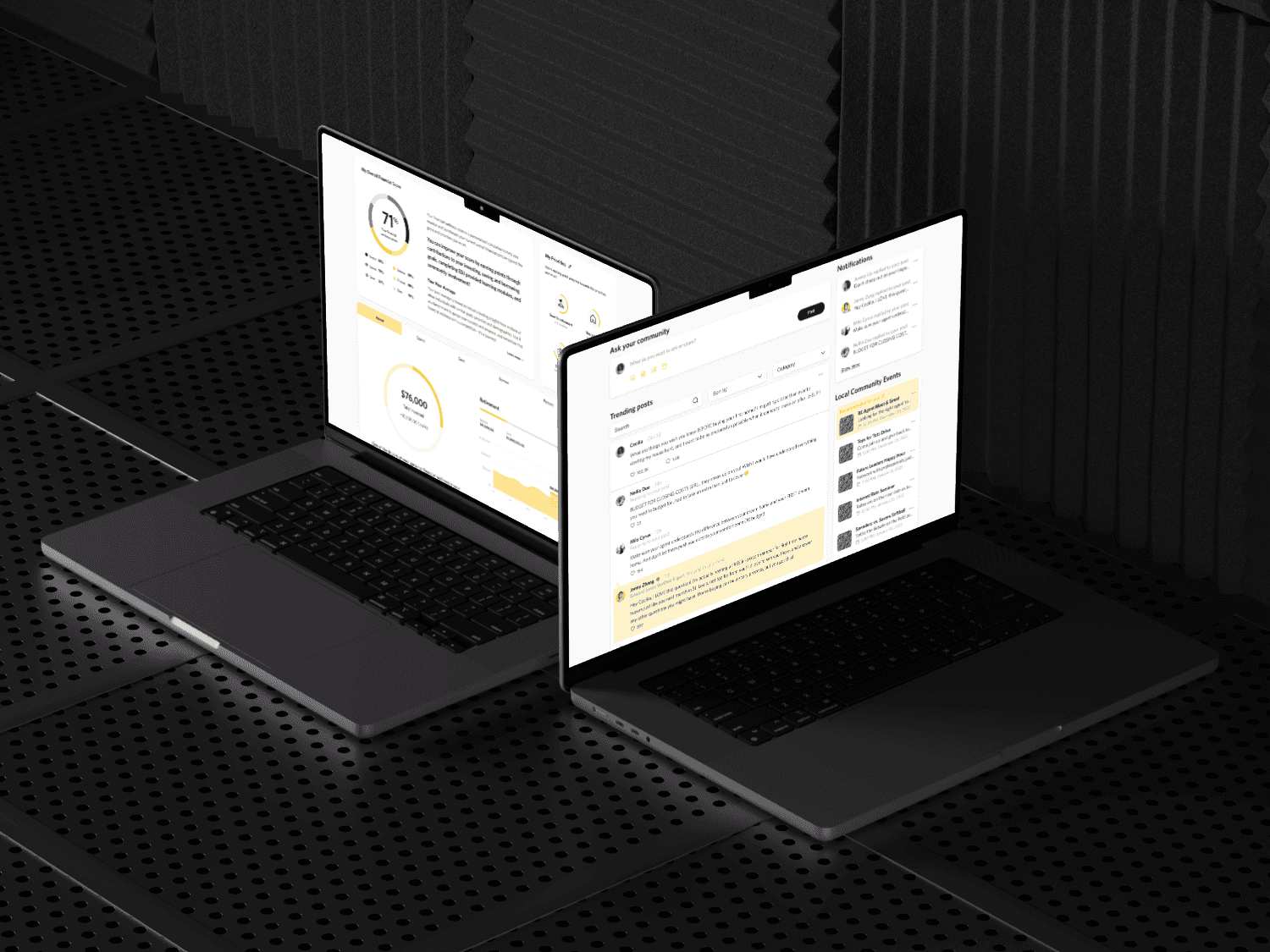

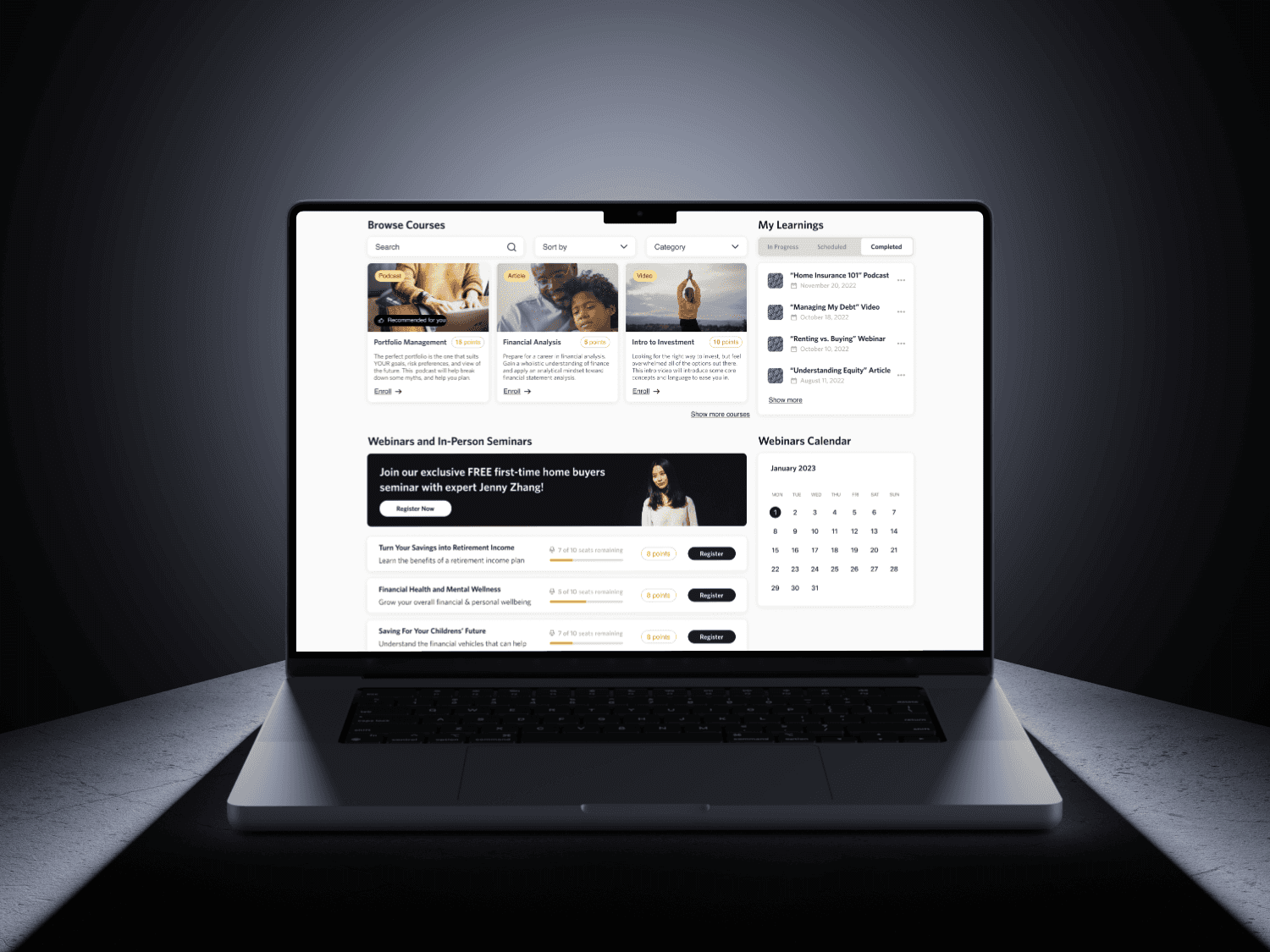

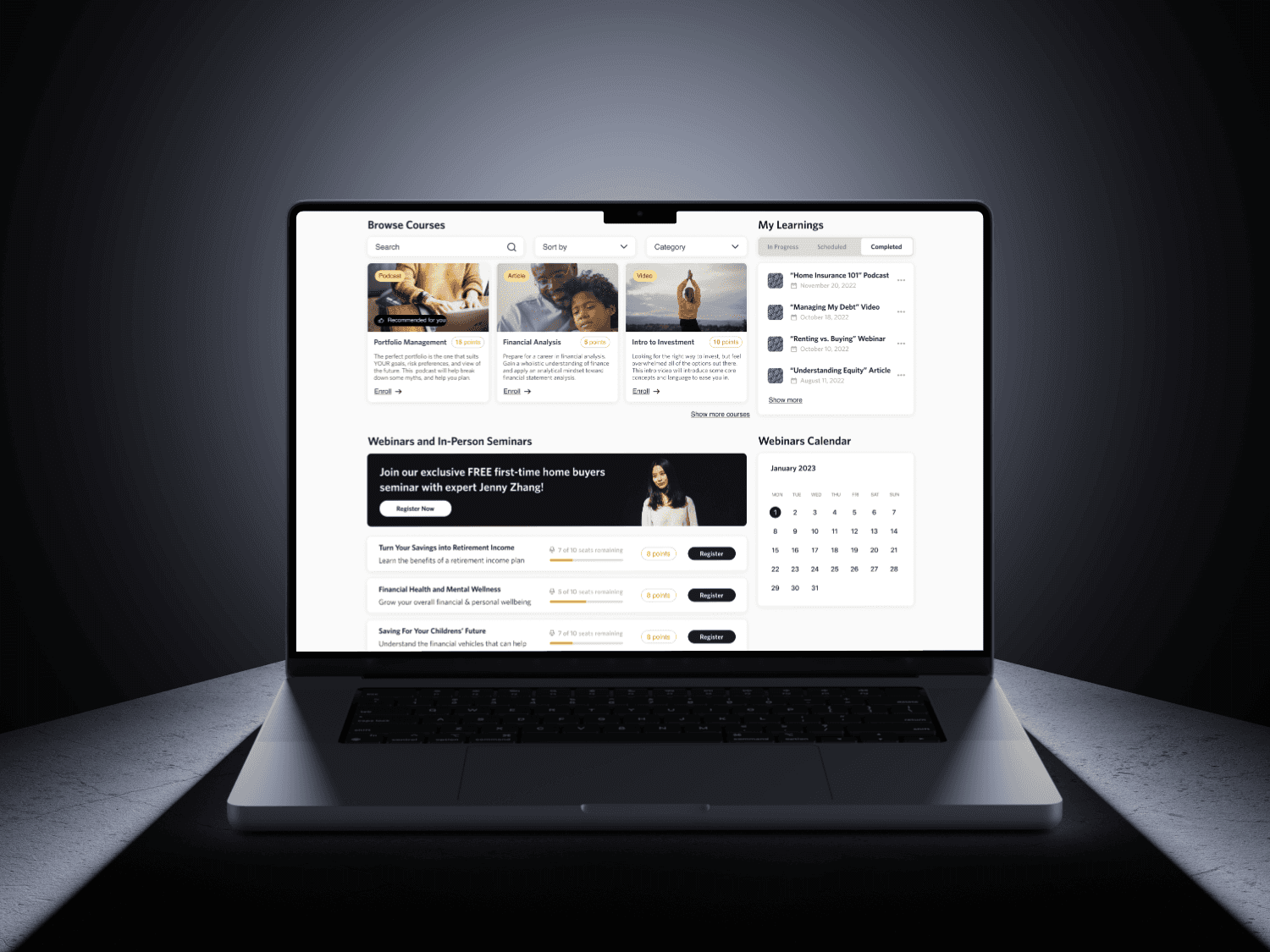

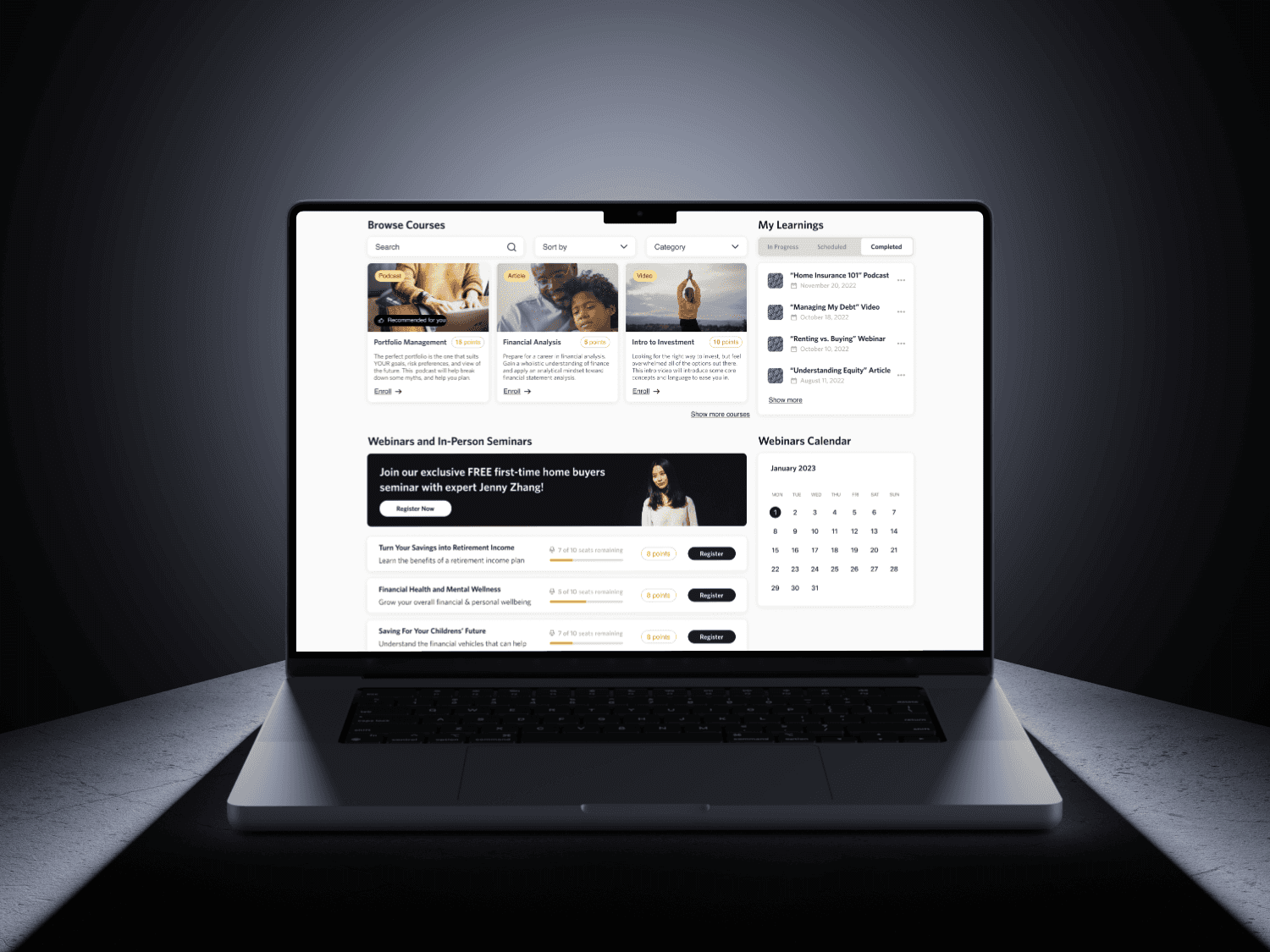

Prototypes

Prototypes

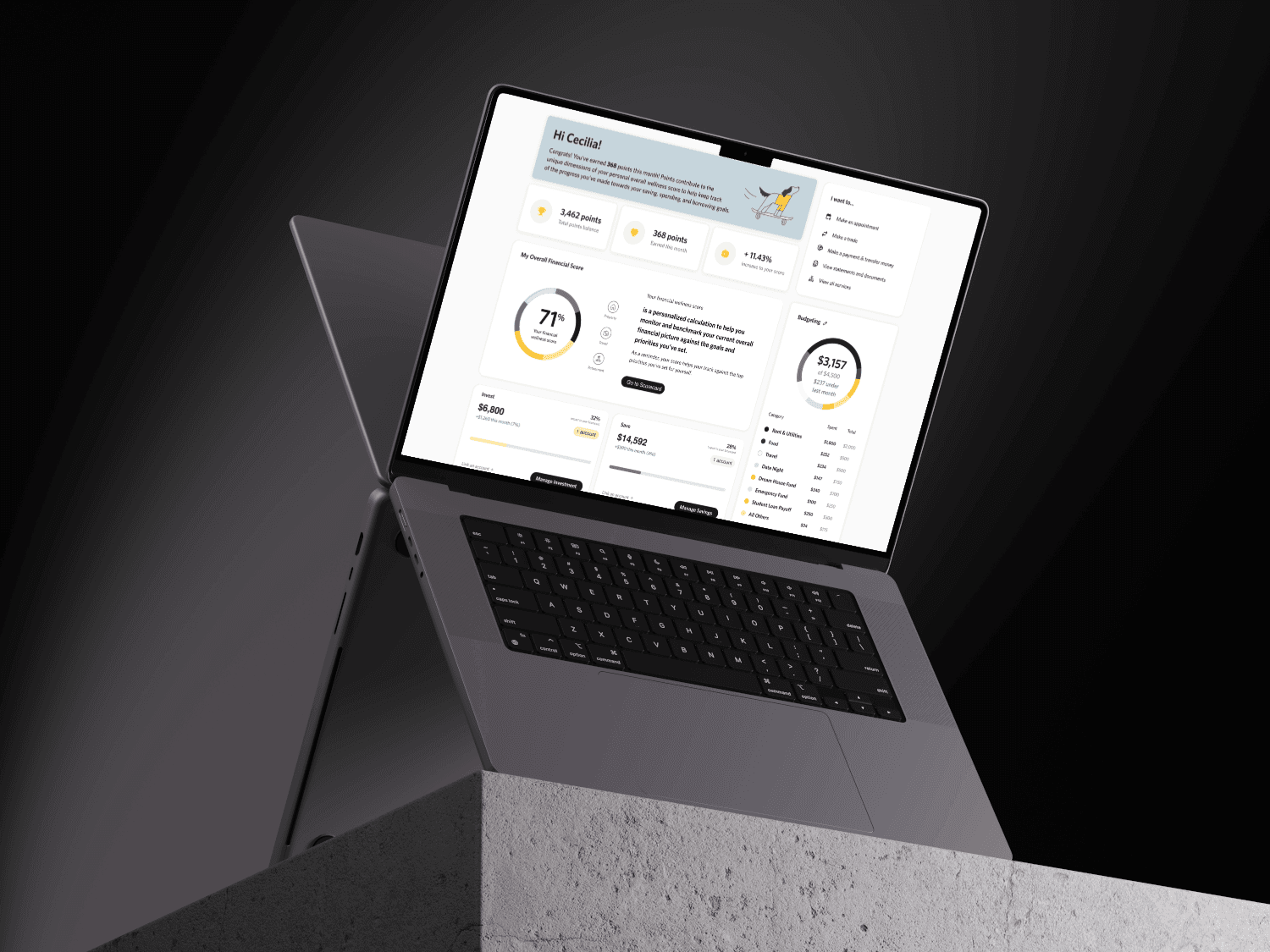

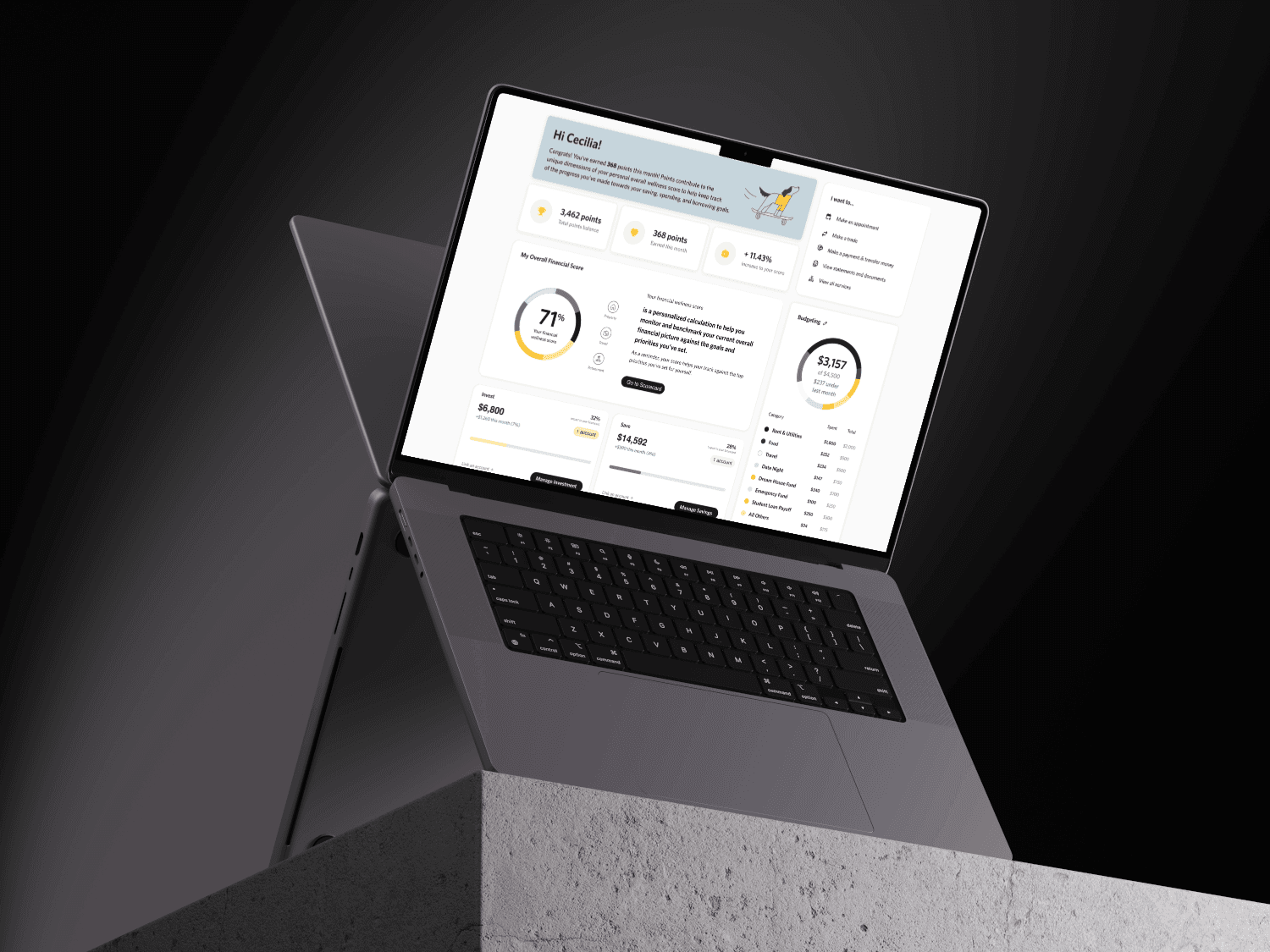

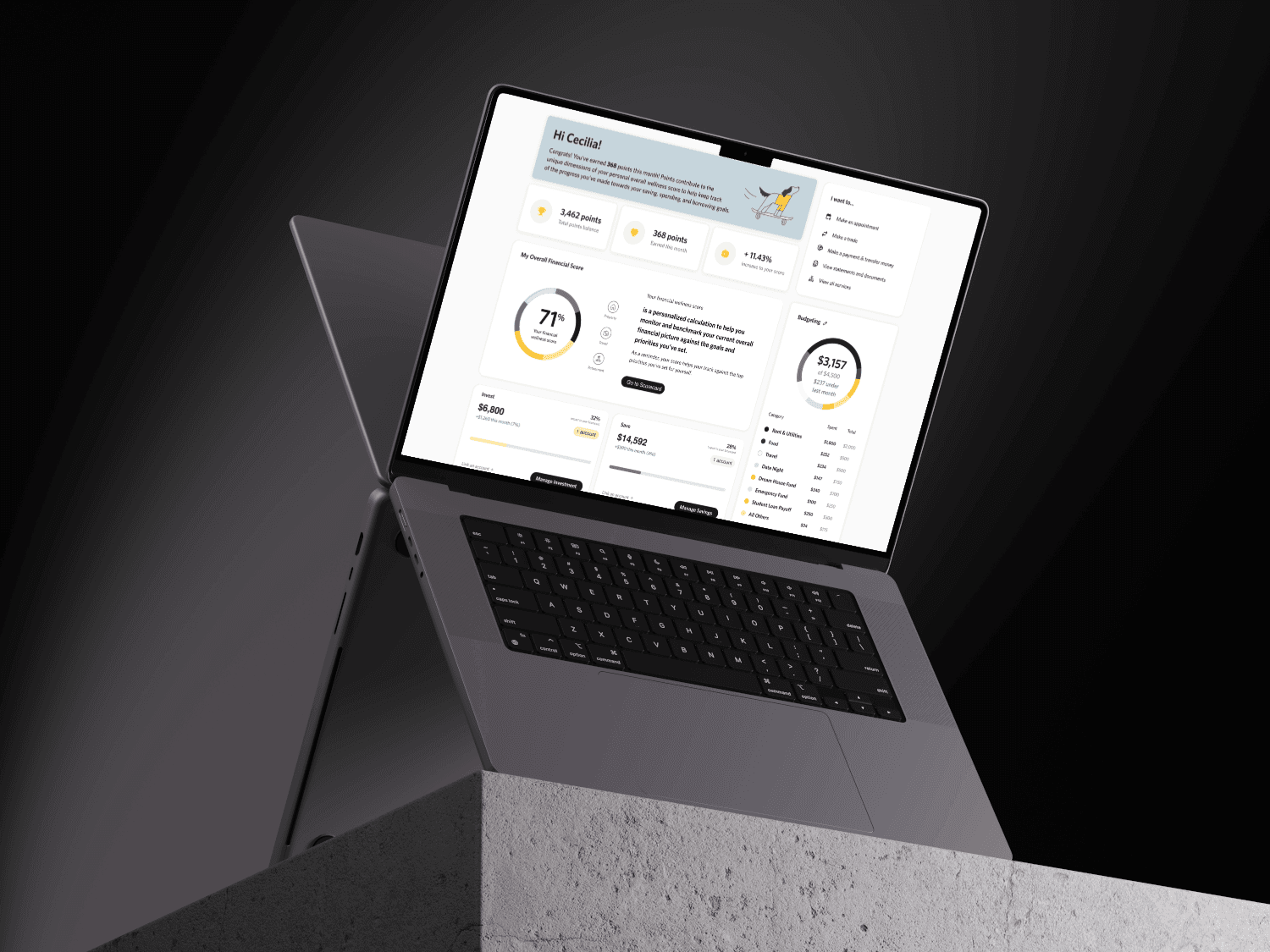

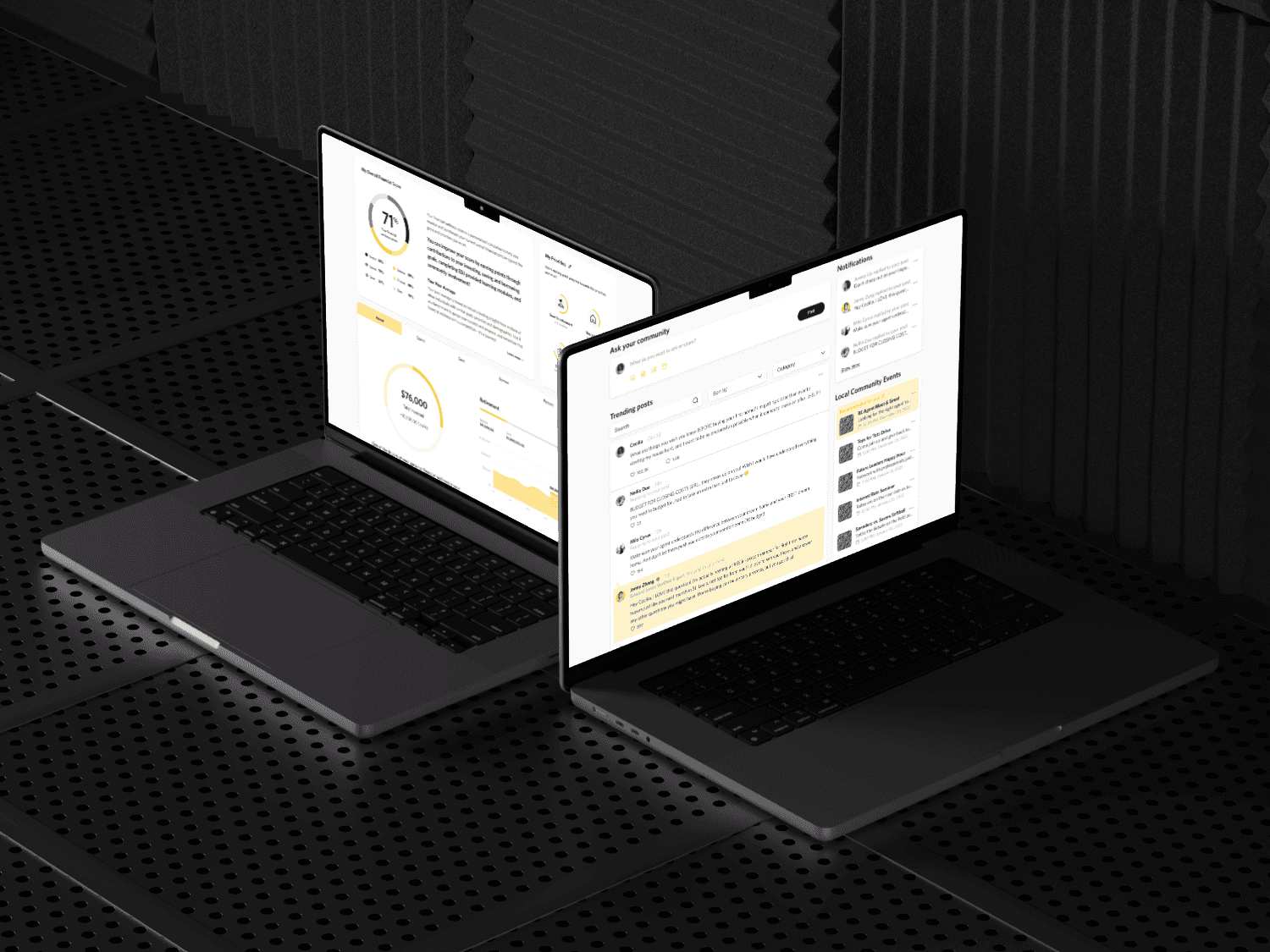

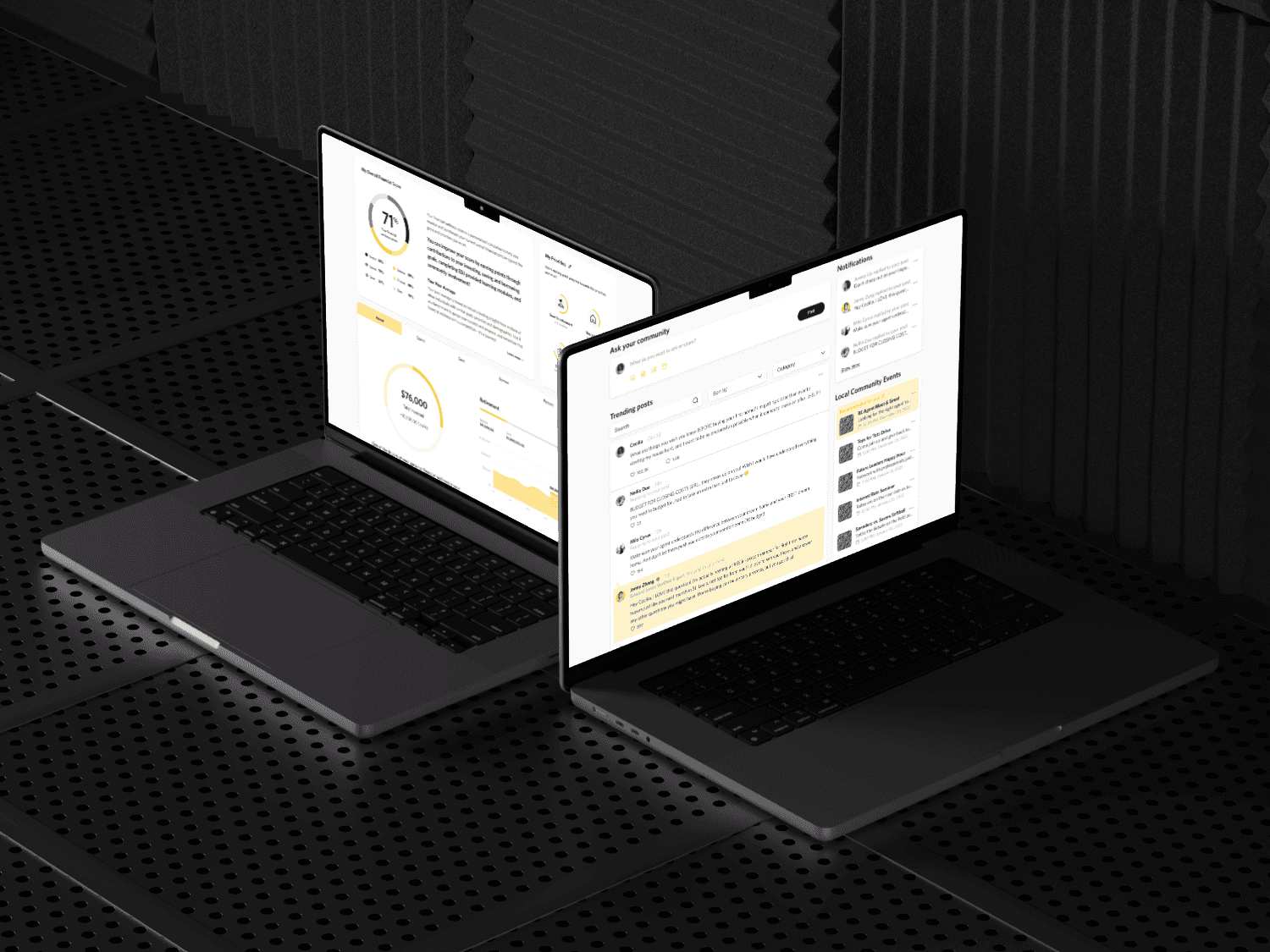

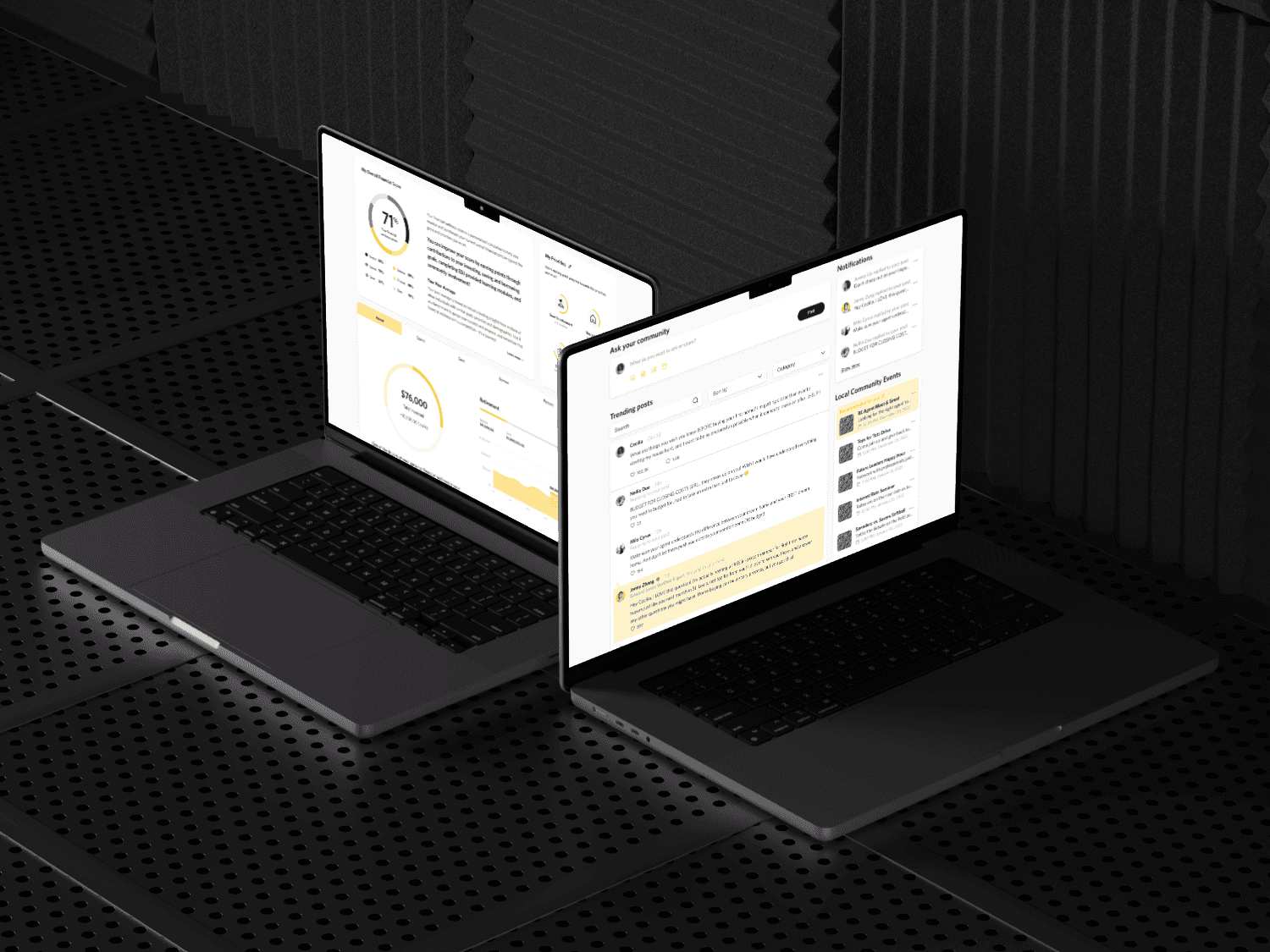

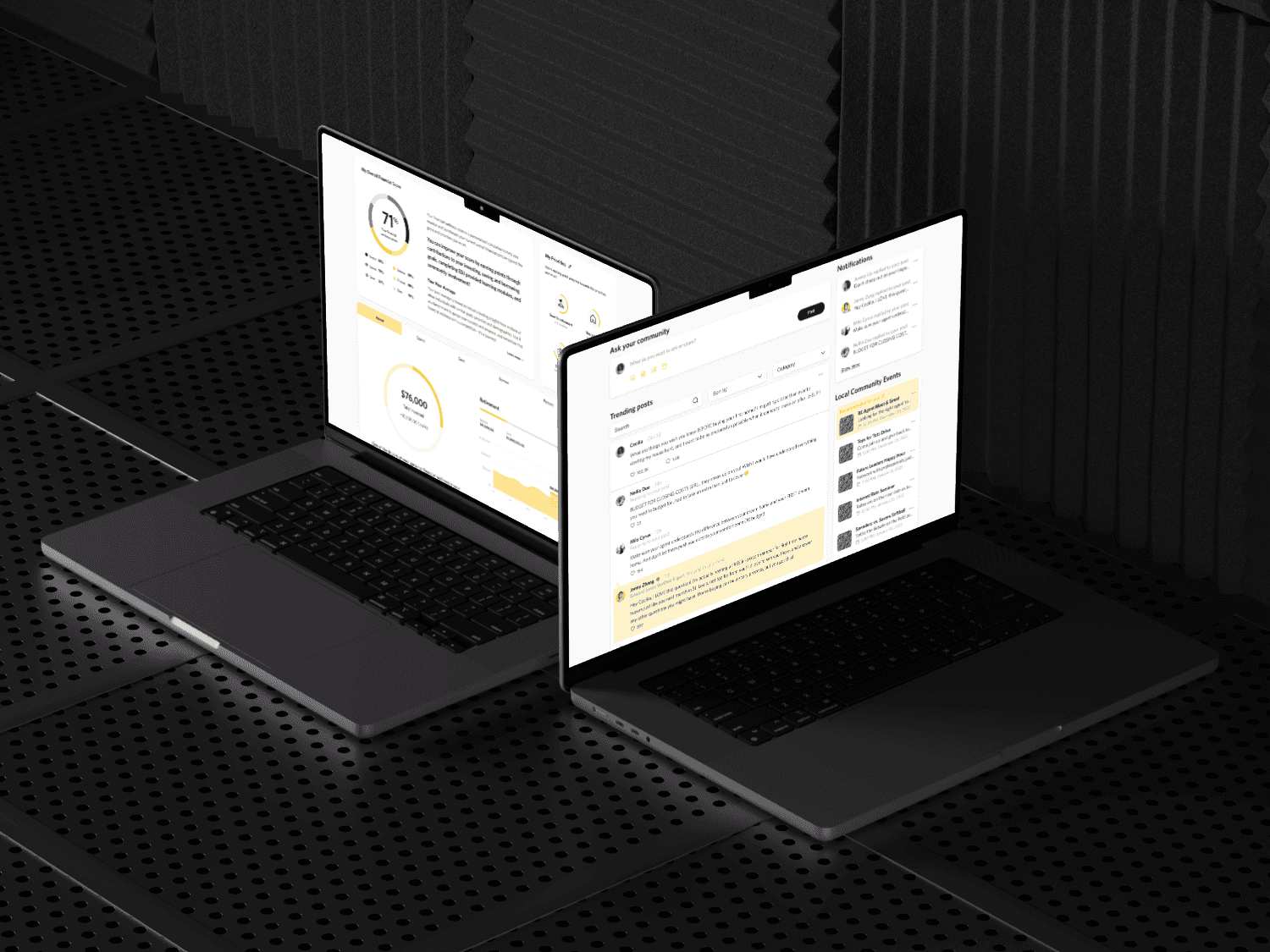

We created fully clickable, high-fidelity prototypes that encapsulated all the insights from our research.

These prototypes allowed us to test the user interactions and gather feedback, ensuring that the final product would be both visually appealing and highly functional, perfectly aligned with our design principles and user journey insights.

We created fully clickable, high-fidelity prototypes that encapsulated all the insights from our research.

These prototypes allowed us to test the user interactions and gather feedback, ensuring that the final product would be both visually appealing and highly functional, perfectly aligned with our design principles and user journey insights.

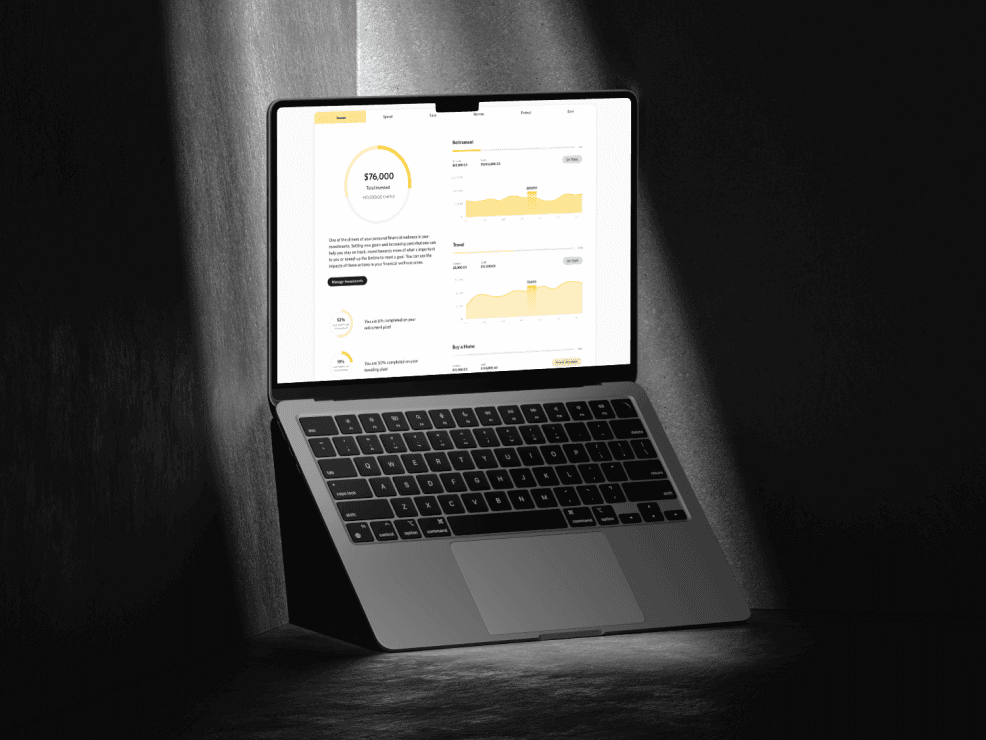

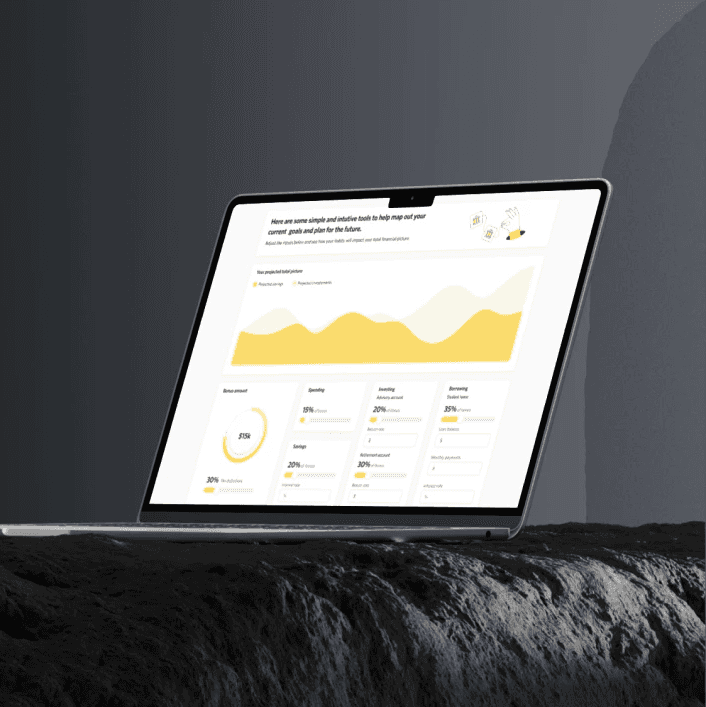

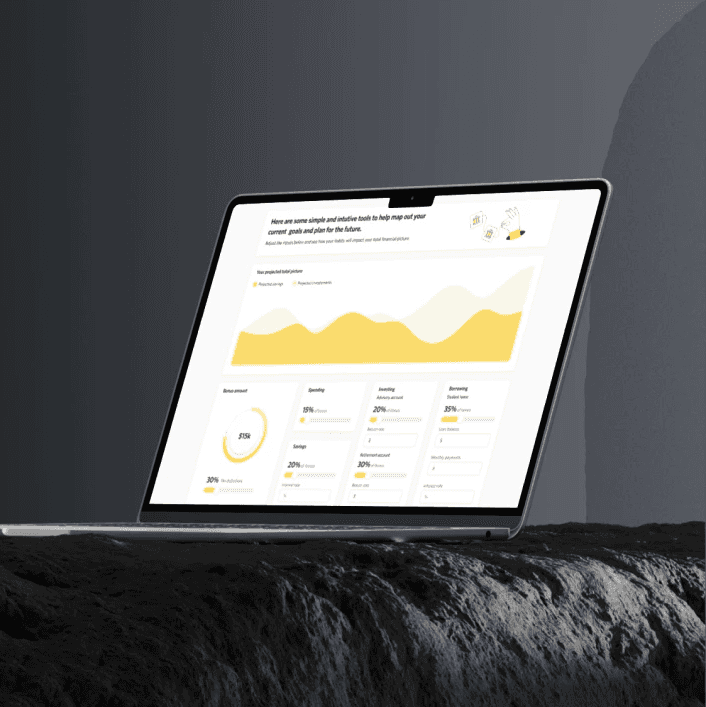

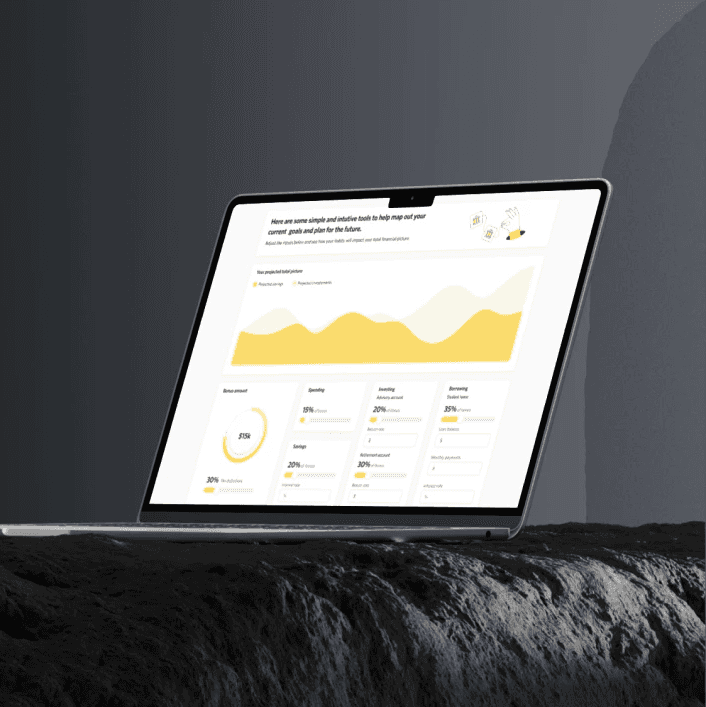

Data Visualization

Data Visualization

We focused on creating clear, intuitive displays that help users easily understand their financial health and progress.

These visualizations transform complex financial data into engaging, easy-to-digest charts and graphs, empowering users to make informed decisions and track their investment journey effectively.

We focused on creating clear, intuitive displays that help users easily understand their financial health and progress.

These visualizations transform complex financial data into engaging, easy-to-digest charts and graphs, empowering users to make informed decisions and track their investment journey effectively.

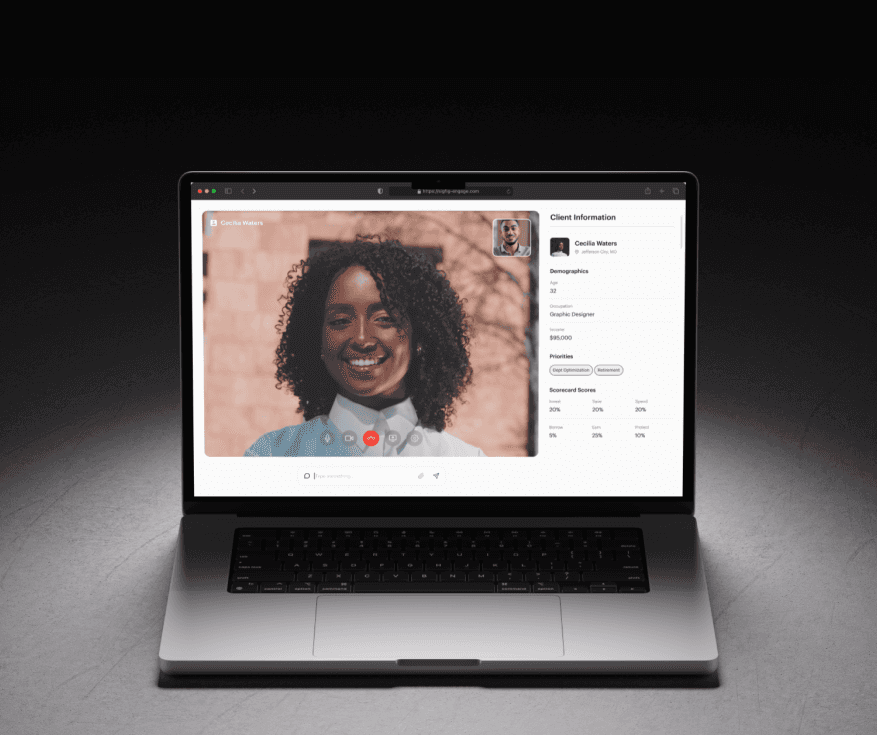

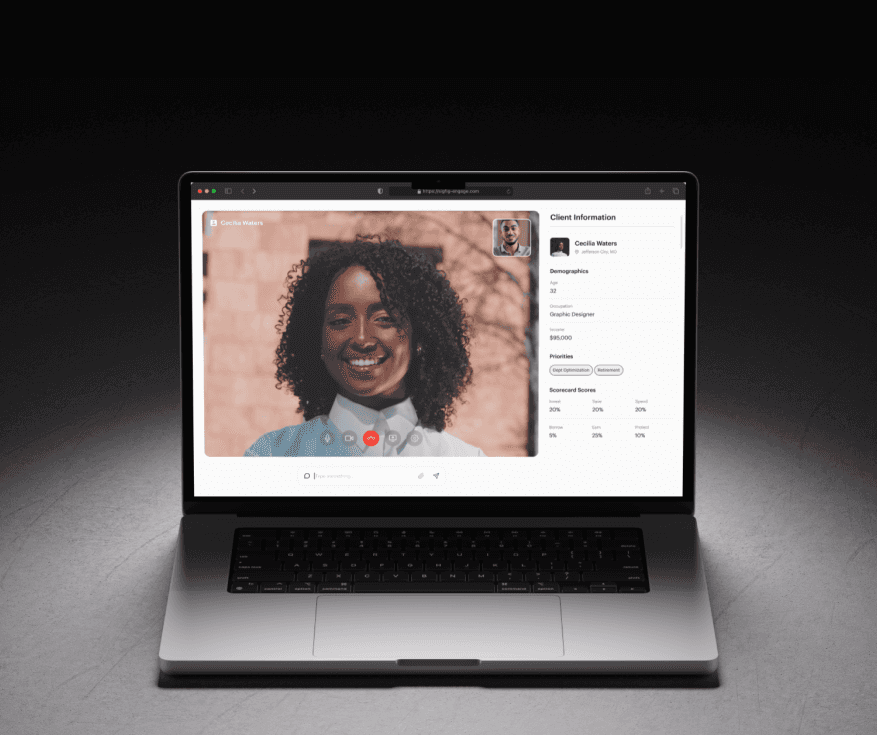

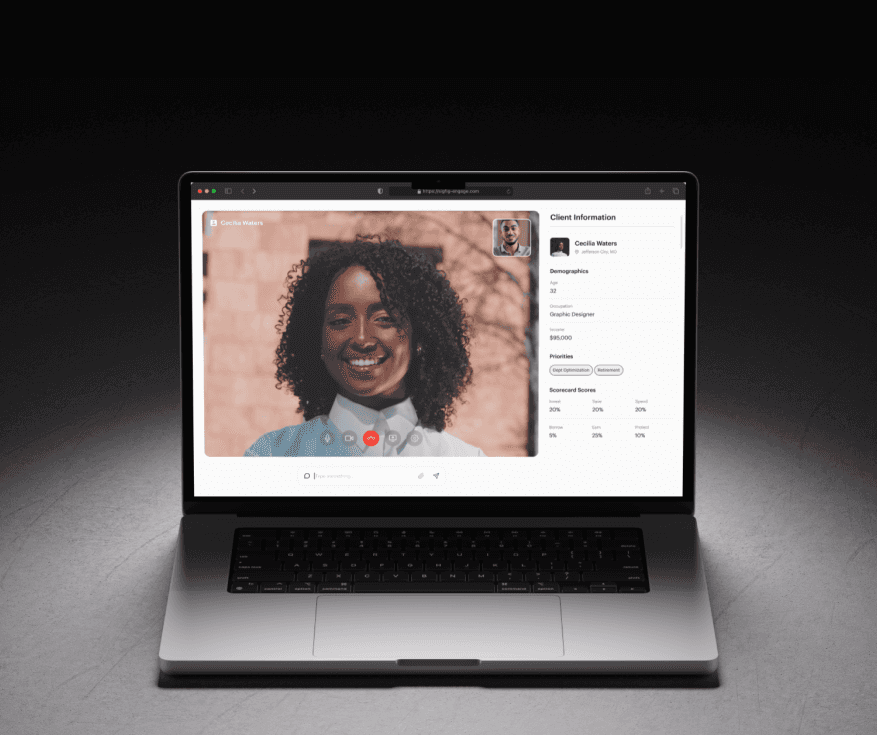

ChatBot

ChatBot

We designed a chatbot to enhance user support by initiating conversations and addressing common queries.

Additionally, it is capable of scheduling video meetings with financial experts, providing users with convenient access to personalized advice, as highlighted by our respondents' needs.

We designed a chatbot to enhance user support by initiating conversations and addressing common queries.

Additionally, it is capable of scheduling video meetings with financial experts, providing users with convenient access to personalized advice, as highlighted by our respondents' needs.

The Results

The Results

Our design process, driven by extensive research and user feedback, led to the creation of an intuitive and user-friendly app for emerging investors.

Key features, such as engaging data visualizations and a responsive chatbot, have significantly enhanced user interaction and satisfaction. The positive reception and increased engagement metrics underscore the effectiveness of our user-centric approach and professional design execution.

Our design process, driven by extensive research and user feedback, led to the creation of an intuitive and user-friendly app for emerging investors.

Key features, such as engaging data visualizations and a responsive chatbot, have significantly enhanced user interaction and satisfaction. The positive reception and increased engagement metrics underscore the effectiveness of our user-centric approach and professional design execution.

/ What's next?

Our work was used to create a video presentation for senior executives, and the design was transitioned to the stakeholders' company to release a full app aimed at outperforming all competitors in the market.

Our work was used to create a video presentation for senior executives, and the design was transitioned to the stakeholders' company to release a full app aimed at outperforming all competitors in the market.

Our work was used to create a video presentation for senior executives, and the design was transitioned to the stakeholders' company to release a full app aimed at outperforming all competitors in the market.

My work has been featured by:

Let’s chat

Contact me today at egarafieva97@gmail.com, and let's start transforming your ideas into extraordinary digital experiences.

Site designed and built by Ellie Garafieva.

Copyright © 2024. All rights reserved.

My work has been featured by:

Let’s chat

Contact me today at egarafieva97@gmail.com, and let's start transforming your ideas into extraordinary digital experiences.

Site designed and built by Ellie Garafieva.

Copyright © 2024. All rights reserved.

My work has been featured by:

Let’s chat

Contact me today at egarafieva97@gmail.com, and let's start transforming your ideas into extraordinary digital experiences.

Site designed and built by Ellie Garafieva.

Copyright © 2024. All rights reserved.

My work has been featured by:

Let’s chat

Contact me today at egarafieva97@gmail.com, and let's start transforming your ideas into extraordinary digital experiences.

Site designed and built by Ellie Garafieva.

Copyright © 2024. All rights reserved.